Welcome back to this brand new edition of the Ostara Newsletter!

This month, we shine the spotlight on the much-talked about SPACs. 2021 was a tumultuous year for SPACs in general and Electric Vehicle (EV) companies that participated in this SPAC-mania, in particular. Read on as we give you a round-up of the rise and fall of SPACs in the past year.

Before we begin, a huge thank you for all the great reviews on last month’s The emerging opportunity in Micro-mobility. You can also read our past editions here.

Podcast update!

Energizing India Podcast, India’s only EV-focused podcast, features an interview with our Founder, Vasudha Madhavan in this special episode. Click here to listen in.

OK, so let’s dive in!

What is SPAC?

Investment banker David Nussbaum and lawyer David Miller — known to each other as “Nuss” and “Miller”— invented the special-purpose acquisition company in 1993 to give private firms another way to access everyday investors. Since at the time, blank check companies were prohibited in the US, SPACs were rarely used and remained obscure for decades, but gained prominence in the past 2 years —attracting the biggest names in finance, technology and entertainment. Since the 90’s, over 500 SPACs have been listed, raising more than $100 billion.

A special purpose acquisition company (SPAC) is a blank check company that raises funds from public investors (typically through a traditional IPO). The money raised from the IPO is placed in an interest-bearing trust account. The goal of the blank check company is to find another business to buy within two years. If that doesn’t happen, the company shuts down and investors get their money back.

