Global investments in Energy Transition technologies reached a record high of $1.3 trillion in 2022, a 19% increase from 2021, according to the International Renewable Energy Agency (IRENA) with major investments into solar and wind technologies.

In the first six months of 2023, new investments in Renewable Energy which is a sub-set of the Energy Transition, reached $358 billion, a 22% increase compared to the start of last year and an all-time high for any six months.

At the heart of these transformative shifts lies the battery – an unassuming yet indispensable component that is reshaping industries, powering our lives, and enabling a sustainable future. In this exploration of batteries’ central role in the global energy transition, we will delve into the technologies driving change, the emerging trends shaping the landscape, and the profound implications for our planet’s future.

We also have a bonus section this month in which we review the Fundraising activity in the Indian EV landscape in the first eight months of 2023 and share some interesting insights.

Sources: Bloomberg NEF, Mercom

Invention of the Rechargeable Battery

Battery technology has evolved significantly over the past 200 years, with remarkable advancements in rechargeable batteries for digital devices, electric vehicles, and consumer electronics. The journey began with Luigi Galvani’s “frog leg experiment” in 1780, which led to the invention of the “galvanic cell” in 1800 by Alessandro Volta.

The first rechargeable battery based on Lead Acid was introduced in the 19th century, with Wilhelm Josef Sinsteden and Gaston Planté contributing to the development of the lead-acid accumulator. Alkaline Batteries emerged in 1899 with the invention by Waldemar Jungner of the nickel-cadmium (NiCd) battery that used nickel as the positive electrode (cathode) and cadmium as the negative (anode). High material costs compared to lead limited its use.

The Nickel-Metal Hydride (NiMH) Battery, introduced in the late 1980s, eliminated toxic metals like cadmium and offered higher capacity, longer lifespan, and improved power and durability. Lithium-ion (Li-ion) batteries, first commercialized by Sony in 1991, have doubled energy potential and gained widespread adoption in laptops, cell phones, and vehicles. Today, they power a wide range of electronic products and are being researched to make them safer, more powerful, and longer-lasting, with potential applications in electric mobility and other fields.

Source: Lion Smart, The Battery University

At 40.77% of Global Battery Market revenues in 2022, Li-ion is the battery of choice for portable devices and the electric powertrain.

Lithium-Ion Battery Market to reach $189.4 bn globally by 2032 at 15.2% CAGR from $46.2 bn in 2022.

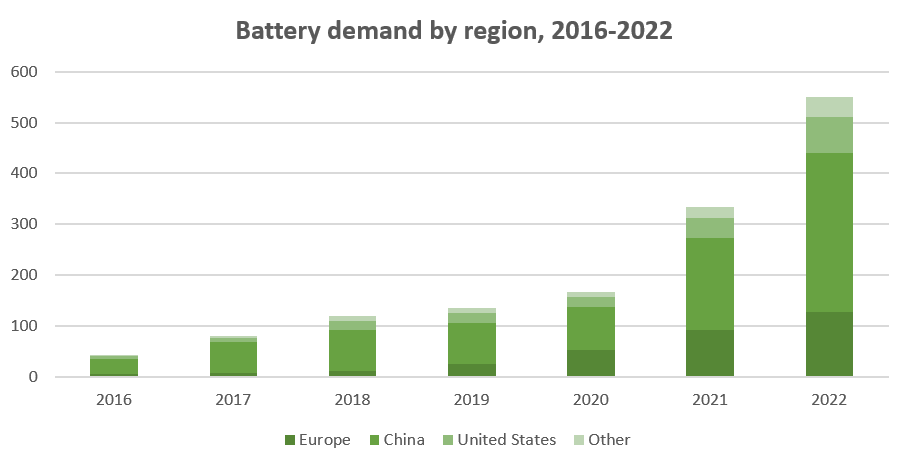

The EV industry is expected to drive the dominance of lithium-ion battery solutions in the coming years. In 2022, automotive lithium-ion battery demand surged by 65% to 550 GWh, from about 330 GWh in 2021, largely due to an increase in electric passenger car sales globally.

Sources: Global EV Outlook 2023, Allied Market Research, Grand View Research

Batteries and the Energy Transition

Renewable energy, while environmentally friendly, has faced challenges with intermittency, a problem that hinders its ability to provide a constant energy supply. This issue is linked to the concept of “base-load” energy, which refers to a power source’s ability to provide a minimum, uninterrupted amount of energy to a grid. Lithium batteries have played a crucial role in addressing intermittency through energy storage and reducing dependence on continuous base-load power from a single source.

