As we launch full steam ahead into the new year, we look back at the year that was. 2022 bore witness to many milestones for Ostara Advisors, which we wrote about last month in the Ostara Rewind. This month, we look at the transformational trends for the Electric Mobility space in India during 2022, in the Ostara Review.

EV Sales hit a million!

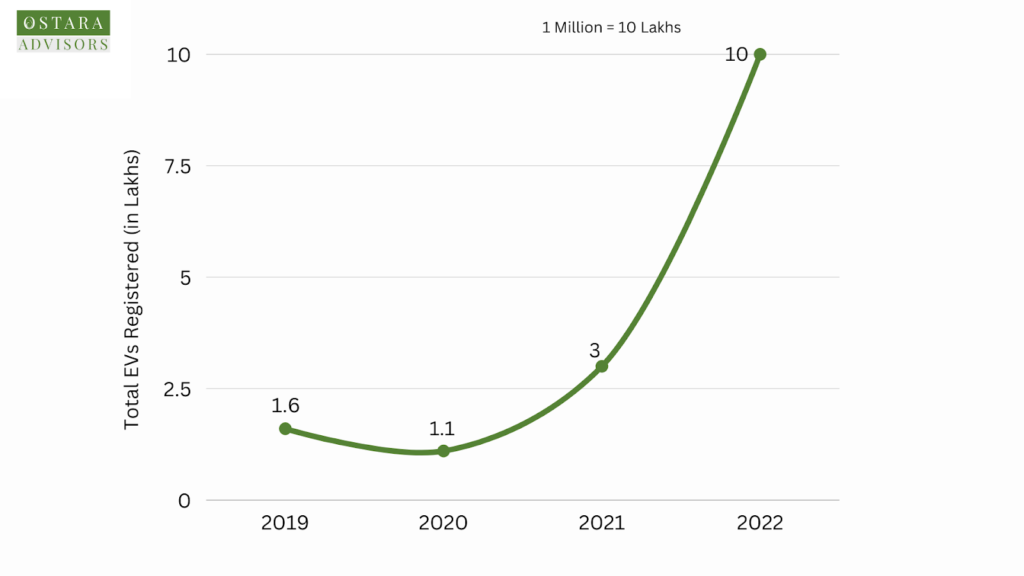

A total of 1,006,412 electric vehicles were registered in India in 2022, of which 2W accounted for 62%, 3W for 34%, and 4W for 4%. The graph below depicts the sales trend over the past 4 years. This was a whopping 233% higher than the EV sales in 2021 and the highest ever in any year!

Thanks for reading The Ostara Advisors Newsletter! Subscribe for free to receive new posts and support our work.

