Editors Note!

Picture this. You are stuck in a jam, at a seemingly unending traffic signal, on your bike and your lungs slowly absorb the rising fumes from the idling vehicles around you. You mentally run through your list of peeves: adulterated fuel sold in fuel stations, rush-hour congestion, lack of effective road planning and traffic management etc. What if, regardless of these problems getting solved anytime soon, there were to be a wholly different solution to traffic pollution that you and I could choose to adopt! A solution that represents a paradigm shift in the automotive industry, at scale. Electric Mobility, of course! This newsletter attempts to provide a perspective on various aspects of this fast-emerging new ecosystem of e-mobility. It’s a vast and extremely interesting ecosystem, which involves a complete rethink of the automotive, energy and even the vehicle financing industries, and I look forward to engaging with all of you through this newsletter.

We kick things off with an easy overview and proceed to get more technical in the editions to follow.

EV’s have come full circle

Around 1832, Robert Anderson, a British inventor, developed the first crude electric carriage. In the U.S., the first successful electric car made its debut around 1890 thanks to William Morrison, a chemist who lived in Des Moines, Iowa. By 1900, electric cars were at their heyday, accounting for around a third of all vehicles on the road. New York City even had a fleet of more than 60 electric taxis. It was Henry Ford’s mass-produced Model T that dealt a blow to the electric car. Introduced in 1908, the Model T made gasoline-powered cars widely available and affordable.