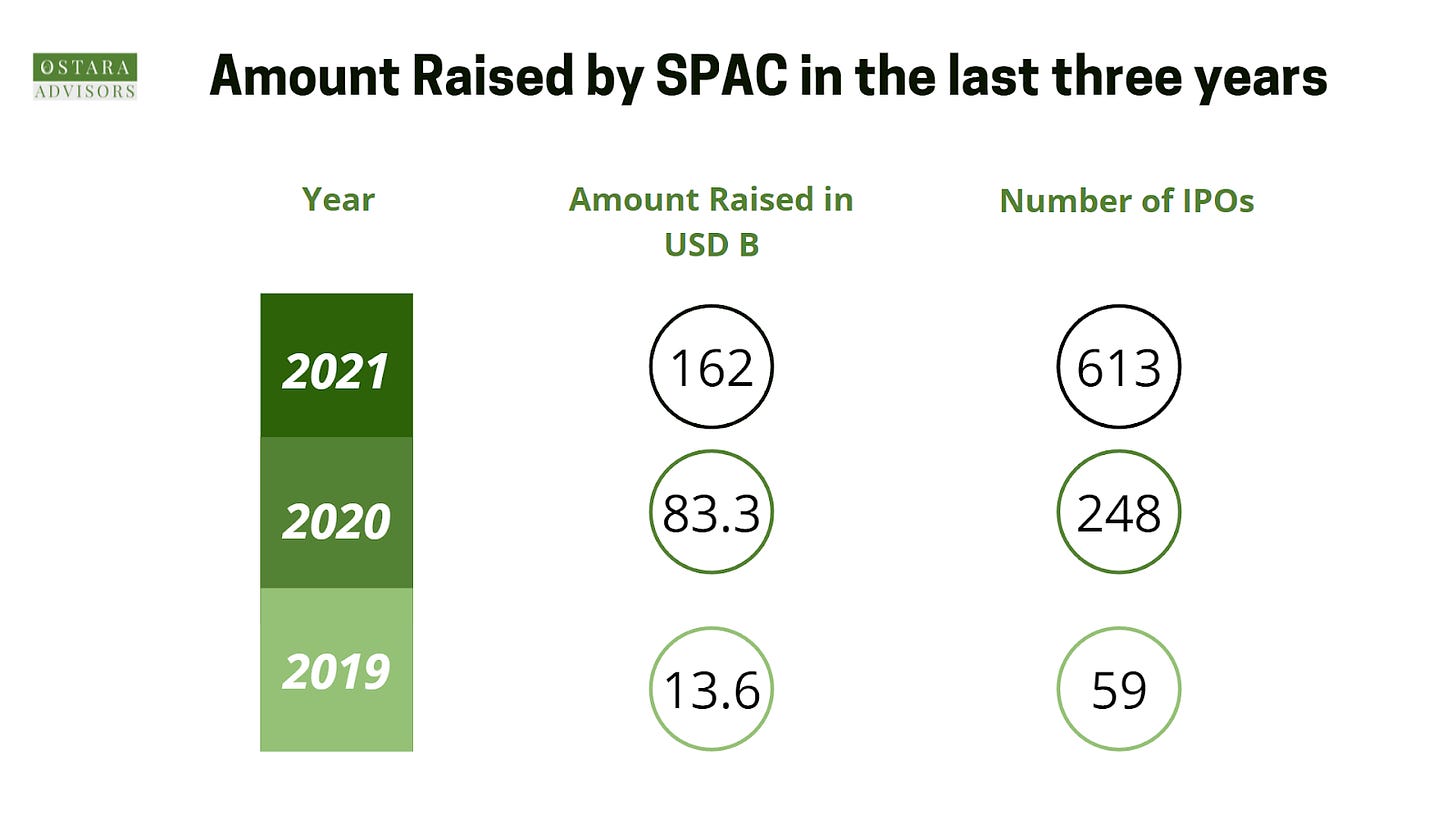

SPACs raised $13.6 billion from 59 IPOs in 2019 (which was more than four times the $3.2 billion they raised in 2016).

2020: $83.3 billion raised from 248 IPOs

2021: $162 billion raised from 613 IPOs

SPAC Analytics gives you a live update on global deal activity.

Sources: The Wall Street Journal, Investopedia, Vested, Excelsior Capital

First-ever SPAC to get listed: The first SPAC officially debuted in 2003 in the US through the IPO of Millstream Acquisition Corporation which then completed the merger with Nations Health in September 2004. This IPO was underwritten by EarlyBird Capital, founded by David Nussbaum, David Miller and others.

How does a SPAC work?

A SPAC is formed by a management team, typically known as a sponsor, that often has a business background, usually with a specific skillset in a niche industry. They initially pony up a nominal amount of investor capital – usually as little as $25,000 – for which they will receive “founder shares”, that often equate to a 20% interest in the SPAC.

After that, the company will then file for and eventually execute an initial public offering (IPO) to raise additional funds from the public markets.

When a blank-check company does go public, it usually sells “units” almost always at $10 per share, which goes onto the company’s books as cash. These units often include a share of common stock, but also a fraction of a warrant allowing investors to buy a common share at some point in the future, typically with an exercise price of $11.50 per share.

Once it goes public, the SPAC typically has between 18 and 24 months to seek out a “target company” and negotiate a buyout. If it does so, it usually will change its ticker to reflect the new entity it has merged with, and shareholders will now be invested in the acquired company.

If the SPAC is unable to make a deal within the predetermined time frame, the SPAC is liquidated. The company’s cash is held in short-term Treasuries until then, so the initial investment will be safe, but the company’s shares might drop under the IPO price in the course of normal market volatility.

Source: JP Morgan, PWC, , Kiplinger

Why EV companies love SPACs

SPACs have become the favourite way many electric vehicle companies have gone public.

Revenue projections vs. actual revenue: SPACs allow for companies to use future revenue projections: something an initial public offering doesn’t allow for. EV companies like Fisker Inc., Canoo and others are at a pre-revenue stage.

Capital-intensive businesses: Several Electric vehicle companies are capital-intensive and raising capital via a SPAC, rather than traditional venture capital financing, could present better terms in the market. The companies likely wouldn’t have to give up as much equity or dilute existing shareholders as much as they would if they got a cash infusion from a VC firm.

Giant market potential: Brian Walsh, head of WIND Ventures, the corporate venture capital arm of Chilean energy company Copec, said: “EV brings together two huge markets that have been historically separate —transportation fuel and electricity — to create a giant market. It’s a huge opportunity that will attract large amounts of capital.”

