EV powertrains for India and similar emerging markets of South Asia, Africa & South America have to be built super-rugged to perform well in tough weather, road and usage conditions. Not just that, they also have to compete in price and performance with fossil fuel vehicles, in order to see accelerated customer adoption. All of these pose interesting challenges and opportunities for Indian EV makers.

What’s under the hood?

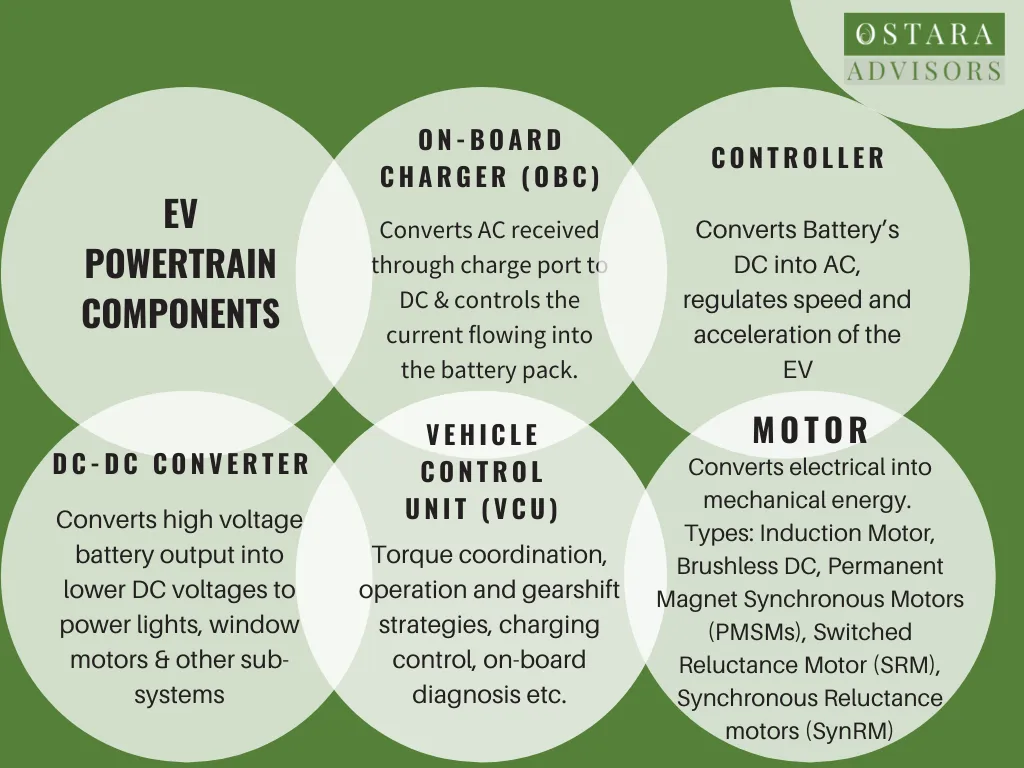

While most electric cars look similar on the outside to their fossil fuel-powered counterparts, underneath the hood things are very different. The electric powertrain is fundamentally superior to an internal combustion engine (ICE). It has one or more motors that produce motion by taking electric energy from the battery, without generating significant heat! With more torque at lower speeds, an electric car

gives more acceleration than a comparable ICE vehicle.

