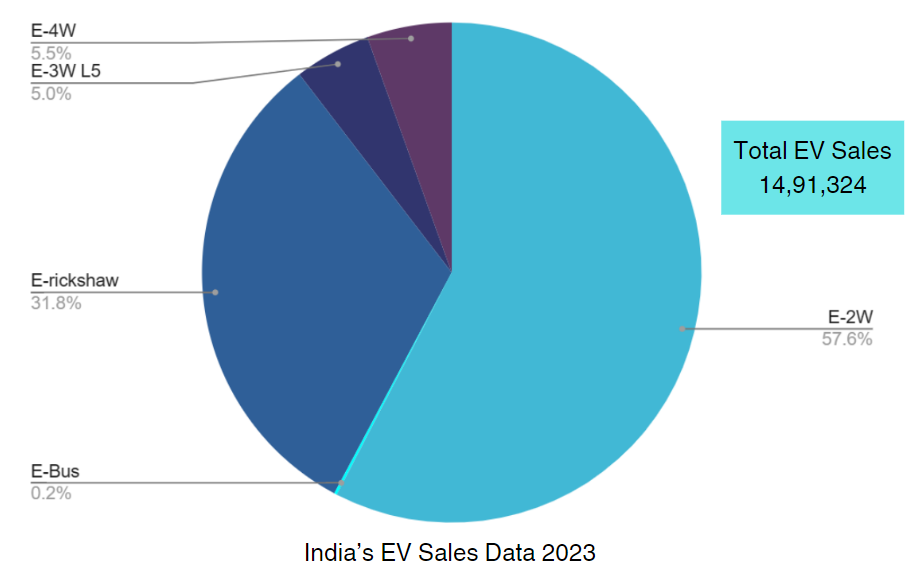

2023 was a transformative year for the Indian EV industry. Electric two-wheelers and three-wheelers, which form ~95% of total EV sales in India currently, grew rapidly even as regulatory changes brought greater compliance with battery safety standards. VC & PE funding in the Indian EV ecosystem grew by ~12% or so, even amidst the severe funding winter. It is truly remarkable that India EV funding grew from a mere 6% of total VC funding in India in 2022 to 22% in 2023!

It is a matter of pride and joy for us at Ostara Advisors to have a ring-side view to and play a role in this growth since our inception as India’s first EV & Climate-tech investment bank in 2015. We started structuring M&A and fund-raising deals in this space at a time when the Indian EV industry was practically non-existent, with very few players at scale. With every year of growth, our mission to catalyse planet-friendly businesses grows stronger.

In this edition, we highlight the key trends in EV sales and EV funding in India for the year gone by, as well as highlight key M&A deals in this space.

First a quick update on Global EV funding…

The global electric vehicle (EV) sector witnessed a remarkable surge in investments, surpassing the previous year’s record, to reach US$28 billion in 430 rounds, setting a new all-time high in the EV industry. This marked a substantial 58% YoY increase over US$18 billion raised in 600 funding rounds globally in 2022. USA, China, France, South Korea and India together contributed to over 87% of this funding, leading the much-needed EV revolution. (Source: Tracxn)

EV sales trends in India in 2023

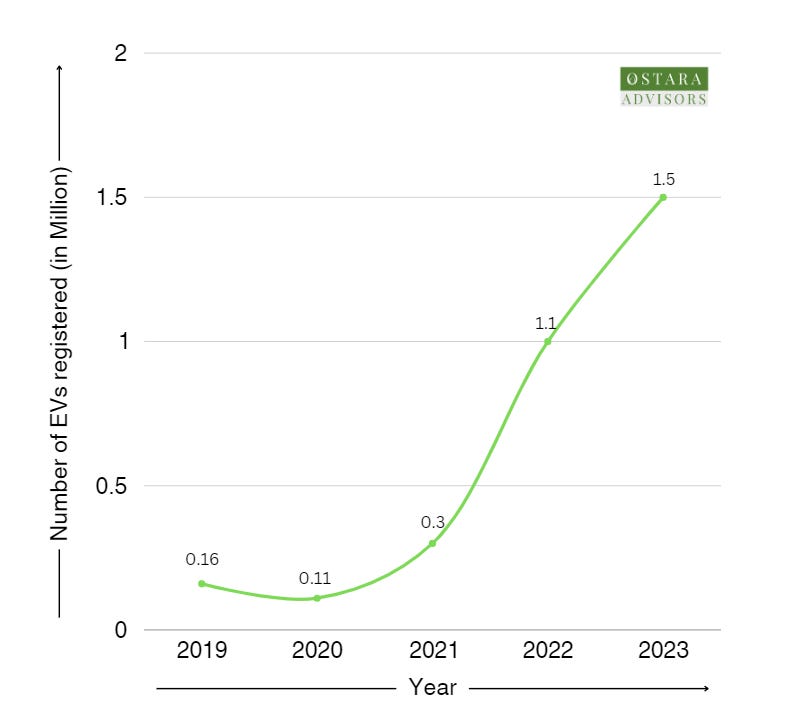

After breaking the 1 million unit barrier in 2022, EV sales in India zoomed 47% YoY to reach ~1.5 million units in sales in 2023.

