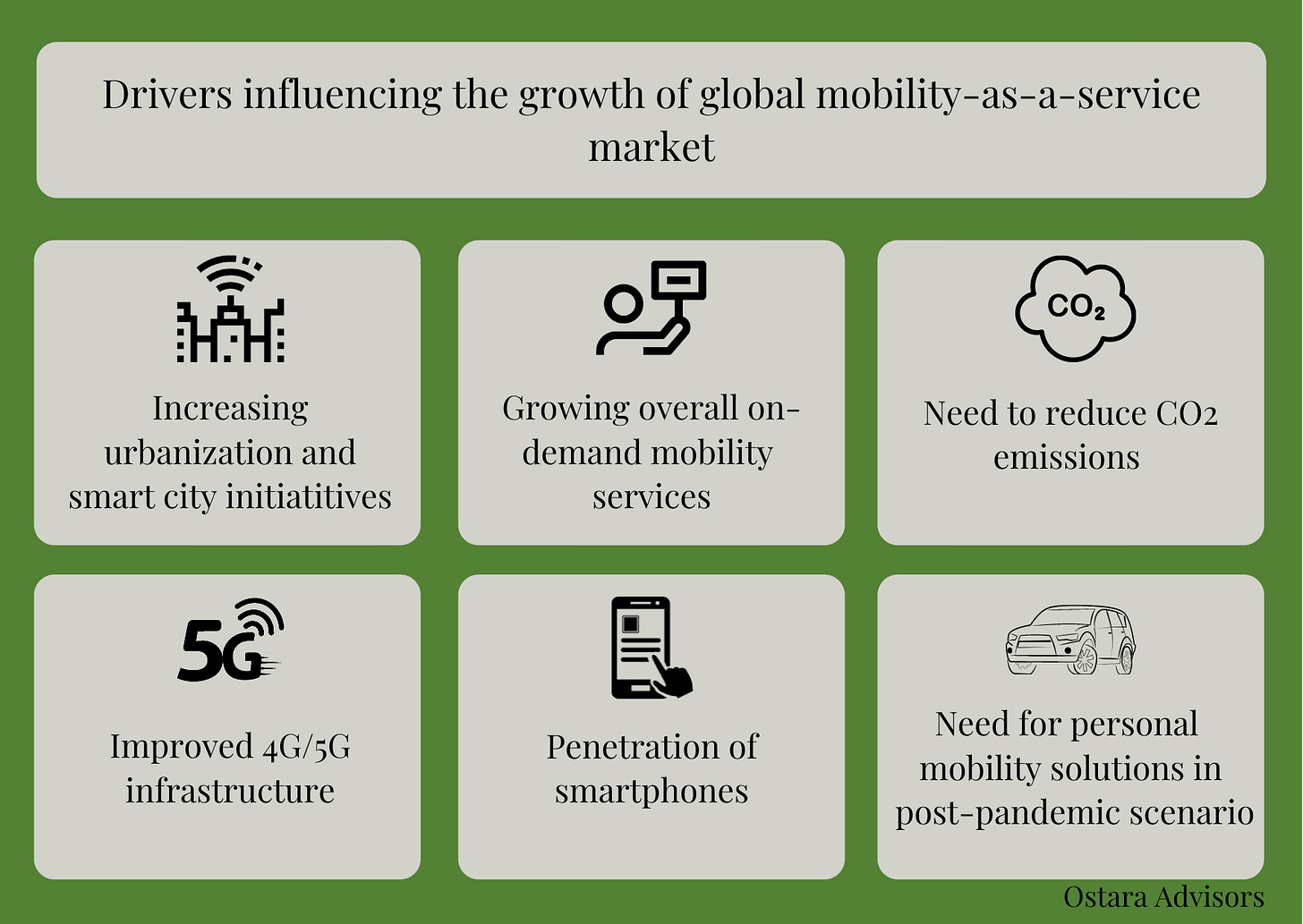

MaaS is an innovative concept that combines different transport modes to offer consumers the possibility to get from A to B in a flexible, personalized, on-demand and seamless way, through a single interface.

