We are happy to share with you that Ostara advised Routematic, a Blume Ventures Fund 1 company, on a landmark fundraise—testimony to entrepreneurial grit and perseverance—bringing in climate capital from global investors. Please read more about it here.

Now, let us dive into the complex, compelling, and fast-evolving world of carbon markets.

As the world races to meet climate goals, carbon markets have emerged as powerful tools to accelerate decarbonization. By assigning a monetary value to greenhouse gas emissions, these markets create financial incentives for companies to reduce their carbon footprint. In this edition, we break down how these markets work, who the key players are, and how India is gearing up with its own carbon credit framework!

Carbon as Currency: What Are Carbon Markets?

Carbon markets are mechanisms that assign a financial value to greenhouse gas (GHG) emissions, enabling companies to buy, sell, or trade carbon credits — each representing the right to emit one metric ton of CO₂ or its equivalent. Companies that emit less than their allotted limit can sell excess credits to those that exceed theirs, encouraging cost-effective emission reductions across the economy.

At their core, carbon markets operate on a simple principle: companies exceeding their emission limits must purchase carbon credits generated by projects that remove or reduce CO₂ from the atmosphere. This creates a direct financial incentive to lower emissions and support climate-positive initiatives.

The adoption of the Paris Agreement in 2015 has significantly propelled the development of carbon markets. With the goal of limiting global warming to well below 2°C — and ideally to 1.5°C — the Agreement requires countries to set Nationally Determined Contributions (NDCs), fostering global collaboration and investment in carbon trading systems.

Two Sides of the Market: Compliance and Voluntary Systems

Cap-and-Trade in Action: Emissions Trading Systems (ETS)

Emissions Trading Systems (ETS) are government-regulated markets that cap greenhouse gas emissions and allow companies to trade emission allowances. The EU ETS, currently covering 40% of the EU’s emissions, allocates allowances to companies, enabling them to sell surplus allowances if they emit less than their allocation, creating a financial incentive to reduce emissions.

Reforms like the Market Stability Reserve (MSR adjusts the supply of allowances based on market demand to prevent price volatility) help manage surplus allowances and stabilize prices. In 2023, EU carbon prices reached €100/ton due to strong demand and the EU Green Deal’s 2050 climate neutrality goal. Although prices have dipped recently due to increased renewable adoption, they are expected to rise long-term as stricter emission targets and reduced allowances take effect, with 2030 estimates ranging between US$50–100/ton, aligning with Paris Agreement targets.

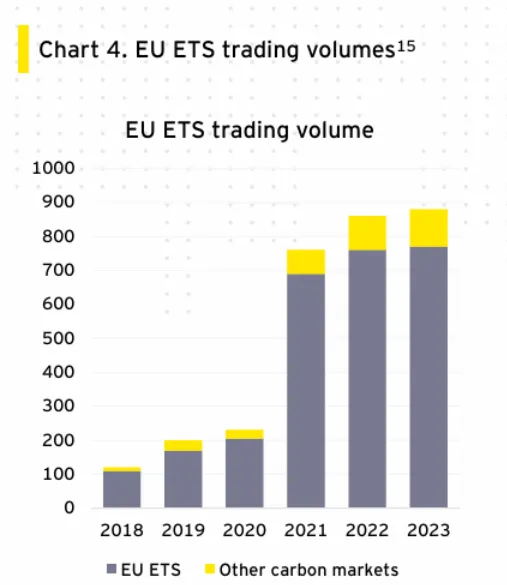

Source: EY (in EUR billions)

As depicted above, the EU ETS has also evolved into a significant financial market, with robust trading activity. In 2023, trading volumes in the EU ETS reached €881 billion, with €770 billion attributed to EU Allowances (EUAs), reflecting a 553% growth over recent years. The remaining €111 billion is attributed to auction revenues and secondary trading of other carbon market instruments, such as carbon offsets and derivatives. In 2024, trading volumes for the EU ETS continued at approximately €800 billion, maintaining its dominance in global carbon market activity, although exact figures are yet to be officially confirmed.

Offsetting with Impact: Voluntary Carbon Markets (VCM)

Voluntary Carbon Markets (VCM) allow companies and individuals to purchase carbon credits independently of regulatory requirements, enabling them to offset their carbon footprints. The VCM has gained substantial momentum as organizations increasingly commit to achieving net-zero emissions. In 2023, the VCM surpassed US$2 billion in market value, driven by demand for credits from renewable energy, forestry, and land-use projects. The market is expected to continue expanding, with projections estimating a market size of US$50 billion by 2030.

A critical aspect of the VCM is the emphasis on the quality and integrity of carbon credits. Various certification processes and standards, such as those developed by the Integrity Council for the Voluntary Carbon Market (ICVCM), ensure that carbon credits represent genuine, measurable, and permanent emissions reductions.