Source: https://www.energy.gov/articles/history-electric-car

How the EV scores over the ICE vehicle

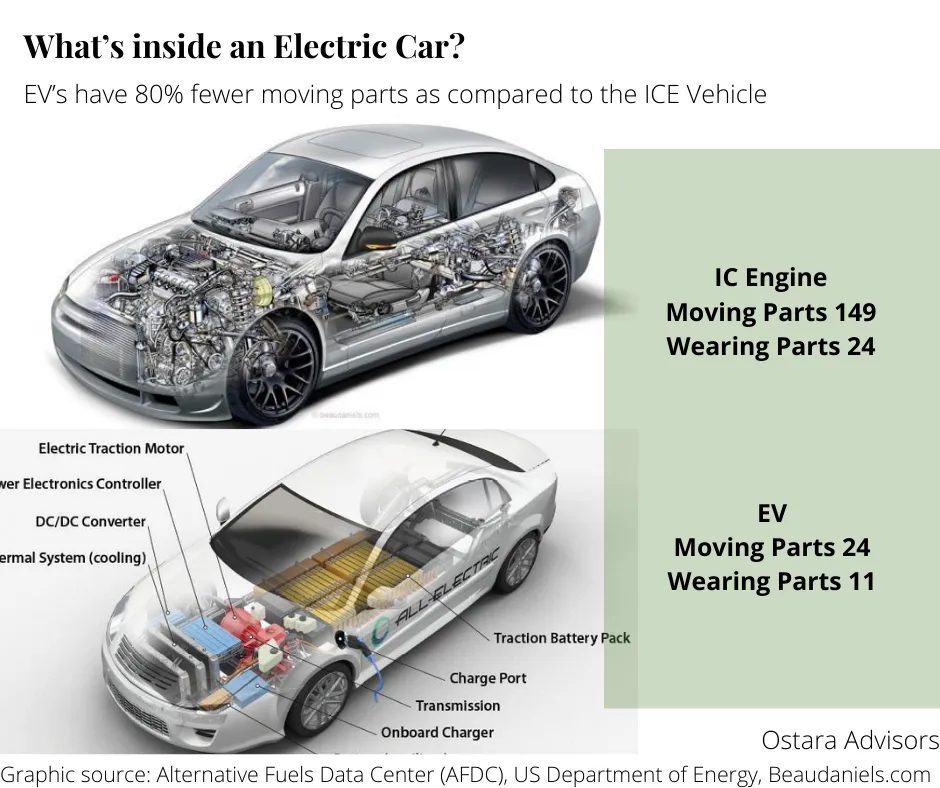

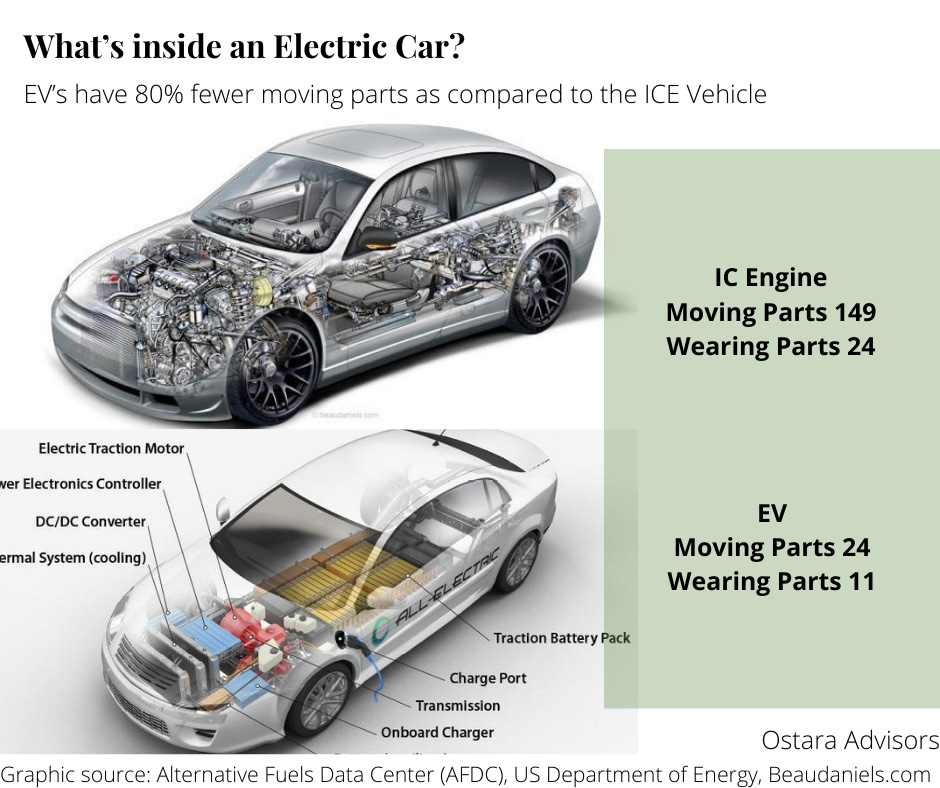

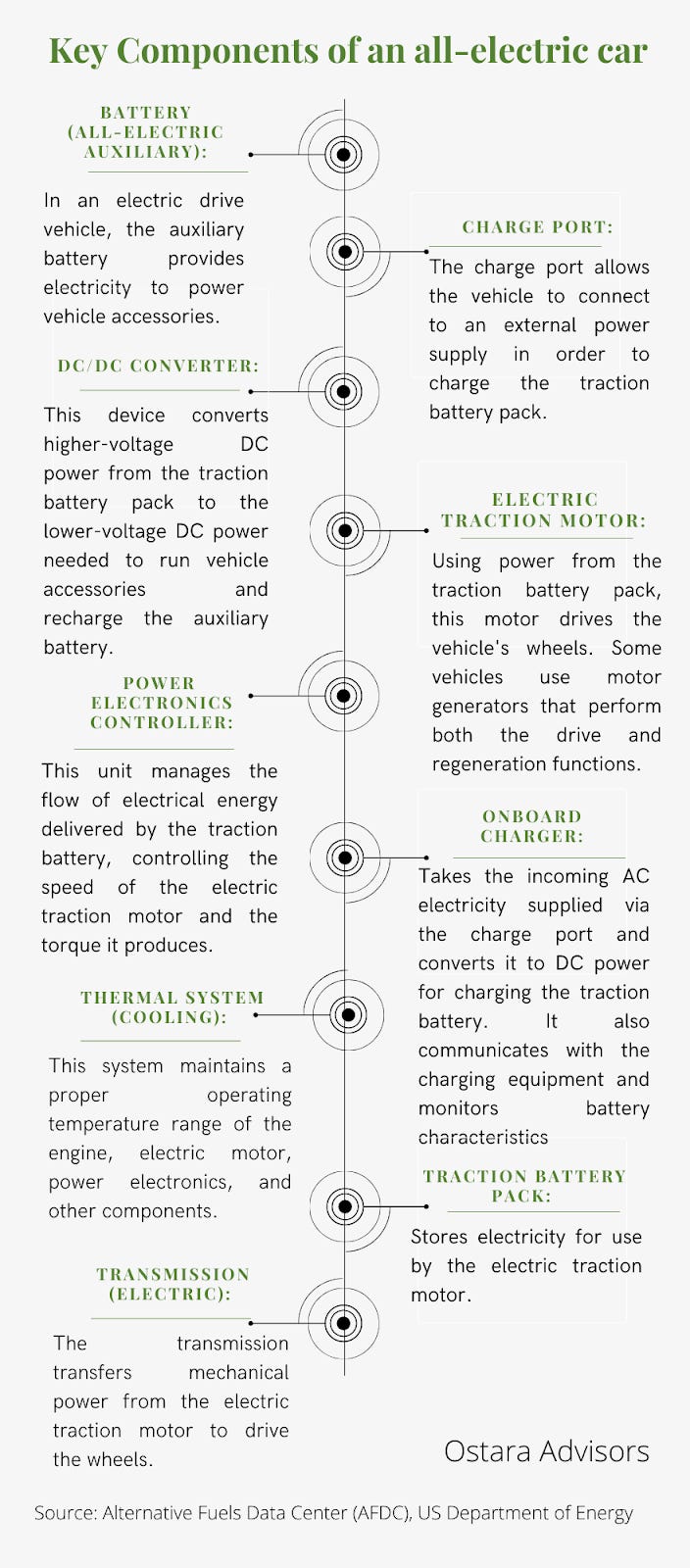

Internal Combustion Engine or ICE technology is extremely complex with an enormous number of parts operating in sync with each other inside an automobile. Electric vehicles (EVs), on the other hand, are very intuitive. Range and refuelling (charging) time are two factors where an ICE engine is (or was) superior to an electric vehicle. In almost every other aspect, electric vehicles are technologically superior to ICE vehicles. EVs are smarter – electronic controls are 3-5x higher in EVs (as compared to ICE) and that translates into features beyond anything that consumers have seen before in an ICE vehicle. EVs lend themselves to connected and autonomous vehicle technologies.EVs are simpler – a battery plus motor and controller is all that’s replacing the entire engine and its related systems in ICE vehicles.EVs are greener and they can enable a zero-emission ecosystem, provided, that the electricity grid shifts to renewable energyEVs are more economical – While they have a higher upfront cost, as compared to ICE vehicles, largely on account of battery costs, the cost of owning and operating an EV, i.e. the Total Cost of Ownership or TCO, is much lower.

Source: https://www.avendus.com/india/ev-report

What the EV opportunity in India looks like

Let’s set some context first – India is the world’s 4th largest vehicle market and the world’s largest two-wheeler and three-wheeler manufacturer*. At a market size of ~$188 billion, India’s automotive industry contributes ~7.1%* to the annual GDP. This is the size of the industry that could potentially face a paradigm shift in the case of an economy-wide move to electric vehicles.

Invest India predicts a CAGR of 44% between 2020-2027 for the EV market, which is expected to hit 6.34 million-unit annual sales by 2027.