Subscribed

VC & PE Funding in the Indian EV ecosystem in 2022

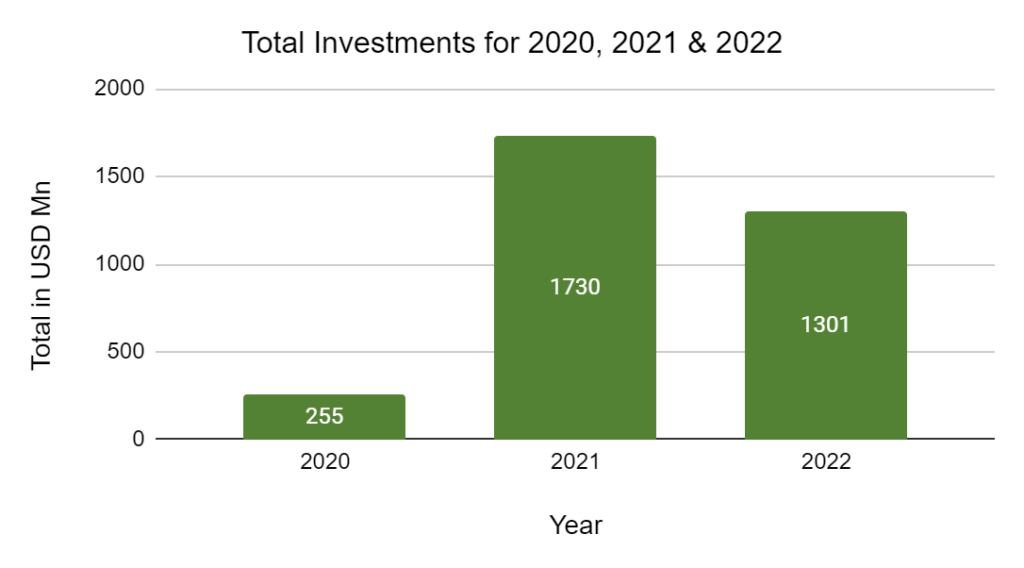

2022 witnessed investments of ~$1.3 Bn, across 41 deals into the Indian EV ecosystem, almost 5x the funding raised in 2020, though 25% lower than in 2021. The largest deal was Mahindra & Mahindra raising $250 Mn from British International Investment for investing in their 4W Passenger EV program, followed by Ola Electric raising $200 Mn from Tekne Private Ventures & others, and Ampere Vehicles raising $150 Mn from Middle Eastern investor Abdul Latif Jameel.

We did a deep dive into funding trends across various sub-segments of the EV Ecosystem.

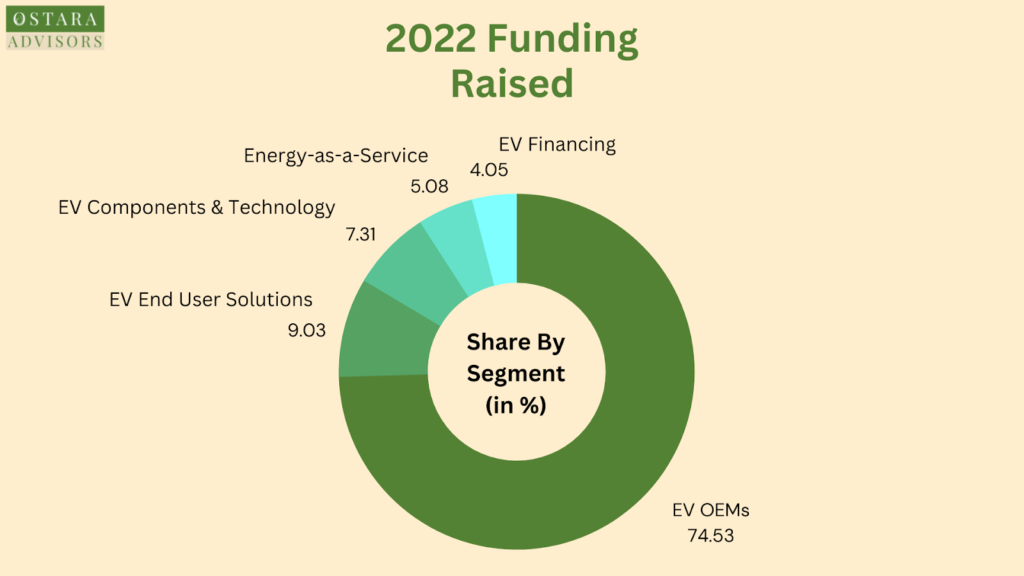

- In 2022, as in the previous year, EV OEMs in India took the lion’s share of the investments. Even though the absolute amounts were smaller – $931 Mn in 2022 as compared to $1561 Mn a year ago – funds invested in EV OEMs in India accounted for 75% of the total capital raised in the EV space in 2022.

- EV end-user solutions, including rental platforms as well as ride-hailing services, had the second-highest share with 9% of the total investments.

- EV components and technology formed about 7% of the funding pie, followed by Energy-as-a-service (Battery Swapping & Charging solutions) with 5%, and EV financing, at 4%.

