Welcome to our latest newsletter focusing on the exciting advancements in energy storage technologies. From grid-scale solutions to innovative portable devices, the field of energy storage is witnessing rapid developments that promise to revolutionize how we generate, store, and utilize energy. In this newsletter, we will explore the importance of energy storage, how it works, current trends, funding news and new innovations in the sector.

The Key to the Puzzle: The Crucial Role of Energy Storage

Enabling Sustainable Energy Transition: Energy storage is key to integrating higher shares of renewable energy into the grid. It supports the transition to a sustainable energy system by providing the necessary flexibility and reliability.

Balancing Supply and Demand: Renewable energy generation is intermittent, meaning it’s not always available when needed. Energy storage systems can store excess energy generated during low demand phases and release it during high demand, ensuring a stable energy supply.

Supporting Remote and Decentralized Energy Systems: In remote or decentralized systems, energy storage provides a reliable backup enhancing local energy resilience. This can help reduce dependency on the central energy grid.

Behind the scenes: How Energy Storage works

Here’s an overview of how various types of energy storage systems function:

Thermal Energy Storage (TES)

TES captures and stores excess thermal energy (heat or cold) in materials like water or molten salts. During the charging phase, the medium absorbs heat from abundant or inexpensive thermal energy sources, such as solar energy or waste heat from industrial processes. This stored thermal energy can then be released during the discharging phase to supply heating or cooling for various uses, including building temperature regulation, industrial processes, and power generation. TES enhances energy efficiency and flexibility by shifting energy use to off-peak times.

Compressed Air Energy Storage (CAES)

CAES stores energy by compressing air in underground caverns or containers. When electricity demand is high, the compressed air is released and expanded through turbines to generate electricity. CAES offers large-scale storage and quick response times but has lower efficiency compared to other technologies.

Battery Energy Storage Systems (BESS)

BESS store electrical energy as chemical energy in battery cells, commonly using lithium-ion batteries. They store excess energy during low demand and release it during high demand or when renewable sources are not producing. BESS support grid stability and renewable energy integration with high efficiency and reliability.

Pumped Hydro Storage

Pumped hydro storage uses two water reservoirs at different elevations. During low demand, water is pumped to the upper reservoir, storing potential energy. During high demand, water flows back to the lower reservoir through turbines, generating electricity. This system is efficient and provides large-scale, long-duration storage.

Flywheel Energy Storage Systems

Flywheels store energy as rotational motion using a spinning rotor. Electrical energy accelerates the flywheel, storing kinetic energy, which can be quickly converted back to electricity when needed. Flywheels offer fast response times and are suitable for applications requiring short bursts of high power.

Supercapacitors

Supercapacitors store energy through electrostatic charge separation between two electrodes and an electrolyte. They can charge and discharge rapidly, making them ideal for applications like electric vehicles and electronic devices. Supercapacitors offer high power density and long cycle life.

Energizing 2024: A Look at the Thriving Energy Storage Market

Global Energy Storage Market Overview

In 2023, the global energy storage market nearly tripled, achieving the largest year-on-year growth on record. This surge coincided with a significant price drop, particularly in China, where turnkey energy storage system costs fell by 43% to $115 per kilowatt-hour for two-hour storage systems.

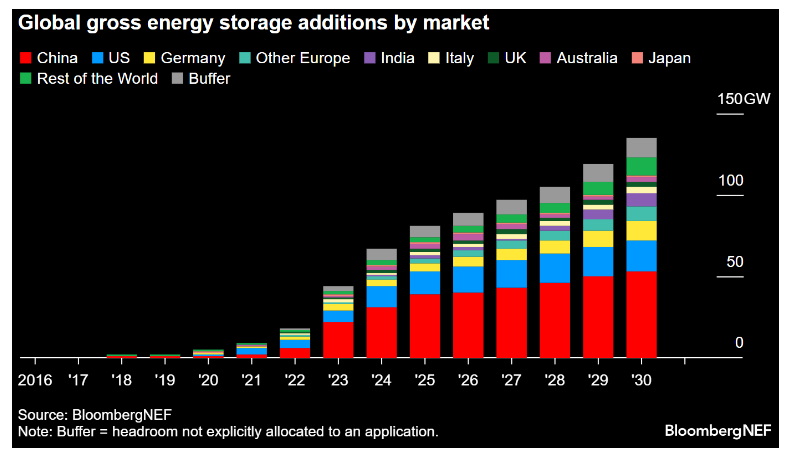

Recent and Projected Growth

A record 45 gigawatts (97 gigawatt-hours) of energy storage capacity was added globally last year. This momentum is expected to continue, with over 100 gigawatt-hours of new capacity projected for 2024, driven primarily by growth in China. The US follows, propelled by state targets and favorable market conditions. In Europe, the Middle East, and Africa, demand for residential batteries, especially in Germany and Italy, will drive growth.