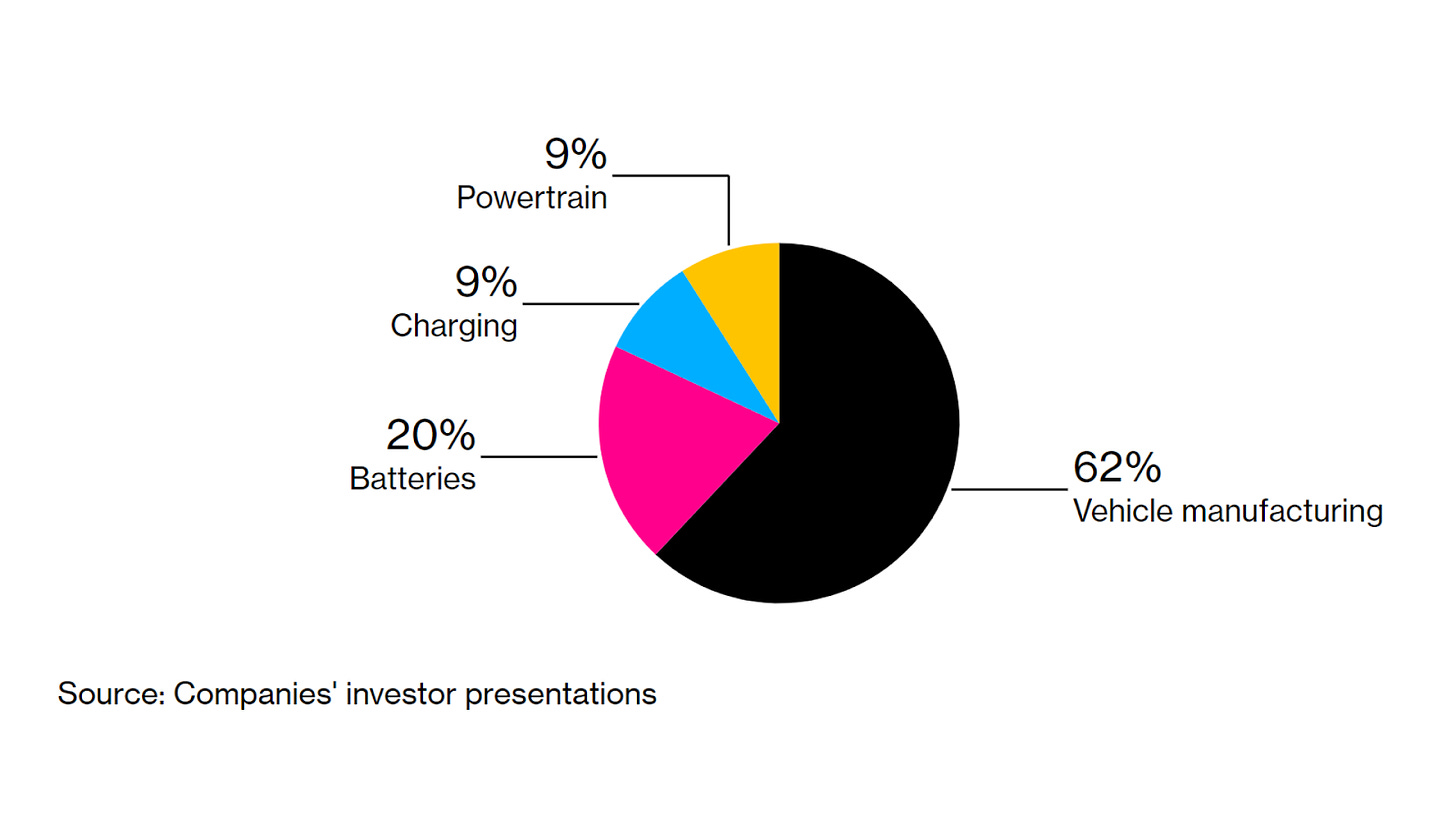

13 EV-related listings via SPACs (upto July’21) raised about $7.5 billion, most of which went to EV manufacturing companies. These manufacturing companies led the number of listings (seven) and raised the most cash ($4.5 billion).

