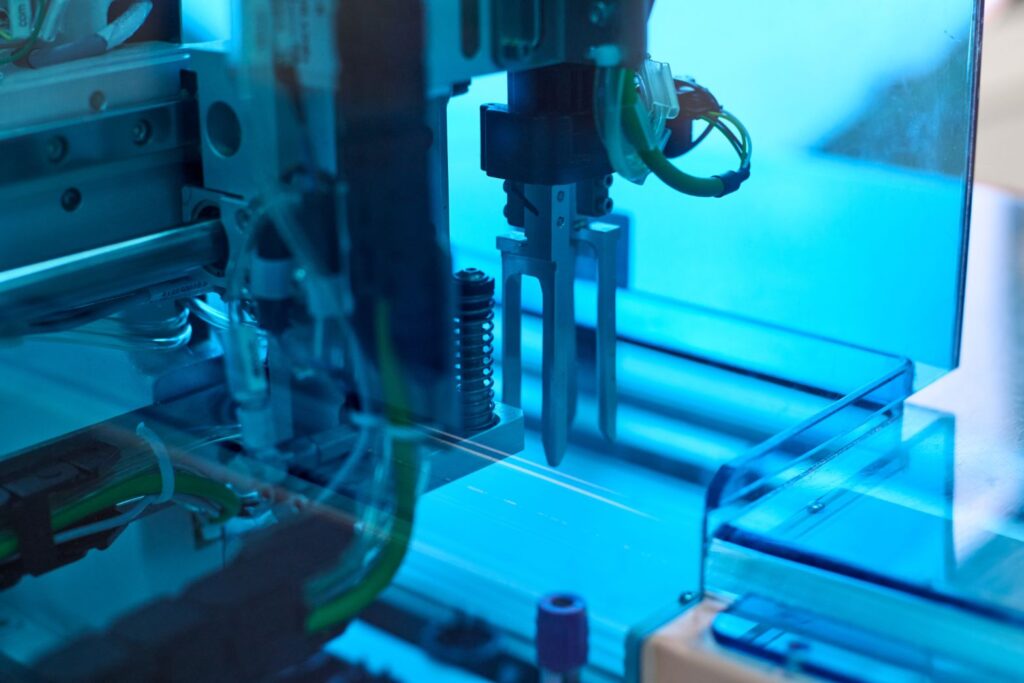

Enabling entrepreneurs who are making the world carbon-free

Ostara Advisors is India’s first specialist climate-tech investment bank

We provide Fundraising and M&A solutions to companies and investors. We work with founders and investors who have a unique vision around building sustainable businesses.

We have built India’s best sector-focused global investor network for mobility and energy businesses, powered by our subject-matter expertise and thought-leadership in these sectors. We bring decades of experience in executing capital-raising strategies and crafting business combinations to drive win-win M&A outcomes for our clients.

The name is symbolic of the ‘dawn’ of sustainability in traditional industries and a growing focus on ‘lightening the carbon footprint’ across businesses

We deliver results for our clients. We work with a long-term perspective supporting clients through multiple growth stages. We were the first investment bank to bring global mobility & sustainability focused investors into India. We are also known for bringing first-time strategic investors to our clients.

Climate Entrepreneur

& Investor

Know more >

Industry Expert – Financial Technology

and Cloud Solutions

Know more >

Investment

Banker

Know more >

Bangalore, India

Vasudha is the founder of Ostara Advisors (formerly Dhruva Advisors) and is one of the first investment bankers in India to specialise in Electric Mobility, having advised clients in this space since 2017. She made her all-India M&A League Table debut in the top 20 in October 2018.

In 2023, Vasudha was felicitated by India Energy Storage Alliance (IESA) as one of the “Women leaders driving energy sector in India”

Vasudha has over 21 years of experience in Corporate & Investment Banking; with leading organizations like Citibank and ICICI Bank, as well as in boutique investment banking, based in Mumbai and Bangalore. Vasudha is responsible for having set up and expanded the ‘Private Equity & Hedge Fund’ coverage vertical for Citibank, India. She has also been part of Citibank’s Risk Management team for mid-size corporates, managing the bank’s lending decisions to a portfolio of companies in ITES, auto components, facilities management services, logistics, diversified manufacturing etc.

Vasudha is also a mentor at Aspire for Her, a unique organisation that enables women to join and stay in the workforce, through campus engagement, mentorships and skilling workshops. Their vision is to impact 1 million+ women and add $5B to India’s GDP through increased participation of women in the workforce by 2025.

Vasudha earned her MBA in Finance from XLRI, Jamshedpur, India and her Bachelor’s degree in Commerce from Mount Carmel College, Bangalore, India. She is also a certified Advanced Scuba Diver and enjoys photography, having held several solo and group exhibitions of her work.

Mukund is a seasoned investment banker with 27 years of experience in advising companies on M&A and capital raising transactions. He has served most recently as Joint Managing Director at Motilal Oswal Investment Banking, where he worked from June 2014 to January 2021. During his career, he has facilitated over 70 strategic financial transactions including Motherson Sumi’s acquisition of PKC Group (Finland), sale of Aurangabad Electricals to Mahindra CIE, Siemens’ sale of Bangalore Airport, sale of Spicejet, Aegis’ acquisition of PeopleSupport (USA), sale of Air Deccan among others. Mukund has extensive experience in raising private equity funding as well as in the capital markets including IPOs, follow-on offerings, GDRs and ADRs for L&T Finance, Indostar, Dixon Technologies, Bharat Financial Inclusion, Tata Consultancy Services (TCS), Wipro, GAIL, etc.

Mukund has earlier worked for 9 years at Edelweiss Financial Services and started his career in 1996 with a 9-year stint at Morgan Stanley. Mr. Ranganathan holds a B.Tech degree in Electrical Engineering from Indian Institute of Technology Madras (1994) and a PGDM from Indian Institute of Management, Ahmedabad (1996).

Climate Entrepreneur and Investor

Industry Expert – Financial Technology and Cloud Solutions

Investment Banker

Subrat Panda is a veteran investment banker with over 20 years of experience in leading Capital Market transactions. His specialities include Public offerings (initial and follow-on), QIP issuances, equity rights issuances, open offers, private equity, debt capital markets, due diligence, corporate finance, financial modelling, valuations and investor interactions. He is currently Director at Motilal Oswal Investment Banking in Mumbai. Prior to this, he was VP, Capital Markets at Tata Capital. He started his career with SBI Capital Markets, the investment banking arm of India’s largest bank where he headed the Equity Capital Markets team in Mumbai. He has extensive experience in advising large and medium companies in the Financials, Infrastructure and Energy sectors on domestic and international fund-raising and M&A strategies. Early in his career, he was also on a special assignment to State Bank of India (SBI) to set up their online banking platform. Subrat earned his MBA in Finance from XLRI, Jamshedpur and completed his B.Tech (Electrical Engg.) from College of Engineering and Technology, Bhubaneswar. Subrat enjoys mountaineering in the Himalayas in his leisure time.