Source: BloombergNEF

Long-Term Projections

By 2030, the global energy storage market is forecasted to grow at an annual rate of 21%, reaching 137 gigawatts (442 gigawatt-hours). Solar and wind markets are expected to grow annually by 9% and 7%, respectively. This growth is driven by policies and subsidies, including China’s co-location mandates and the US Inflation Reduction Act, with new support schemes emerging globally.

Technological Shifts

Falling battery costs, especially in China, are crucial for economic deployments. Lithium iron phosphate (LFP) batteries, cheaper and simpler than nickel manganese cobalt (NMC) batteries, are gaining market share due to increased manufacturing capacity by Chinese battery makers. Companies outside China, like LG Energy Solution, Samsung SDI, Panasonic, and Freyr, are also shifting towards LFP production. By 2030, NMC batteries are expected to hold only about 1% market share.

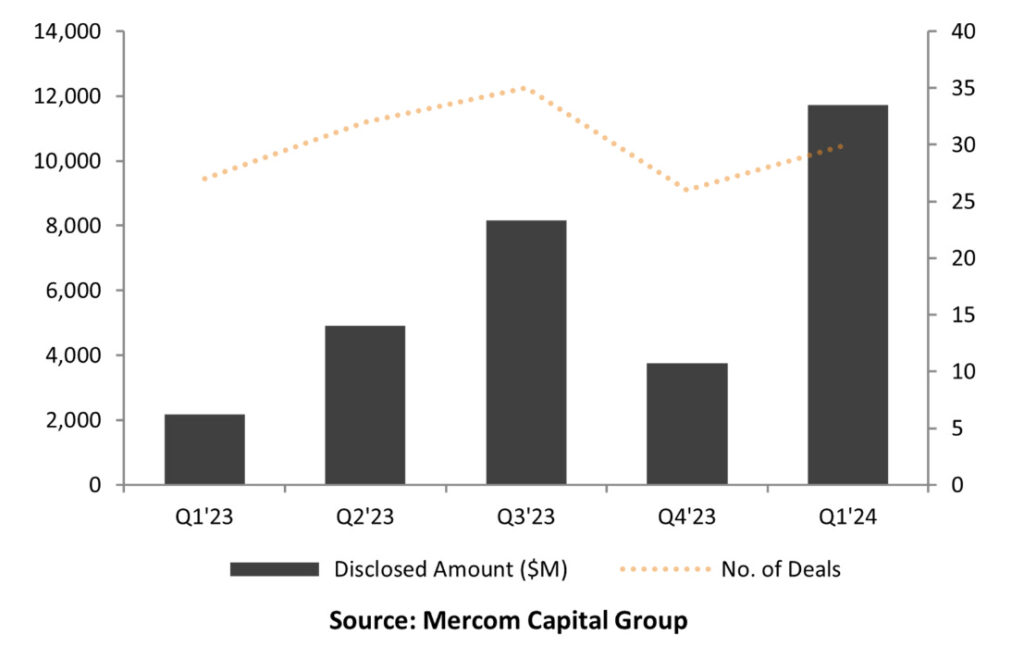

Fueling the Future: Investments and Financing in Energy Storage

Corporate funding in the global energy storage sector in Q1 2024 experienced a remarkable 432% year-on-year increase, reaching $11.7 billion across 29 transactions, compared to $2.2 billion across 27 transactions in Q1 2023, as depicted below.

Source: Mercom Capital Group

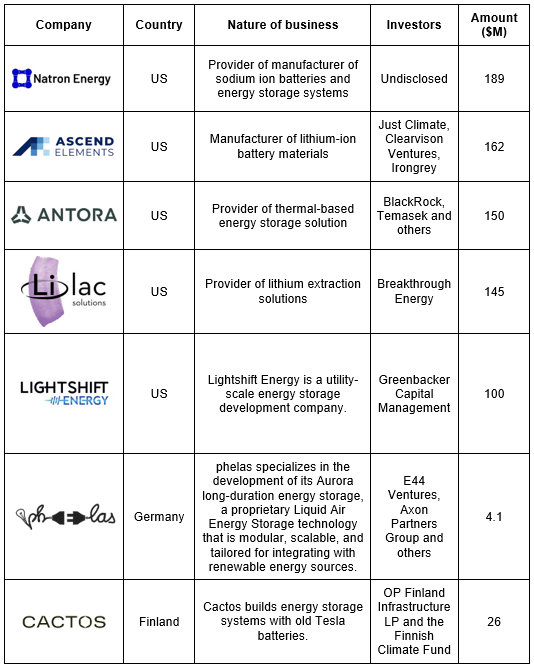

Global Venture capital (VC) funding in the sector also saw growth, with a 9% year-on-year increase to $1.2 billion across 23 transactions in Q1 2024. Some of the global energy storage deals are depicted below:

Source: Mercom Capital Group, EU startups, Mercom articles

Developments in the Energy Storage Ecosystem in India

Investments by the Adani Group: Indian conglomerate Adani Group will invest USD 5.1 billion in Tamil Nadu, focusing significantly on pumped storage projects. Announced at the Tamil Nadu Global Investors Meet 2024, this includes an investment by Adani Green Energy Ltd in three pumped storage projects in Thenmalai, Alleri, and Aliyar, with a total capacity of 4.9 GW, expected to create over 4,400 jobs.

