Greetings, dear Readers!

With the Indian General Elections around the corner, the energy in the air is palpable. The Indian Administration has been very pro-active in pushing the Climate agenda forward and we hope to see this continuing with even greater momentum later this year. Amidst all this enthusiasm, the world of Batteries and Energy storage is also abuzz with new developments and exciting trends. Let’s dive into the latest updates from the Global Battery market, where Innovation meets Sustainability and shapes the future of Energy.

If you haven’t already, be sure to check out Part 1 of our newsletter, where we covered the Battery value chain, major Funding in the sector, and the Declining cost of battery cells, all from the insightful Volta Foundation Annual Battery Report 2023.

This month, we continue our exploration of the battery world by delving into Battery Manufacturing across the globe, falling Battery Raw Material prices, the role of Software across the battery lifecycle, and the Policy Incentives available worldwide for the battery value chain. Additionally, we bring you an exciting policy update for manufacturers of 4-wheeler passenger electric vehicles in India.

Crafting Tomorrow’s Powerhouses: A Look Inside the Global Battery Factory

Manufacturing Capacity: By 2030, the global manufacturing capacity for lithium-ion batteries is projected to reach 7 TWh, with China expected to account for 68.5% of this capacity.

Sustainable Supply Chain Guidance: North America and the European Union have outlined guidance aimed at developing a more sustainable supply chain for batteries, emphasizing environmental and social responsibility.

Gross Margins and Net Margins: Cell and pack manufacturer gross margins declined over the last 5 years (2018- 2022) as material prices pressured midstream suppliers like cathode and anode manufacturers, which further reduced cell and pack manufacturing margins. For battery manufacturer CATL, while gross margins declined, net margins increased due to economies of scale.

Regional Differences in Gigafactory Capex: Factors such as labor costs, vendor proximity, and others contribute to gigafactory cell production setup costs being twice as high in North America and the European Union compared to Asia, highlighting regional differences in manufacturing costs.

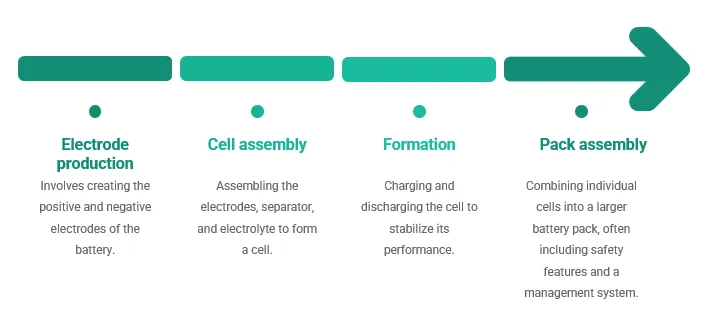

Manufacturing Process: The manufacturing process requires precision and efficiency to meet the increasing demand for batteries in various industries. This process involves four steps as illustrated below:

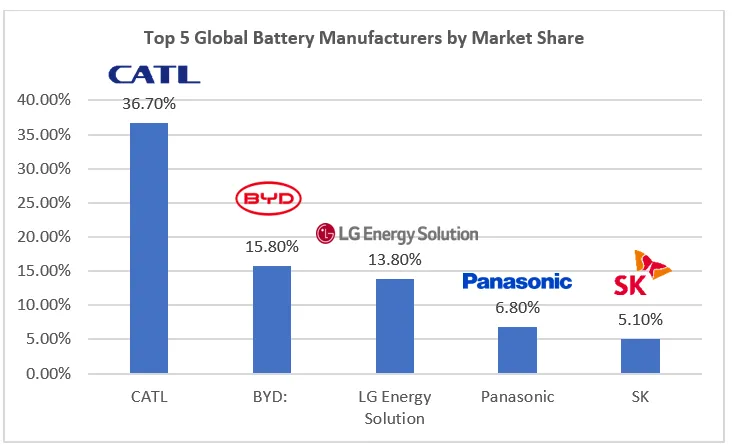

Top 5 Global Battery Manufacturers by Market Share, 2023:

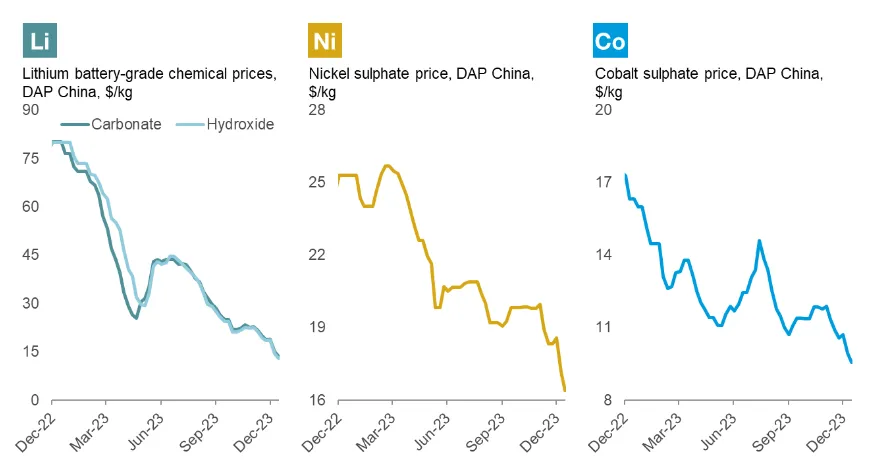

Market Shift: Raw Material Prices Dip, Impacting Battery Industry

Some of the important raw materials used in batteries are:

Lithium Battery-Grade: High-purity lithium compounds tailored for rechargeable lithium-ion batteries.