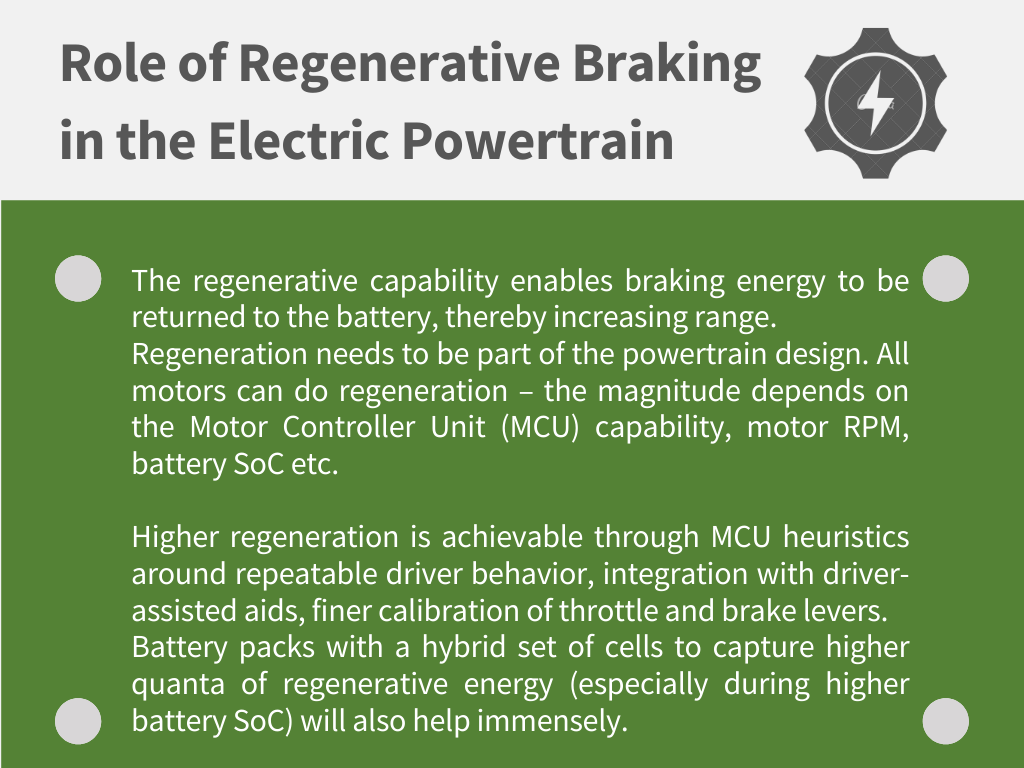

Did you know that, unlike your petrol or diesel car that gives you fewer km to the liter in city driving vs on the highway, the electric vehicle can actually deliver better “fuel economy” in the city due to regenerative braking? As EVs can harvest energy from braking, most of the kinetic energy spent to accelerate when the light turns green is recaptured at the next red light.

Source: EV Reporter- EV components, CEEW-India’s-EV-Transition-Post-COVID-19-22Dec20, Avendus EV Report, https://www.innovativeautomation.com/the-electric-vehicle-drivetrain/

