Last month, we discussed some key terms in EV financing, along with different frameworks and policies of the same. Continuing in the same vein, we will once again be delving into the world of financing, albeit from a different perspective. In Part 1, the frameworks and business models were from the perspective of NBFCs and and other non-banking institutions. This month, in Part 2, we will take a look at Green Bonds and the Banking system’s role in Financing India’s EVs.

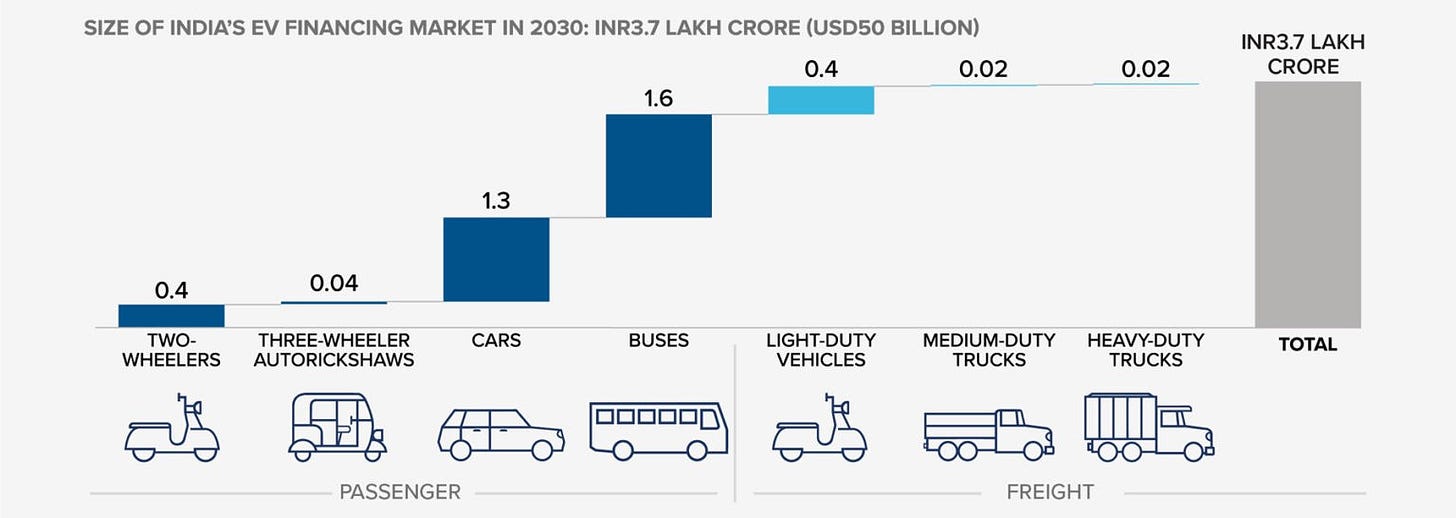

According to an RMI report, the cumulative capital cost of the country’s EV transition between 2020 and 2030 is approx. $266 billion across vehicles, charging stations, and batteries. The projected size of the annual loan market for EVs in 2030 is approx $50 billion.

EV Financing by Indian Banks

Most Private sector banks are currently providing car loans to EV buyers at the same or similar terms as for regular ICE car buyers. This is currently happening mainly for the B2C segment, i.e. end consumers who look to buy EV cars or even two-wheelers for personal use. These loans take into account credit scoring models on the borrower, and place lesser emphasis on the type of car or scooter.

This changes when it comes to commercial EVs, mainly 2Ws and 3Ws used for cargo or shared mobility, where the type and usage of the vehicle plays a critical role in the risk assessment and loan pricing by banks. Most banks are currently assessing EVs in order to accurately estimate residual value and are putting together loan products for buyers of electric commercial vehicles. We expect many EV bank loan products to be present in the market in 6-12 months from now.