The 2030 EV Goalpost for India

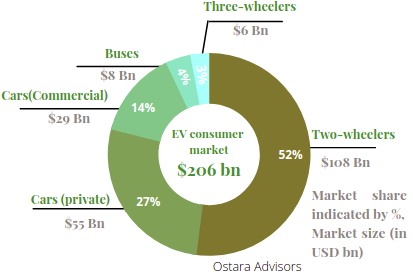

In 2019, NITI Aayog set the goalpost – 70% of all commercial cars, 30% of private cars, 40% of buses, and 80% of two-wheeler (2W) and three-wheeler (3W) sales to be electric by 2030. In Dec 2020, the leading think-tank Council on Energy, Environment and Water (CEEW), based in Delhi, released a report which added some market contours to the 2030 goalpost.

If we take the 2030 target as the Base Case, this would represent an EV market opportunity of $206 billion between 2021 and 2030. This ambition translates into total sales of 102 million vehicles between 2021 and 2030, an annual battery demand of 158 GWh and a support infrastructure of 2.9 million public charge points by FY30.

The level of EV adoption in these scenarios is likely to be driven by three factors:

- The quantum of the regulatory push – both on the demand and supply side – such as restrictions on conventional vehicles;

- Market pull – demand for the vehicle based on the favourable ownership costs of EV vs. ICE vehicles;

- Infrastructure support – support from the government for EV chargers.

The high adoption scenario considers projected sales to be 10% above the base case across vehicle categories.

The low adoption scenario maps the investment required for a 40% smaller EV market than the base case, considering the current economy-wide recession caused due to externalities like COVID-19, may have dampened consumer purchasing power.

The Medium adoption scenario projects EV sales to be 20% below the stated NITI Aayog target for 2030.

Source: CEEW-CEF analysis

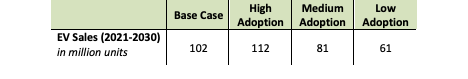

EV Components Market opportunity:

The EV Component Market is estimated at $178bn during the 2021-2030 period. This includes manufacturing of battery packs to meet domestic requirements, as well as manufacturing of all other components like the drivetrain, electronics, chassis, and others. To meet total battery demand of 158 GWh for EVs under the base case, India will need to invest USD 12.3 billion by FY30 to build battery production capacity.

The EV Financing opportunity:

If 50% of the EV upfront costs – i.e., Rs. 7,21,000 crore (USD 103 billion) – required through FY21–FY30 is to be financed through debt, the banking sector will have to more than triple its current advances of Rs. 2,17,000 crore (USD 31 billion) towards vehicle loans in the next 10 years. This also creates a huge white space for new financing models and fintech players to interpret and underwrite EV credit.

Sources :ttps://www.investindia.gov.in/sector/automobile, NITI Aayog and Rocky Mountain Institute Report, 2019,# CEEW – Centre for Energy Finance Report, Dec 2020