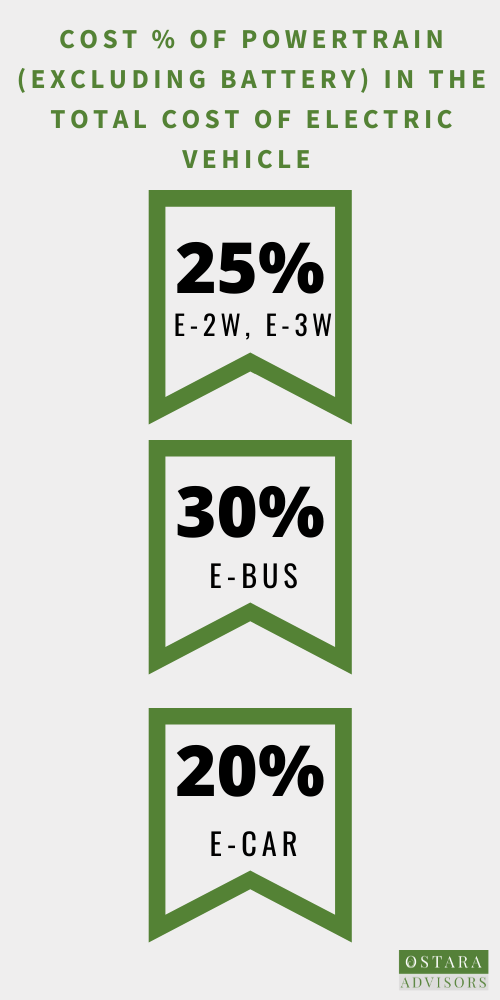

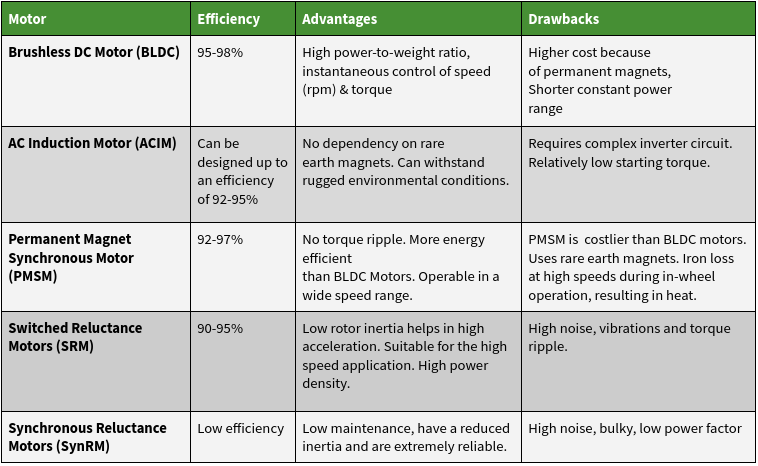

Understanding the Motor

Sources:

https://circuitdigest.com/article/different-types-of-motors-used-in-electric-vehicles-ev; https://gomechanic.in/blog/electric-vehicles-types-explained/ ; https://www.mdpi.com/1996-1073/13/4/1004/ ; https://www.ee.co.za/article/advantages-synchronous-reluctance-motor.html ; https://insights.globalspec.com/article/14597/switched-reluctance-motors-for-electric-vehicles ; https://www.mdpi.com/2071-1050/13/2/729/pdf,https://www.mdpi.com/1996-1073/12/11/2190/pdf