Solar park in Gujarat: After successfully implementing Battery Energy Storage Systems (BESS) in Modhera, Gujarat plans to establish a larger BESS at Charanka, its first solar park. The Gujarat Power Corporation Limited (GPCL) has begun the bidding process for the project, which will use 20 MWh and 60 MWh battery systems to supply daytime solar power for agriculture, replacing the current practice of providing subsidized electricity to farmers at night.

Ostara Updates

1. April 2024: Our Founder, Vasudha Madhavan was interviewed by CNBC_Awaaz on the emerging climate-tech startups and their ideal fundraising strategy on the sidelines of the LowCarbon.earth Accelerator Demo Day, in Bangkok, Thailand.

Source: CNBC_Awaaz

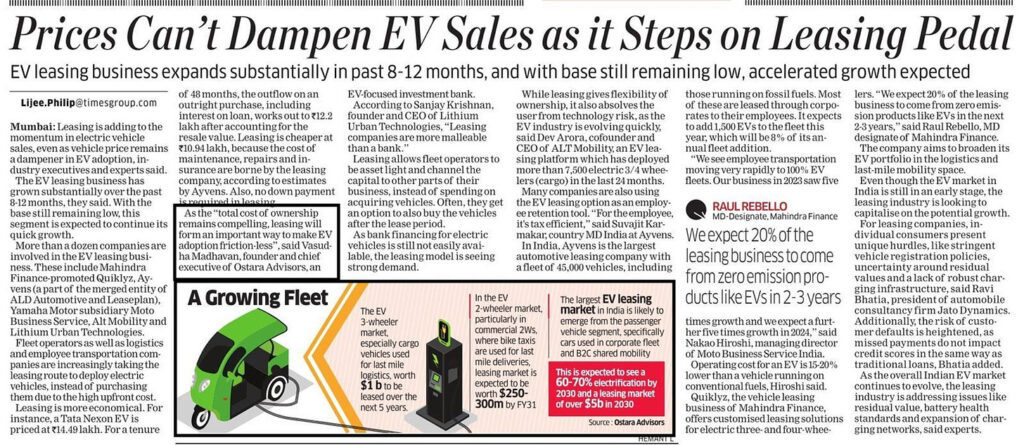

2. April 2024: Ostara Advisors views on the Indian EV leasing market have been published in The Economics Times dated April 28, 2024.

Source: Economic Times

Breaking Boundaries: Innovations Shaping the Future of Energy Storage

As COP28 emphasizes the need to triple renewable energy, innovative storage solutions beyond lithium-ion batteries are emerging. Here are ten promising technologies making headlines:

Gravity Storage: Uses cranes to lift and release custom-made bricks, storing kinetic energy, similar to hydropower but not limited by geography.

‘No-water’ Hydropower: Uses a dense fluid to turn gentle hills into energy storage sites, expanding potential locations globally.

Compressed Air: Uses excess energy to compress and heat air, storing it in custom-built caverns filled with water. When energy is needed, water pushes the air back up, where it’s reheated to drive a turbine and generate electricity. This system can be built anywhere, solving geographic limitations.

Concrete Batteries: Supercapacitors made from cement and carbon black could turn buildings and roads into energy storage units.

Superheated Bricks: Uses electric heating elements to superheat thousands of tons of bricks. When energy is needed, air flows through the hot bricks and is delivered as superheated air or steam.

Metal Blocks: Shoebox-sized blocks store thermal energy, providing a compact and efficient solution.

Tree Power: Batteries use wood-derived carbon for sustainable energy storage, reducing the carbon footprint.

Iron-flow Batteries: Long-lasting batteries using liquid electrolytes for safe and efficient energy storage.

Iron-air Batteries: Batteries use reversible rusting to store electricity for extended periods.

Nickel-zinc Batteries: Revives an old battery design with new technology, offering a safer, more powerful alternative to lead-acid batteries.

The future of energy storage is bright, with continued advancements and innovations driving the industry forward. From gravity-based systems to novel battery technologies, the possibilities are endless. As we look ahead, it is clear that energy storage will play a pivotal role in enabling a sustainable and resilient energy future.

Sources:

Global Renewable Energy Storage Market: Growth and Key (openpr.com)

Ten energy storage technologies that want to change the world | Recharge (rechargenews.com)

Enabling renewable energy with battery energy storage systems | McKinsey

The Importance of Energy Storage in Future Energy Supply (azom.com)

Understanding How Energy Storage Systems Work | Veolia

Global Energy Storage Market Records Biggest Jump Yet | BloombergNEF (bnef.com)

Corporate Funding in Energy Storage Sector Surges Five-Fold to $11.7 Billion in Q1 (mercomindia.com)

Adani Group to invest in pumped storage projects in Tamil Nadu (renewablesnow.com)