Key Instruments and Concepts relevant in Global EV financing

Green Bonds

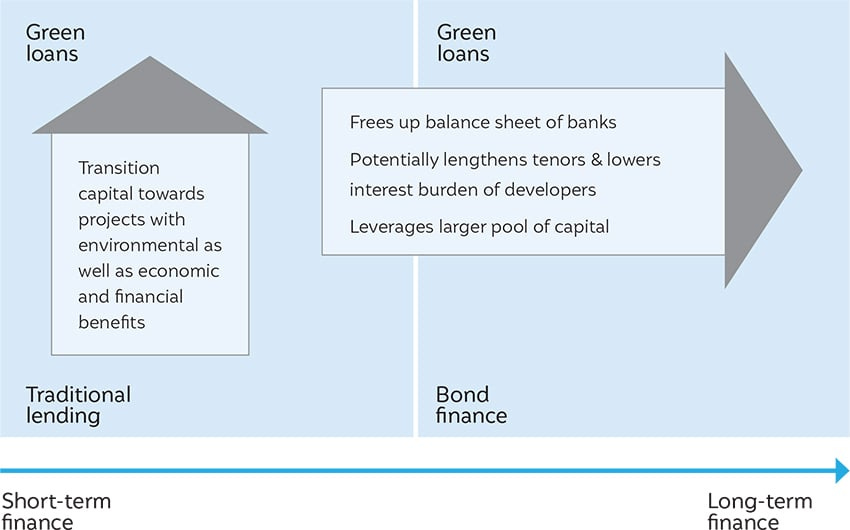

A green bond is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects. Basically, Green bonds work like regular bonds, with one key difference: the money raised from investors is used exclusively to finance projects that have a positive environmental impact, such as renewable energy and green buildings.

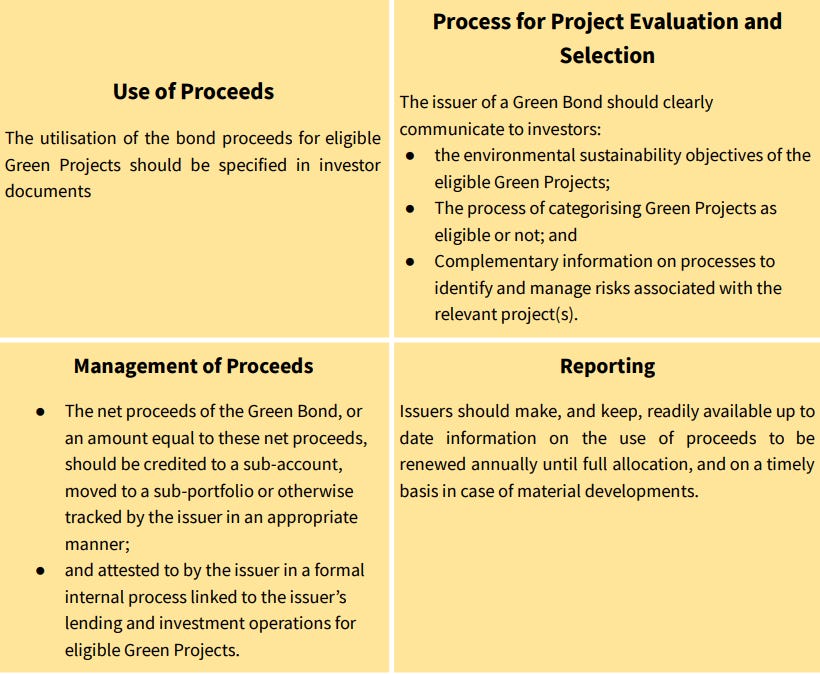

The Green Bond Principles (GBP) are voluntary process guidelines clarifying the approach for issuance of a Green Bond. The ICMA (International Capital Market Association), serves as Secretariat to the Green Bond Principles (GBP).

The four core components for alignment with the GBP are:

Green Bond Market

Green Bond issuances are at an all-time high. Ending 2021, annual issuances crossed the half-trillion dollars mark for the first, showcasing the growing potential of the Green Bond market. The USA, at $81.9 bn, was the most prolific source of green bonds, followed by China at $68.1 bn.

Europe was the most prolific region, with cumulative issuance reaching $758 bn by year end. Asia-Pacific became the second most prolific region for green bonds reaching a cumulative total of $371.7 bn by year end. North America fell one spot to third place with cumulative green bond issuance of $343 bn.

2021’s leading sovereign green issuer: The UK.

21 sovereign green bond issues were priced in 2021, including a GBP 10bn (USD13.7bn) UK Gilt, the largest single debut sovereign green bond to date and the largest green bond of 2021. A smaller GBP 6bn ($8.25 bn) deal followed later in the year, making the UK the third largest sovereign green bond issuer after France and Germany by volume.

Green Bonds in India

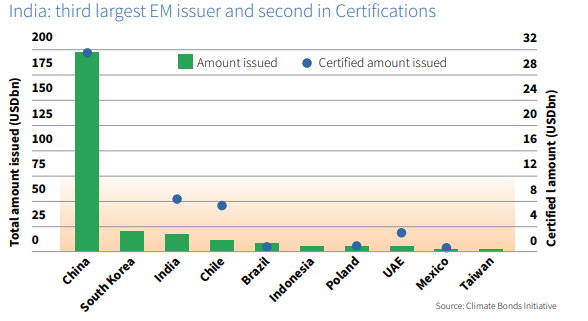

India emerged as the sixth largest country in the Asia-Pacific region in terms of total amount of green bonds issued in 2021. Green bonds issuance from India jumped 523% from a year ago to $6.8 billion.