Y-o-Y funding trends

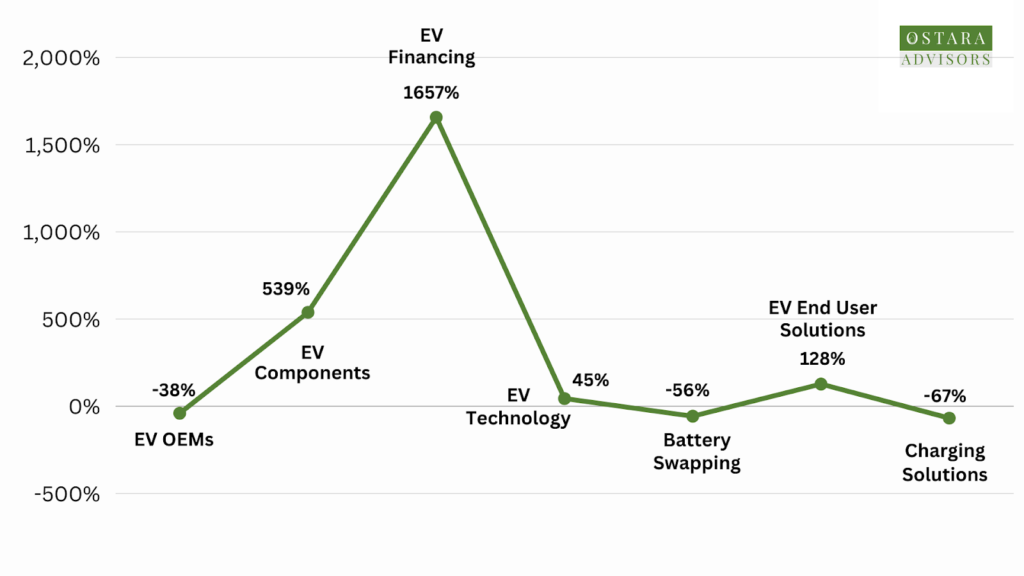

As we predicted a year ago, 2022 witnessed significant growth in VC fund flows into the EV financing segment, almost 17x the value of funding this segment received in 2021. Another segment that observed high growth was the EV components segment, which saw 6 times more venture capital flows than last year. The End-user segment was 2x of that in 2021, while the charging segment raised 1.4x more funding than in the previous year.

Compared to 2021, the total funding decreased by $0.43 Bn, but the investment activity in the EV ecosystem has been much more diverse, as evidenced by the tremendous increase in other segments.

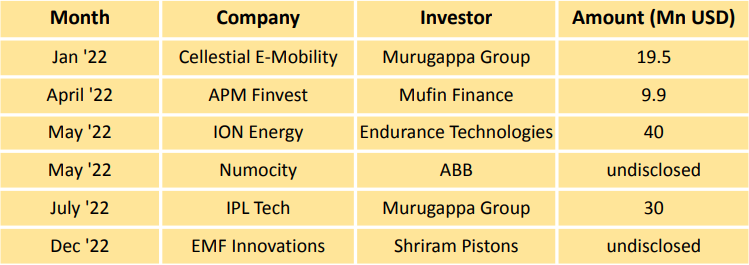

Key M&A Deals in 2022 Indian EV ecosystem

Cellestial E-Mobility: Muruguppa group firm Tube Investments of India (TII) acquired a 70% stake in startup Cellestial E-Mobility for Rs 161 crore. Cellestial E-Mobility is engaged in the design and manufacture of electric tractors, aviation ground support, electric equipment and other electric machinery.

APM Finvest: Mufin Finance acquired APM Finvest, a BSE-listed NBFC, for over Rs 76 crore, in a bid to create India’s first financing ecosystem for the fast-growing electric vehicles(EVs) market. This came after Mufin Finance acquired Rupee Circle, a P2P (peer-to-peer) non-banking financial company, in June 2021.

ION Energy: Maxwell Energy Systems (MESPL), the advanced electronics business unit of ION Energy, was acquired for $40M (Rs 308 Crores) in an all-cash transaction by Endurance Technologies. ION Energy is an AI-enabled platform offering Battery Management Systems.

Numocity: Swiss technology company ABB’s e-mobility division has acquired a 72% controlling stake in Numocity. The acquisition cost, however, was not disclosed. ABB had made an initial investment of 7% in the EV charging solution startup as part of its seed-stage.

IPL Tech: Muruguppa group firm TI Clean Mobility acquired a 65% stake in IPLTech, for Rs 246 Crore. IPL Tech is a leading OEM startup in the electric heavy commercial vehicles.

EMF Innovations: Auto component company Shriram Pistons & Rings Ltd acquired a majority stake in EMF Innovations. The deal size was not disclosed. EMF Innovations is an electric motor design and manufacturing company.

Ostara’s Take

2022 was a notable year for the Indian EV ecosystem. Not only did EV sales hit all-time highs in India with over a million EVs sold, but there were also strong and swift policy moves by the Indian administration to strengthen battery safety as well as towards enabling battery swapping. These are good signs for strong and stable growth in zero-emission vehicles.

As we foresaw, leading startup OEMs in the electric 2-wheeler and 3-wheeler segments raised important funding rounds that set them up for scale. Clearly, the most notable trend of the past year in VC funding was the diversity of EV ecosystem startups that raised institutional funding – 4 segments of the EV landscape raised funds of $50m or above.

We see 2023 continuing these trends of a wider spread of funding across sub-sectors, as well as greater capital flows into the EV components segment.