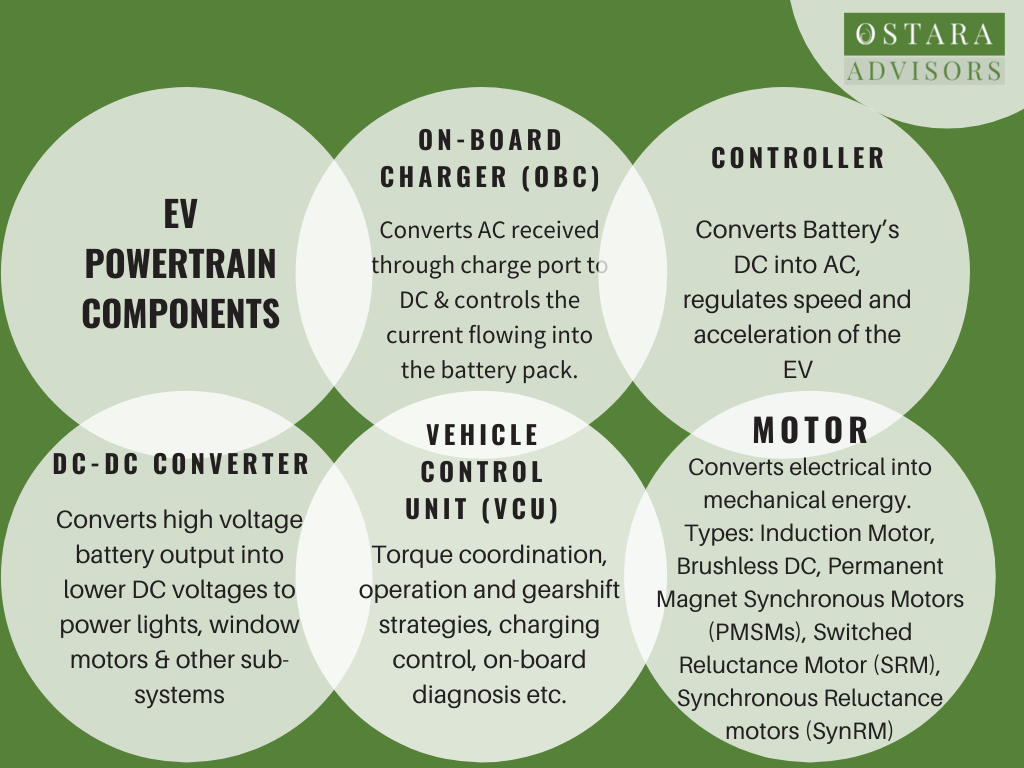

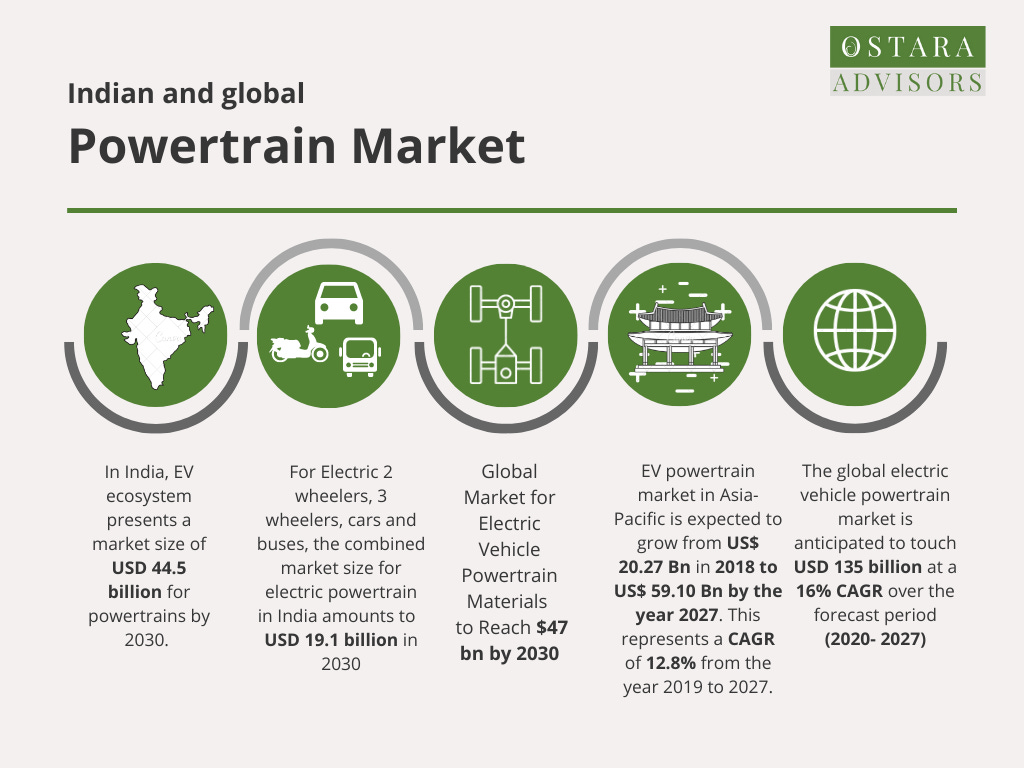

Powertrain Market

Source:Avendus EV Report , Ostara Advisors Estimates, globenewswire.com/Electric-Vehicle-Powertrain-Market-to-touch-USD-135-billion-by-2027-Market-Research-Future-MRFR.html,mordorintelligence.com/industry-reports/electric-vehicle-powertrain-market,researchandmarkets.com/reports/asia-pacific-ev-powertrain-market-to-2027,CEEW-India’s-EV-Transition-Post-COVID-19-22Dec20.pdf,eqmagpro.com/market-for-electric-vehicle-powertrain-materials-to-reach-47-bn-by-2030