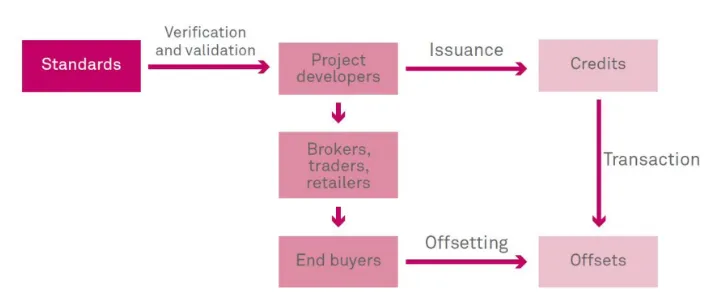

In 2023, approximately 40% of VCM transactions were focused on nature-based solutions, which not only sequester CO2 but also promote biodiversity and social impact objectives. Prices for carbon credits vary widely, from US$2 to US$50 per credit, depending on the nature of the project. Despite this price variation, the VCM offers cost-effective solutions for organizations striving to meet their long-term sustainability targets. The below is the voluntary carbon market process:

Source: SP Global

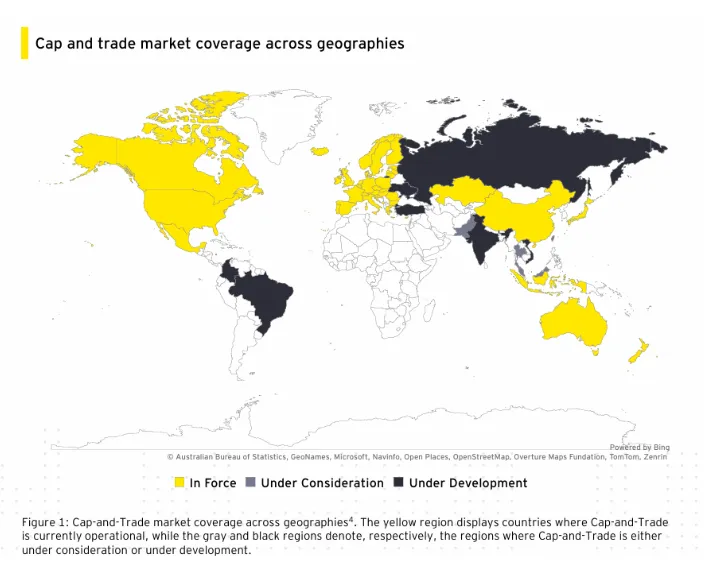

Navigating a Greener World: Mapping Compliance Carbon Markets!

As countries ramp up efforts to meet climate goals, compliance carbon markets—primarily built on cap-and-trade systems—are gaining momentum worldwide. In these regulated markets, governments cap total emissions and allow trading of emission allowances among covered entities. The map below illustrates the geographic spread of such systems, showing where they are in force, under development, or under consideration.

Source: EY

Who’s Who in Carbon Markets: Key Participants

Project Developers

Project developers create projects that reduce or remove GHG emissions, generating carbon credits. These range from industrial efforts like fugitive emissions capture to nature-based solutions like afforestation. Projects come with a vintage (issuance year) and may deliver co-benefits such as improved livelihoods or biodiversity, supporting the UN SDGs.

Standards Bodies

Standards bodies like Verra and Gold Standard certify projects by verifying that they deliver real, additional, and permanent emission reductions. They ensure credits meet strict rules around additionality, permanence, and no double-counting, and promote social and environmental co-benefits. These are essential in case of voluntary carbon markets.

Retail Traders

Retail traders buy carbon credits in bulk, bundle them into portfolios, and resell them to end buyers. They operate mainly through private deals or exchanges like Xpansiv CBL and AirCarbon Exchange, helping to increase liquidity and simplify access to a complex market.

Brokers

Brokers connect retail traders or suppliers with end buyers, facilitating transactions and negotiating terms for a commission. They help navigate credit quality, pricing, and contracting, making the market more efficient and accessible.

End Buyers

End buyers—corporates, governments, or individuals—purchase credits to offset their emissions as part of net-zero or compliance goals. Some prefer standardized products for simplicity, while others choose specific projects to ensure quality and avoid greenwashing.

India’s Carbon Shift: From Targets to Trading

India is making significant strides toward industrial decarbonization with the establishment of a formal carbon market framework. Building on the launch of the Carbon Credit Trading Scheme (CCTS) in 2023, India is now proposing binding greenhouse gas (GHG) emission targets across four key energy-intensive sectors: aluminium, cement, chlor-alkali, and pulp & paper. Under the draft Greenhouse Gas Emission Target Rules, 2025, industrial units will be assigned specific emission intensity targets for FY26–FY27, based on their FY24 performance.

If adopted, these rules will apply to over 130 major industrial units, including companies like Vedanta, Hindalco, UltraTech, and Ambuja Cements. Entities failing to meet their targets must either purchase carbon credits or pay environmental compensation—calculated at twice the average carbon credit price—within 90 days to the Central Pollution Control Board.

The system works through a dual approach:

- Mandatory emission reduction targets for companies.

- Regulated trading of carbon credits to offset shortfalls.

As these markets mature, the focus must remain on integrity, transparency, and impact. Done right, carbon markets can not only drive emission reductions but also deliver co-benefits for communities, biodiversity, and sustainable development. The race to net-zero is on—and carbon markets are helping chart the course.

Ostara in the News

On April 4, 2025, Vasudha Madhavan was featured in Entrepreneur India sharing her perspective on the impact of the recent reciprocal tariffs imposed by the U.S. under President Trump on the Indian automobile and the EV industry.

Vasudha noted that the U.S. tariffs could present a unique opportunity for Indian manufacturers. With India’s cost-effective EV models, there’s potential to tap into the U.S. market and fill the gap created by costlier Chinese imports.

Read the full article here: Entrepreneur India