Nickel Sulphate: Key for cathode production in high-energy-density lithium-ion batteries.

Cobalt Sulphate: Essential in high-energy-density cathodes, but efforts are ongoing to reduce its use.

In 2023, as supply outpaced demand, battery chemical prices fell, as illustrated below:

The factors contributing to the price decline include increased mining investments, high inventories, and shift to LFP from nickel and cobalt materials.

Policy Pulse: How Global Policies are Energizing the Battery Industry

In 2023, the world saw a surge in policy incentives and regulations aimed at promoting sustainability and securing critical mineral supplies, particularly for the burgeoning electric vehicle (EV) market.

North America: Initiatives like the IRA EV Tax credit updates were introduced to boost onshoring and EV sales. The ‘Foreign Entity of Concern’ Rule requires new vehicles to be assembled in North America without any critical minerals or battery components from the specified entities.

Europe: The region implemented new battery regulations focusing on sustainability, circularity, and digitalization. Additionally, the Critical Raw Materials Act was introduced to ensure a stable domestic supply of battery materials. The EU Commission also launched a substantial $4 billion Innovation Fund to drive innovation, local manufacturing, and supply chain improvements.

Asia: China, a key player in the EV market, introduced graphite export controls in response to restrictions imposed by the US and EU. Chinese investments in mining and intermediate materials such as lithium, cobalt, and nickel are expected to grow significantly by 2028, aiming to secure non-domestic upstream supply.

India: The country launched the Advanced Cell Chemistry program to strengthen its ecosystem for electric mobility and battery storage, signaling a strong commitment to sustainable practices.

Rest of the World: Emerging markets are looking to leverage their critical mineral resources, but many are lagging behind in EV policy implementation. For example, Australia updated its Critical Mineral Strategy to include materials like nickel, highlighting its potential role in the global battery supply chain.

Optimizing the Battery Lifecycle: The Role of Software and Analytics in Battery Technology

Software solutions help to optimize battery performance across the battery lifecycle:

Design / R&D Analytics: Software is used for design and R&D analytics to optimize battery materials and structures for performance and cost-efficiency.

Process Control: In manufacturing, software provides process control to ensure consistency and quality in battery production.

Manufacturing Analytics: It enables manufacturing analytics for data-driven decision-making, improving efficiency and reducing defects.

In-Field Analytics: For in-field analytics, software monitors battery performance in real-time, enabling predictive maintenance and performance optimization. Cloud-based algorithms can enhance Battery Management System (BMS) capabilities by leveraging vast data sets for statistical anomaly detection, identifying potential battery issues before they escalate. Additionally, forecasting models in the cloud can predict battery performance, optimizing charging schedules and extending battery life.

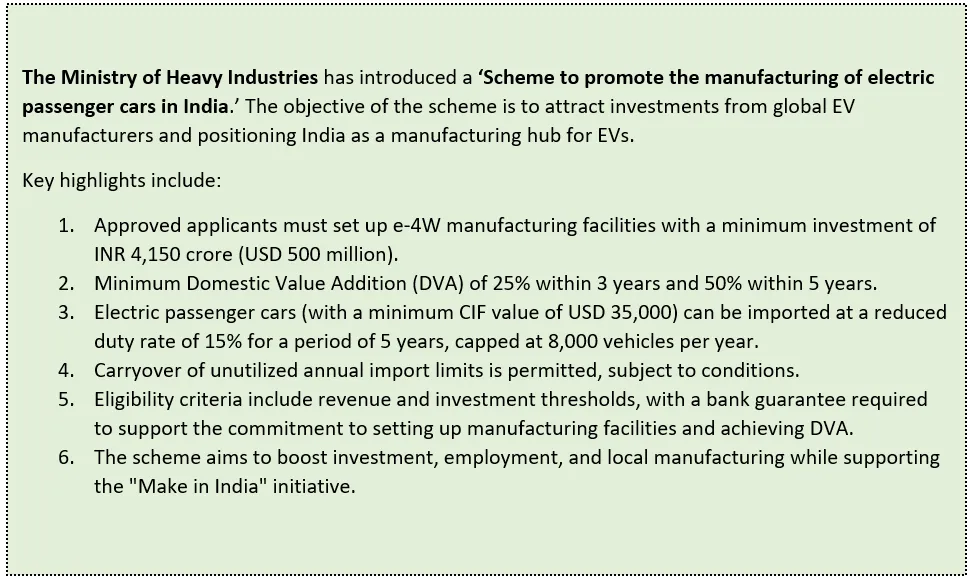

India EV Policy update: Incentives for 4-wheeler passenger EV manufacturers

In conclusion, the global battery market is experiencing a surge of innovation and sustainability, driven by increasing demand from various industries, particularly electric vehicles and consumer electronics. Stay tuned for our upcoming newsletters, where we dive deeper into the current and upcoming developments in battery cell chemistry and components.

Follow Ostara Advisors to stay updated with the latest trends related to Electric Vehicles, Innovation and Sustainability from India and around the globe.