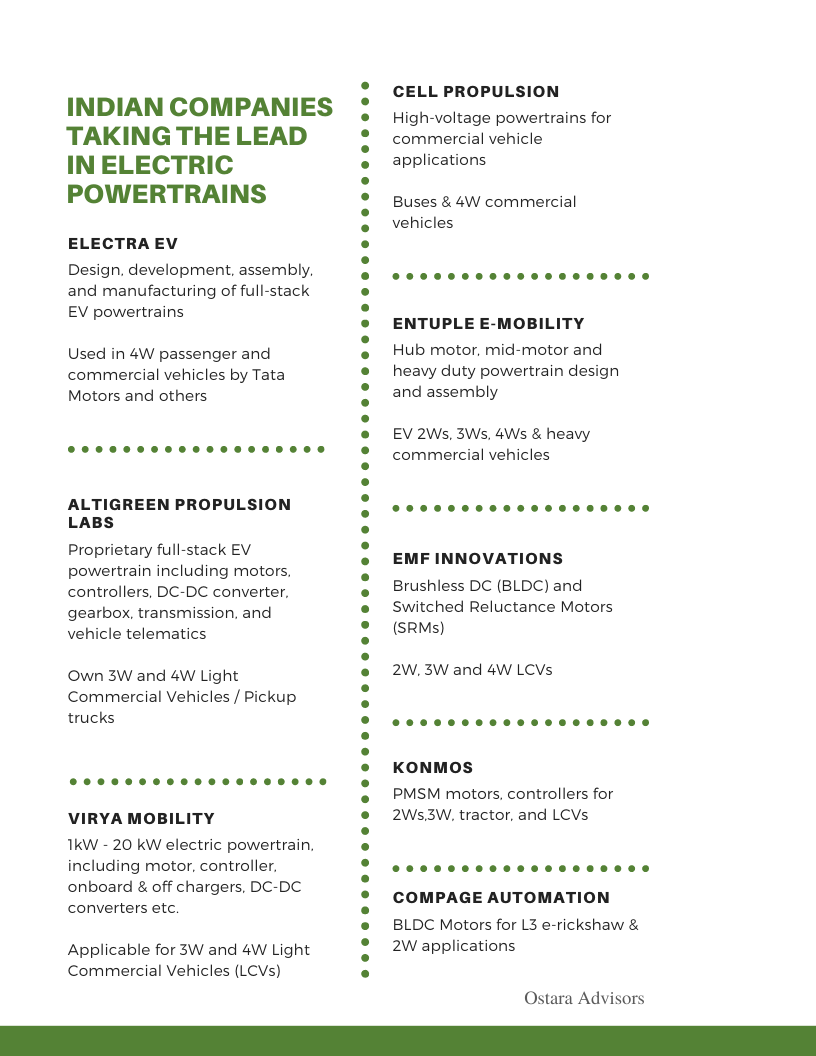

Source :https://evreporter.com/ev-powertrain-components-manufacturers-in-india/, Individual Company websites

Top 4 global trends in EV powertrain technology

- Use of silicon carbide transistors in inverters. Use of insulated-gate bipolar transistors, or IGBTs, in inverters in advanced e-powertrain designs bring in cost efficiency at high volumes, wide availability, and operational efficiency. Customized inverters with silicon-carbide metal-oxide-semiconductor field-effect transistors (SiC MOSFET) are even more efficient and can provide significant opportunities to optimize the e-powertrain system—for e.g., downsizing the thermal management system.

- Smart thermal management. These systems, which connect the battery, electric motor (e-motor), inverter, and cabin, have become the standard architecture for state-of-the-art BEVs. These systems enable vehicle components to maintain optimal temperatures, regulate heat flows, and maintain energy efficiency. Overall system costs can be further reduced if vehicles can use heat from their e-motors or inverters, eliminating the need for a separate heater.