India’s growth in green issuance is especially evident when compared to other emerging markets (EM). India stands third in EM cumulative green issuance and is the second largest source of Climate Bonds Certified deals. Following Turkey, South Korea and Argentina, India is also the fourth fastest growing EM, with 484% year over-year growth in 2021.

India’s first Sovereign Green Bond Framework

On Nov 9, 2022, Finance Minister Nirmala Sitharaman approved the final sovereign green bonds framework to fund environmentally sustainable projects. The approval is the fulfilment of the announcement in the Union Budget FY 2022-23 by the Union Finance Minister that Sovereign Green Bonds will be issued for mobilising resources for green projects.

Source: Business Today

First Loss Guarantees

The first loss guarantee is a mechanism whereby a third party compensates lenders if the borrower defaults. As the third party pays for the losses, it gives lenders confidence to give out loans. It is an insurance against a loss. The government uses it to ensure that banks are not averse to lending because of the risks involved.

For example, if the government provides 100% credit guarantee for loans of up to ₹1 crore. It means that if a bank lends up to ₹1 crore, and the borrower is unable to repay, the government will make good the entire loss. If the guarantee is for 20% of the loan, the government will compensate up to ₹20 lakh for a ₹1 crore loan.

For EV financing in India, the government, World Bank and Small Industries Development Bank of India (SIDBI) are set to launch a $1 billion fund to provide guarantees against loan default to lenders financing purchase of electric two- and three-wheelers.

The entities will initially set up a $300 million first-loss risk sharing instrument, which would act as a hedging mechanism for banks to access in case of defaults of loans on purchase of electric vehicles. This is expected to bring down the cost of financing EVs by 10-12%.

Source: Livemint, Economic Times

Risks

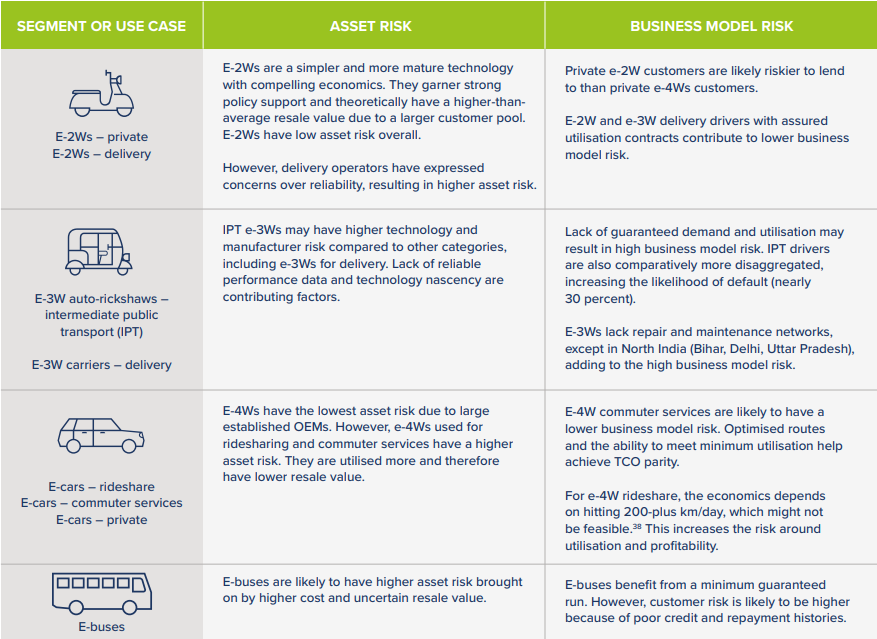

Just as any investment, financiers assess the risk involved in lending, irrespective of the loan being retail or commercial. The asset risks can be categorised under different use cases, as shown in the table below:

Priority Sector Lending: The Messiah of EVs?

The Reserve Bank of India (RBI) introduced the priority sector lending (PSL) guidelines in 1972 to expand financial access to vulnerable sections of society by enhancing credit for “priority” sectors with high employment and poverty alleviation potential but low bankability.

Priority sector status to EVs can address the lack of availability of finance. Banks that have not yet ventured into financing EVs may consider doing so. Further, for the ones already financing EVs, PSL may become a motivation to create financing options with lower interest rates and longer loan tenures.

There is a strong case for EVs as livelihood-generating and supporting assets across urban as well as rural India, especially for economically weaker sections of society.