What’s remarkable is that EV two-wheeler (e2W) sales quickly brushed off the impact of a sudden 30% reduction in Demand Subsidy for this segment by the Indian government in June 2023, and bounced back within 2 months, to reach average monthly sales of 70,000+ units for the full year, which was 38% higher than the 2022 monthly average.

Here are the other notable India EV sales trends for 2023:

- By far, the fastest growing EV segment was Electric 3W L5, which more than doubled to ~74,000 units in 2023 from 33,000 units in 2022. These are purpose-built for last-mile and mid-mile cargo and passenger transport, are capable of 500kg+ payloads and retail for US$ 5500-6200.

- Electric cars and Four-wheelers were the second-fastest growing segment with 71% YoY sales growth in 2023

- Electric 3W L3 vehicles or E-rickshaws, as they are popularly known, were the third-fastest growing segment with 55% YoY sales growth in 2023. These are low-speed EVs serving the last mile commute segment, with top speeds of upto 25 km/hour and selling for an average of US$1500

- Electric Buses are catching up too with annual sales of 2600+ units in 2023.

Sources: News articles, Tracxn, others

While 2022’s Top 5 E2W OEMs by units sold included Ola, Okinawa, Hero Electric, Ampere and Ather Energy, 2023 sales toppers were Ola, TVS Motor, Ather Energy, Bajaj and Ampere, suggesting a re-calibration of the industry on the back of revised regulations and subsidies as well as a stronger entry by incumbents.

Key Fund-raising Trends in the Indian EV ecosystem in 2023

As per our estimates, the total funding raised by the Indian EV ecosystem in 2023 was in the region of US$ 1.8 billion, which was ~12.5% higher than the previous year. These numbers include deals announced and/or funded during 2023, and include debt financing as well as future funding commitments in certain cases.

- While EV OEMs continued to dominate the fund-raises, their share in the total fell to 55% in 2023 from ~75% in the previous year. A total of US$1bn was raised by EV 2W, 3W and 4W OEMs this year, with EV two-wheeler OEMs getting the lion’s share of the funding.

- Significant increases in funding were seen in Battery Swapping, EV Fleets and Mobility Services, driven by fast adoption of EVs in Corporate, Ride-hailing and Logistics fleets. This is, by far, the defining trend of 2023, as Commercial Vehicle consumers in both B2B and B2C categories started to adopt EVs for their businesses.

- The fastest electrifying segment in 2023 was the Cargo Three-wheeler segment, which is expected to reach ~25% EV penetration by March/April 2024.

Going forward, we foresee greater funding flows into Electric Light and Small Commercial Vehicles, incl three-wheelers, EV Charging and Electric Bus solutions in 2024, even as EV adoption grows among end-consumers.

Key M&A Deals in 2023 in the Indian EV Ecosystem

December 2023: Livguard, an Energy Storage and Solutions company under the SAR Group, has announced a strategic acquisition of Emuron Technologies, a battery swapping and battery intelligence solutions provider for electric two- and three-wheelers.

October 2023: Sajjan Jindal-promoted JSW Group signed a Memorandum of Understanding to buy ~38% stake in MG Motor India, a wholly-owned subsidiary of the Shanghai-based SAIC Motor. This marks the US$23 billion Group’s entry into the EV market. As of Jan 23, 2024, this deal received Competition Commission of India (CCI) approval.

August 2023: Gulf Oil Lubricants India Limited (GOLIL), a Hinduja Group Company, announced the acquisition of a controlling stake in Tirex Transmission Pvt Limited for ~ $13m subject to the completion of definitive agreements and the satisfaction of predetermined closing conditions.

July 2023: TI Clean Mobility Pvt Ltd (TICMPL), a subsidiary of Murugappa Group’s engineering firm Tube Investments of India Ltd, takes a majority stake in Auto parts firm Jayem Automotives Pvt Ltd. This subsidiary will manufacture and sell electric small commercial vehicles (eSCVs) with TICMPL and the Jayem promoter holding 80% and 20% respectively.

May 2023: Siemens’ acquired the EV division of Mass-Techs Controls Private Ltd., which is engaged in design, engineering and manufacturing of a wide range of AC chargers, and 30 to 300kW capacity DC chargers for various end applications for EVs, for approximately $4.75m.

April 2023: German Electric Scooter Brand, Kumpan, was acquired By Indian Firm Lohia Auto. Kumpan’s parent company E-bility was forced to file for bankruptcy on February 10, 2023 and consequently, the Brand was taken over by Lohia for an undisclosed amount. As per reports, Lohia has already begun restructuring the brand.

Follow Ostara Advisors to stay updated with the latest trends related to Electric Vehicles, Innovation and Sustainability from India and around the globe.