- Submerged oil cooling of the e-motor. Many vehicles cool their e-motors via liquid-cooling jackets because it’s a low-cost solution. But another solution, oil cooling, enables a higher peak power at lower cost. Oil cooling also provides the packaging advantages of a slimmer motor, since an outer shell is not required. Models that use oil cooling can reach a peak power of 211 kilowatts (kW),whereas models which are cooled by a liquid jacket, only reach up to 160 kW

- Integrated onboard charger and converter of direct current-to-direct current. An integrated direct current-to-direct current (DC–DC) converter and onboard charger (OBC) unit can significantly reduce costs through the integration of physical and functional components,the cost of a single DC–DC and OBC unit is 19 percent lower than the cost of having two separate units.

Source: https://theicct.org/sites/default/files/publications/Battery-capacity-ev-india-feb2021.pdf, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/winning-the-chinese-bev-market-how-leading-international-oems-compete

Powertrain Investments & deals

INDIA

- Tata AutoComp signs a Joint Venture with Prestolite Electric to supply EV powertrain solutions in India. The joint venture will have access to technologies for various powertrain products like motors, controllers as well as integrated drivetrain (integrated motor, inverter, and transmission) – Jan 2020

- Bharat Forge has set up state-of-art R&D centres in India and the UK providing full powertrain solutions: They engage in modular design, motor design, motor testing, BMS, and Inverter design & development.

- New generation Volvo XC60 to go green with an all-electric powertrain – June 2021

- Mahindra has revealed that the XUV700 SUV will be available with the option of electric powertrain along with a choice between petrol and diesel engines. – May 2021

GLOBAL

- Marelli, a leading global automotive supplier, and PUNCH, a supplier for the development, integration and manufacturing of driveline and powertrain solutions, to jointly develop e-axle solutions. Both companies combine their extensive expertise in the area of electric powertrains to offer integrated systems for electric vehicles. – May 2021

- Skoda has announced its ‘Next Level Strategy 2030’ concentrating on being more digital along with embracing electric powertrain technology and going more global. – June 2021

- LG Electronics Inc. and Canadian auto parts maker Magna International Inc. are in the final phase of launching their electric vehicle (EV) powertrain joint venture– June 2021

- Ford Motor Co. announced Monday it is changing the name of one of its components plants in southeast Michigan to reflect the automaker’s transition to electrified powertrains.The Van Dyke Transmission Plant in Sterling Heights will now be known as the Van Dyke Electric Powertrain Center– May 2021

EV Investment & deals

- Grinntech, a Chennai-based EV start-up working on lithium-ion batteries for electric vehicles & energy storage systems, has closed a bridge funding round of approximately $2 million– June 2021

- Harsha Moily’s $200 million fund to focus on climate tech companies – June 2021

- Bengaluru-based electric mobility startup, Cell Propulsion, has raised $2 million from a clutch of private equity investors, including Endiya Partners, GrowX Ventures, Huddle Accelerator and Micelio– June 2021

- Amazon’s Climate Pledge Fund has made its first investment in India through energy-tech startup ION Energy and participated as a part of the startup’s Pre-Series A round worth $3.6 million– June 2021