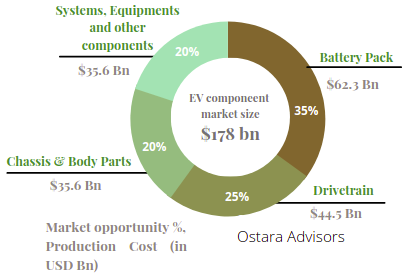

EV Ecosystem Map

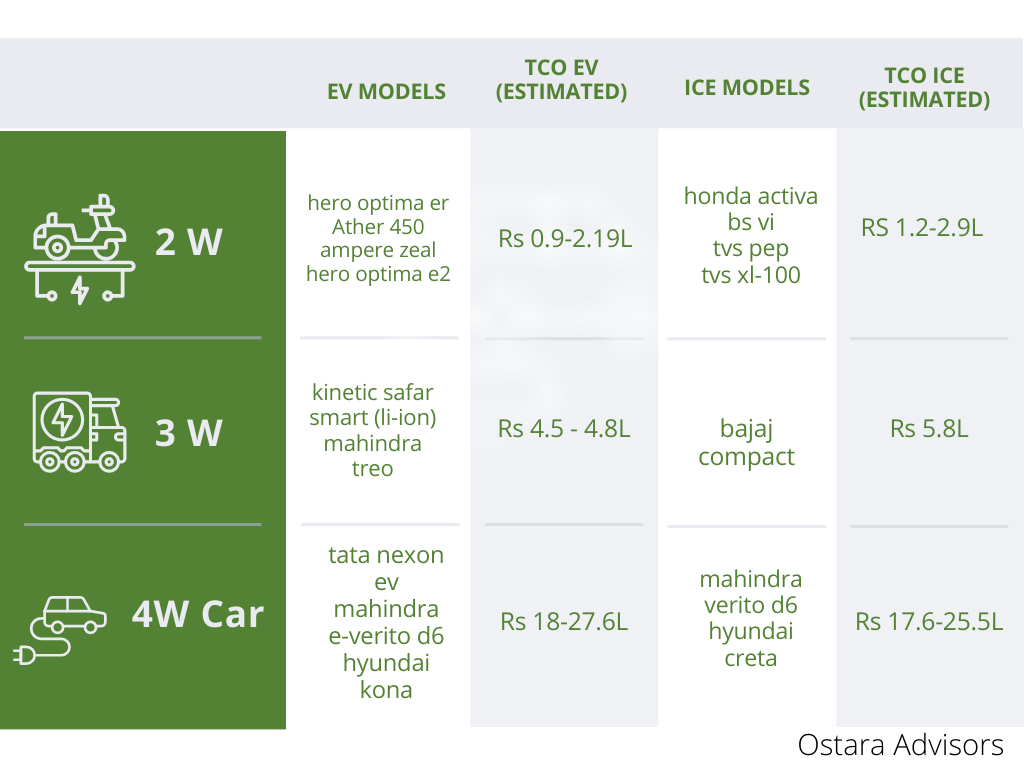

Concept Corner: Total cost of ownership (TCO)

A key barrier to EV adoption, particularly in India’s price-sensitive automobile market, has been the higher purchase price. However, advances in battery and power component technologies & growing economies of scale are pushing EV prices down.

The battery prices have fallen by almost 85% in the past decade, from USD 1,000/kWh to USD 150/kWh. The prices are expected to decline further to USD 100-120/kWh by FY25.

EVs also score over ICE in fuel and maintenance cost. All of this leads to a lower ‘total cost of ownership (TCO). The TCO model uses 3 input parameters:

1.Capital costs include vehicle purchase cost, discount rate, financial incentives applicable incl subsidy, resale value and miscellaneous cost.

2.Operational costs comprise fuel/electricity, maintenance, staff cost and miscellaneous cost.

3.Vehicle usage profile includes the vehicle holding period, average kilometres driven per day, and a number of operational days in a year.

