2022: The Ostara Rewind

2022 has been an exciting year for Ostara Advisors. The mission that we started out with in 2018 – to create India’s first specialised investment bank focused on Mobility and Sustainability – has led us to pole position in our chosen sectors in 2022. As we bid farewell to this exciting year, let’s recap what we’ve been […]

Industry Report: The New World of Electric Vehicles – Investment and M&A Trends

Bangalore – Dec 12, 2022 – Ostara Advisors is pleased to share its latest Industry Report: The New World of Electric Vehicles – Investment and M&A Trends. Describing the forces that will define the next decade in personal transportation, the report contains an executive summary followed by six sections: Status of Automotive Software and Electronics The […]

Financing India's EVs – II

Last month, we discussed some key terms in EV financing, along with different frameworks and policies of the same. Continuing in the same vein, we will once again be delving into the world of financing, albeit from a different perspective. In Part 1, the frameworks and business models were from the perspective of NBFCs and […]

Financing India's EVs

Increased consumer interest in electric vehicles and strong policy support point to a positive growth trajectory for the Indian EV ecosystem. Financing of EVs has continued to remain a challenge both for B2C and B2B customers. Having said that, solutions continue to evolve and we take a look at some frameworks and trends in our […]

Electrifying Freight – The Global Perspective

We started covering Freight Electrification in our newsletter last month, as we believe this to be one of the most compelling use-cases for the clean mobility transition. We wrote about various zero-emission technologies currently available for freight vehicles, the limitations of these technologies for long-haul trucking and also shared a snapshot of the Indian policy framework for electric freight and logistics. Moving on to our […]

Electrifying Freight – The Indian Context

India has been the world’s fastest-growing major economy for 4 of the past 5 years. The movement of goods across the country and beyond its borders has created economic opportunities for millions of India’s citizens. Today, the logistics sector represents 14% of India’s Gross Domestic Product (GDP) and handles ~4 bn tonnes of goods each year, Trucks and […]

The EV Battery Management System (BMS)

The past few months have put electric vehicles (EVs) in India in the spotlight for all the wrong reasons! Recent EV fires have raised concerns about the safety of the electric vehicles, with many companies coming under scrutiny. The good news is that this affords a great opportunity for the EV ecosystem to course-correct, invest […]

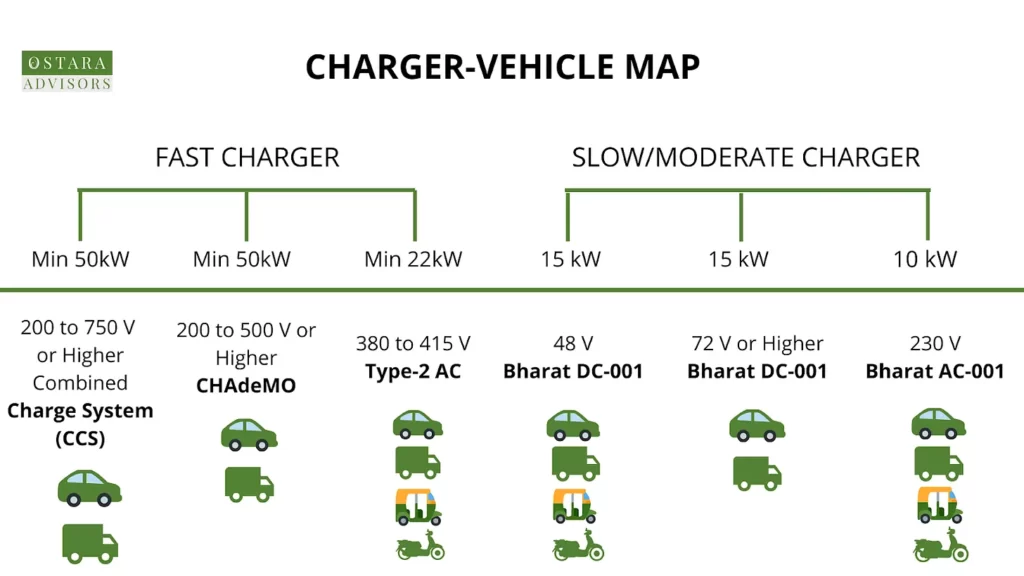

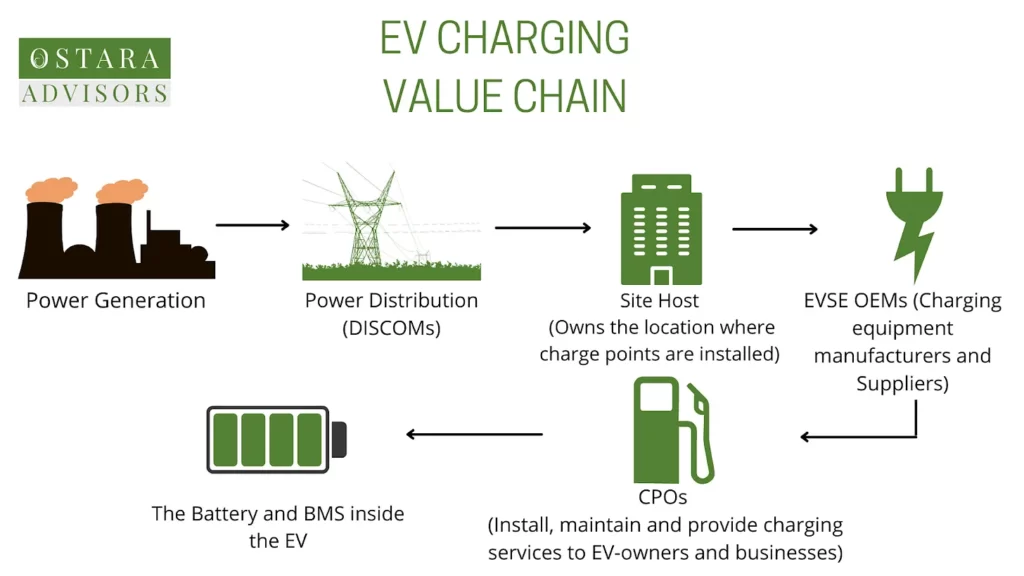

A Quick Overview of EV Chargers

Previously, on the Ostara Guide, we talked about Chargepoint Operators. This month, continuing with Part 3 of our 4-Part series on the Indian Charging Landscape, we are shifting our focus to EV chargers and their manufacturers. What is EVSE? EV chargers, also known as EVSE (Electric Vehicle Supply Equipment), are used to charge a vehicle. The speed at which […]

The Ostara Newsletter: First Anniversary edition

Hello everyone, here we are with our First Anniversary edition of the Ostara Newsletter! Yes, we started publishing “All Above EVs” exactly a year ago. As the first and only electric mobility-focused investment bank in India, we love to learn and share insights & key developments and showcase interesting startups in the Indian EV ecosystem. We feel […]

The Ostara Guide to EV Charging: Safe Charging Stations

In recent weeks, India has witnessed a spurt in EV fire incidents, which have even proved fatal! While the most common explanation given to these fires is the rising summer temperatures in India, nothing could be further from the truth. In this edition of the Ostara Newsletter, we attempt to demystify the causes of battery […]