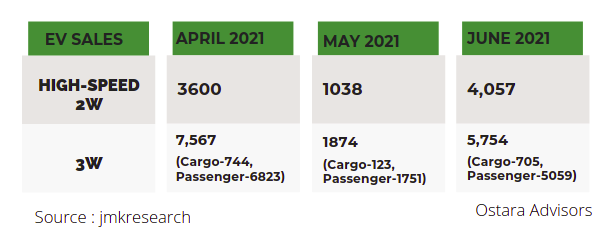

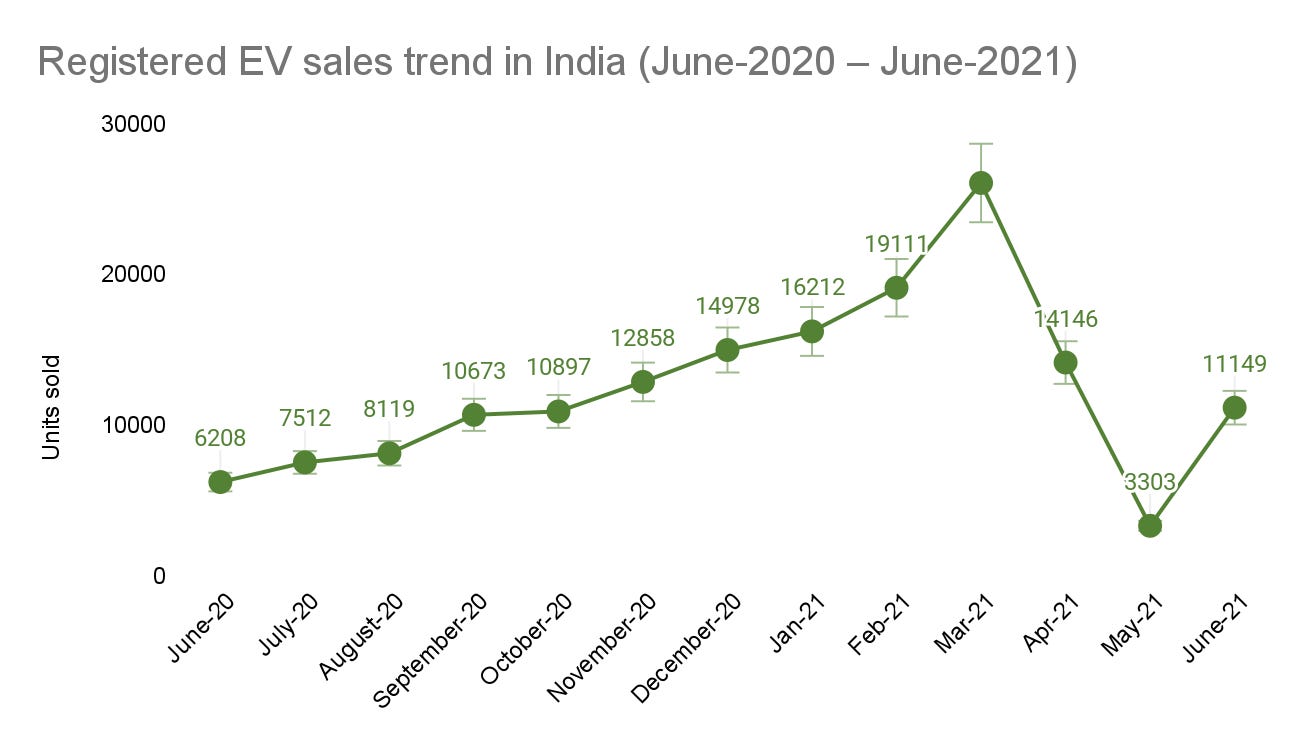

EV Sales tracker

Source: jmk research-monthly-ev-update-JUNE-2021

Credits: We would like to thank Dr. Amitabh Saran, Co-Founder, Altigreen Propulsion Labs for his inputs on challenges and opportunities for Indian EV powertrain makers.

About Ostara Advisors:

Ostara Advisors (formerly Dhruva Advisors) is India’s first e-mobility and sustainability-focused boutique investment banking firm. Our focus sectors are Electric Vehicles, IoT & Automation, CleanTech, and Renewable Energy. The firm was founded in 2015 by Vasudha Madhavan, who is one of the first investment bankers in India to specialise in Electric Mobility. Marquee deals include advising on India’s first Electric Vehicle two-wheeler M&A, where she represented Greaves Cotton Ltd. on their acquisition of pioneering EV 2W maker, Ampere Vehicles.

CopyrightOstara Advisors 2021, All rights reserved Bangalore, India