Source: TCO WRI India Blog, EV Report 2020, Avendus

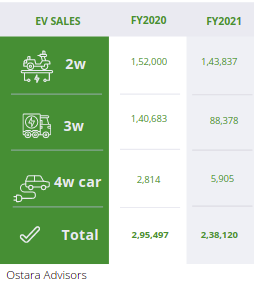

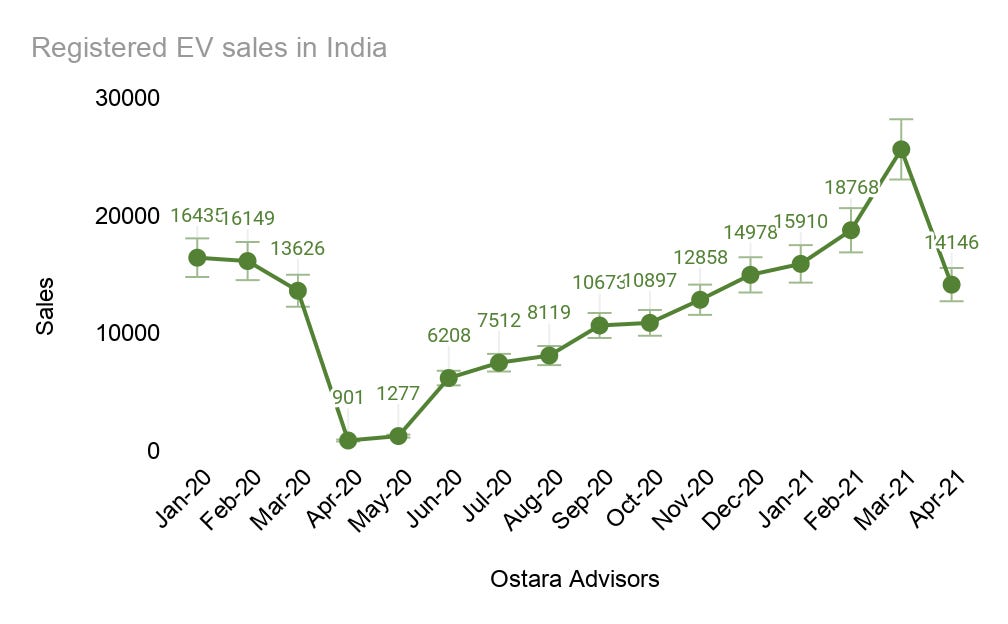

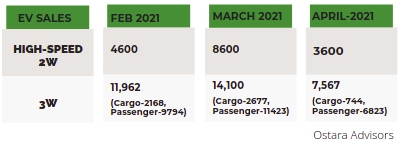

EV Sales Tracker

While annual EV sales were 20% down in FY2021 y-o-y from FY2020, the Covid-19 pandemic created headwinds for EV adoption in personal transportation (2W) and e-commerce-driven logistics (2W and 3W). EV adoption has also increased due to the positive TCO equation becoming more apparent to consumers.The registered EV sales in March 2021 has steeply grown to 25,640 units, registering an m-o-m increase of 34.2% and a y-o-y increase of 88.2%.

Source: VAHAN dashboard, JKM Research, SMEV, JKM Research

EV Trends from the globe

2.Global Auto OEMs invest in battery gigafactories

3.Europe’s biggest EV fast-charging station by EnBW in Germany: 52 fast charging points with up to 300-kilowatt capacity4.China smartphone maker Xiaomi to invest $10 bn in new EV unit over 10 years

Deals in the Indian EV space

April 2021: Revolt Intellicorp raises ₹150 crore equity investment from RattanIndia EV motorcycle-maker, Revolt said it has raised ₹150 crore equity investment from RattanIndia Enterprises Limited, through which the company would expand its presence across key 35 metro cities.

April 2021: deep-tech startup Chara raises $850K seed round from Kalaari CapitalChara is building a scalable, cloud-controlled, and rare-earth free platform for designing, building, and deploying electric motors for various applications. The motors will be based on a variation of the well-known Switched Reluctance Motor technology and other magnet-free motor technologies.

March 2021: Euler Motors, raises its Series A round from ADB Ventures and others.Euler, which is focused on electric commercial vehicles (ECVs) closed its Series A funding round at $9.5 million, with additional investments of $2.6 million raised from new investor ADB Ventures and existing investor Blume Ventures. This also marks the first investment by ADB Ventures in an EV company globally.

About Ostara Advisors:

Ostara Advisors (formerly Dhruva Advisors) is India’s first e-mobility and sustainability-focused boutique investment banking firm. Our focus sectors are Electric Vehicles, IoT & Automation, CleanTech, and Renewable Energy. The firm was founded in 2015 by Vasudha Madhavan, who is one of the first investment bankers in India to specialise in Electric Mobility, having advised clients in this space since 2017. Marquee deals include advising on India’s first Electric Vehicle two-wheeler M&A, where she represented Greaves Cotton Ltd. on their acquisition of pioneering EV 2W maker, Ampere Vehicles.