Source: Bloomberg, CNBC, Pitchbook, Crunchbase News

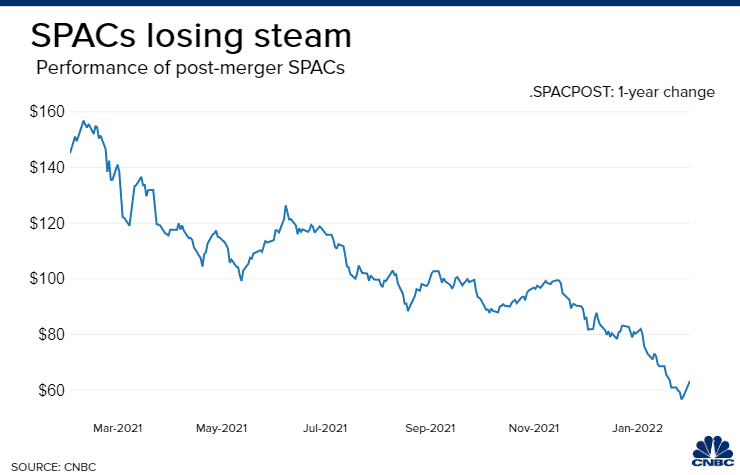

EV SPACs losing steam

EV start-ups Nikola, Lordstown Motors, Canoo, Faraday Future Intelligent Electric, Fisker and Lucid Group all went public through SPAC deals over the last two years. All but two, Fisker and Faraday Future, have disclosed federal investigations. Nikola founder Trevor Milton is scheduled to go on trial April 4, 2022 in Manhattan for allegedly defrauding investors in that company’s IPO, among other things.

Other than Lucid, most have performed horribly for investors after receiving initial pops when their deals were announced or when the companies went public. All of their shares, including Lucid, have fallen by double-digits so far this year and are trading at or near 52 week lows recently.

Source: CNBC

Some of the biggest losers last month included clean energy player Heliogen, self-driving related companies Aurora Innovation and Embark and 3D technology company Matterport, which all tumbled more than 50% in a single month.

Source: CNBC

India on the global SPAC map:

In August 2021, one of India’s leading renewable energy producers, ReNew Power became the first Indian company to raise more than $1 billion by combining with a US-based SPAC. It also became the first Indian renewable energy entity to be listed on NASDAQ. This is the biggest listing of an Indian company through the SPAC route.

In June 2021, Global Consumer Acquisition Corp (GCAC) became the first India-related SPAC to raise funds. GCAC raised $170 million from its Nasdaq listing. Backed by private equity veteran Rohan Ajila and Manipal Technologies chairman Gautham Pai, GCAC intends to invest in industries focusing on consumer products and services sectors.

While India currently does not have a specified SPAC regime in place, the International Financial Services Centres Authority (IFSCA), being the regulatory authority for development and regulation of financial products, financial services and financial institutions in the Gujarat International Finance Tec-City (GIFT City), has recently released a consultation paper where (among other proposed measures) IFSCA is exploring to facilitate listing of SPACs in the GIFT City.

The proposed scheme defines critical parameters such as offer size to public, compulsory sponsor holding, minimum application size, minimum subscription of the offer size, etc.

Ostara’s Take:

The downside of SPACs for investors: The way some SPACs are structured might lead to misaligned incentives between public investors and the SPAC sponsors (the management that raises the funds carry out the selection on which company to buy and perform the due diligence).

The sponsors are usually entitled to purchase 20% of the SPAC’s equity at a nominal value of US $25,000, incentivizing the management to find a suitable company to merge with, and if the merger is successful, the equity value can be worth much higher. However, this structure can also encourage the sponsors to pick companies that are popular in the market without conducting proper due diligence, in the hope that the combined merged stock pops.

The downside of SPACs for startups: Listing on the public markets brings with it increased disclosure requirements and regulatory oversight, which may be onerous for a young business that is yet to achieve a steady revenue and profit growth trajectory.