In recent years, the concept of Mobility-as-a-Service (MaaS) has been gaining popularity. The rise of Mobility-as-a-Service (MaaS) platforms, shared and networked vehicles, and other transportation technologies have changed the way we think about cities, transport, and data.

In this month’s edition of “All about EV’s”, we share an overview of M-a-a-S models and how electric mobility provides an impetus to this revolution.

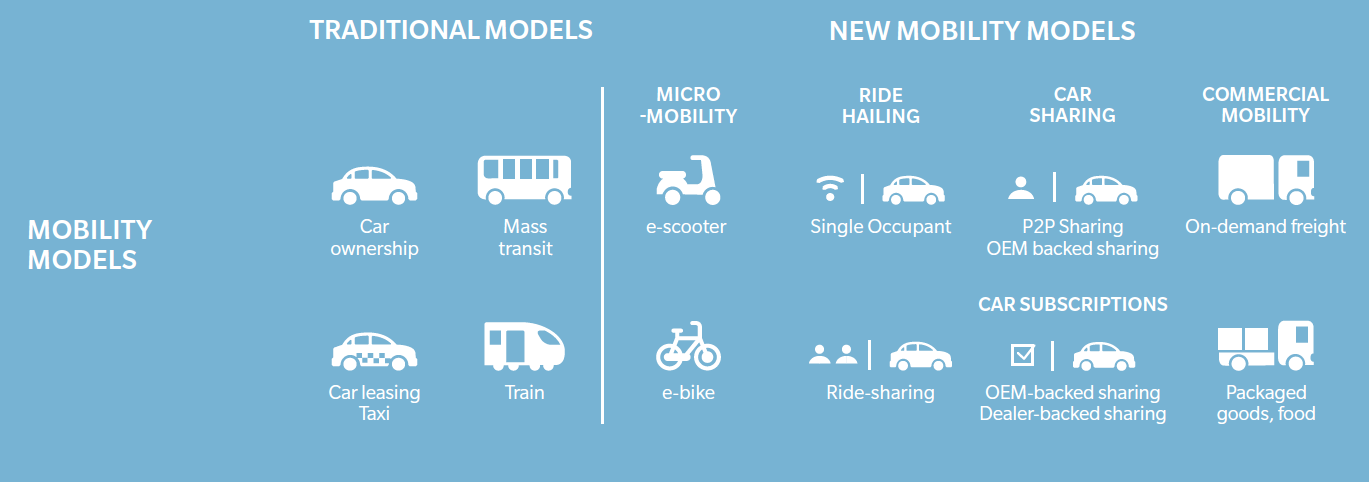

How Mobility models are changing

Source: Marsh & McLennan Advantage Insights, Marsh, Oliver Wyman

Five new mobility models

Mobility ecosystems are forming around the needs and preferences of end-users. Private-vehicle ownership is increasingly becoming just one of several mobility options. Today’s mobility landscape is more complex, with new, customer-focused mobility players creating an additional service layer between OEMs and users.

Ride-Sharing

The shared mobility trend started with ride-hailing. A modal shift in shared mobility is the switch from the one rider-one car model to the one-rider one seat- in-a-car model. In exchange for a slightly longer total travel time, route optimization technology allows drivers to save fuel and reduce emissions. For riders, it allows on-demand travel at a reduced fare.

USD 250bn Global revenues in the ride-hailing & taxi segment in 2021

USD 377bn by 2025 Revenues are expected to grow at a CAGR of 10.73% during 2021-2025.

Car-sharing

The average car is parked over 90% of the time. The owner must bear the cost of maintenance and insurance to use the vehicle for only a fraction of the time. Car-share aims to address this under-utilization issue. Car-share provides on-demand, short-term access to a vehicle usually reserved through a mobile application. Users are then charged by either time or distance.

Several varieties of car-share models exist. A standard model is round-trip car sharing, which requires us to borrow and return vehicles at the same location. A more flexible model is point-to-point car -share, which allows customers to pick up a vehicle at one location and drop it off at another. The latter is rapidly becoming a model of choice.

Image Source: Unsplash

By integrating software, telematics, and other fleet management solutions, car-sharing platforms can better determine the rental status of vehicles and driving behaviors of the renters.

Car Subscriptions

Subscribing to a car is fast becoming an alternative to owning or leasing and aims to address the underutilization of personal vehicles. Car Subscription programs offer individuals access to a suite of cars, with maintenance, roadside assistance, and insurance often included for one all-inclusive price.

A key differentiator between car subscription programs and traditional car leasing is the ability to “flip” in and out of different cars every month, or in some cases with just a few days’ notice.

Micro-mobility

Today, micromobility refers to vehicles that carry one or two passengers primarily for personal use. They are electric, weigh less than 1000 pounds, generally travel less than 15 miles per hour, and can be owned or shared.

Micromobility solutions include bikes, scooters, and mopeds. They address the need for trips on average less than 5 km.

Over the past 18 months, micromobility adoption rates have eclipsed ride-hailing growth rates. The mode has moved approximate 30 trillion passenger miles annually across the world. An explosion of e-bikes, e-scooters, and mopeds in the US and Asia have led the charge.

Sources: National Highway Traffic Safety Administration, CB Insights

Southeast Asia and India may have the fastest shift to micromobility, given a high percentage of two-wheeler ownership in these regions.

Commercial Mobility

The explosion of e-commerce is placing increasing demands on shippers to scale up their commercial freight capabilities within their overall supply chain. Freight brokering enables shippers and carriers to connect on-demand to ship specific loads.

Freight brokers add value by acting as a demand/ supply aggregator, creating transparency in load management, and reducing friction for shippers and carriers.

Impact of Electric Mobility in MaaS in India

Fleets drive higher usage of vehicles, which, in turn, drives TCO parity for EVs with their ICE counterparts. TCO parity is already starting to happen across 2, 3 and 4-wheelers in India due to rising oil prices as well as higher taxes on fuel, unlike in other countries.

EVs experience significantly fewer maintenance needs, major repairs, and downtime compared to diesel and gasoline vehicles; there are only 20 moving parts in an electric engine compared with nearly 2,000 in an ICE.

EVs also allow seamless integration of electronics and telematics as they are more amenable to connected vehicle technologies.

Early adopters of EV fleets have already realised the 20-25% cost savings, putting themselves in pole position for expansion as more EV models become available and the policy environment moves further towards electrification.

Event updates:

Ostara Advisors, represented by Vasudha Madhavan, has been invited to a panel discussion at the TiE Sustainability Summit 2021 taking place during Oct 4-6, 2021. TSS 2021 will be attended by delegates from across fourteen countries comprising Entrepreneurs, Global Leaders, Nobel Laureates, Investors, Government Representatives and Academia.

We will also be speaking at the CII Karnataka Electric Mobility Conclave, happening on the 7th October, 2021.

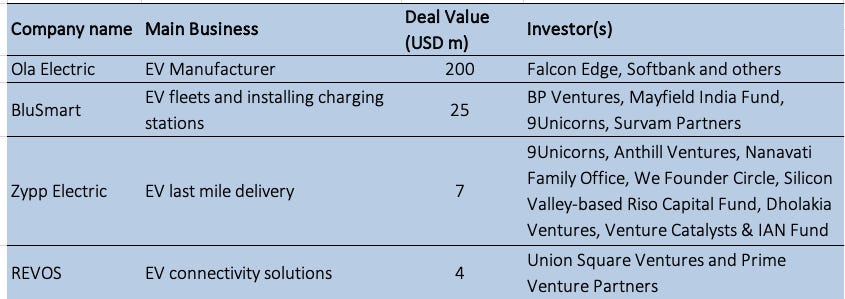

Deal Updates:

September 2021 was an eventful month for fund-raising in the Indian EV industry with ~$236m raised by 4 leading startups in electric mobility. 2 global investors, bp Ventures and Union Square Ventures, participated in the Indian EV ecosystem for the first time – a very encouraging sign for the industry!

Copyright Ostara Advisors 2021, All rights reserved

Bangalore, India