Source: World Bank, Know How

Types of Energy Storage System (ESS)

Mechanical storage systems (MSSs) store energy by utilizing kinetic or gravitational forces, with the Flywheel Energy Storage System being a popular choice due to its high efficiency and power density. These systems can be combined in hybrid setups for EV energy storage.

Electrochemical devices can store and convert energy in various forms. Electrochemical electrical storage is based on systems with either high energy density (batteries) or power density (electrochemical capacitors). They store and release electrical energy through chemical reactions with various metals (lithium, iron, lead, etc.)

Electrical storage systems store energy in electric or magnetic fields, with ultracapacitors being widely used for quick power bursts during sudden acceleration.

Chemical conversion systems, like fuel cells, convert chemical energy into electrical energy without mechanical motion, offering high efficiency, extended operational lifespan, and noise-free operation. Fuel cells are available in various types based on the ion carrier and fuel used.

Sources: MDPI, Research Gate, Special thanks to Murari Ramkumar, Co-Founder and CEO of Vimano Inc.

India’s Energy Storage Market

The share of renewable energy will increase from 9.2% in 2019 to 32% in 2030 in India. This will require the installed capacity of renewable energy to be scaled up from 82.5 GW in 2019 to 455 GW in 2030. The government has set a target of having 500 GW of installed renewable energy by 2030.

India’s Battery Energy Storage System (BESS) market is estimated to be at $3.10 billion by the end of 2023 and is projected to reach $5.27 billion in the next five years, registering a CAGR of over 11.20% during the forecast period.

Source: TOI, CSE India, Mordor Intelligence

Ostara Review: Fund-raising in the Indian EV Ecosystem (Jan – Aug 2023)

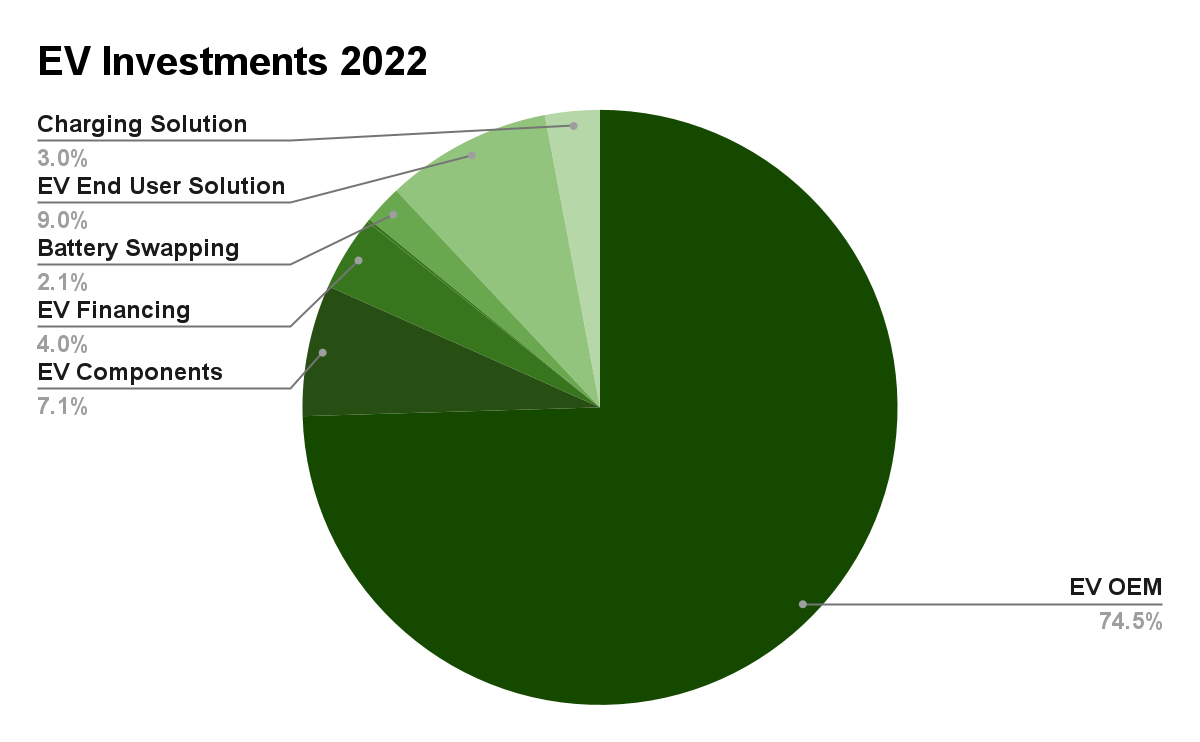

A total of $1161m in investments (incl. debt and equity) were announced in the Indian EV ecosystem during Jan-Aug 2023. Of these, EV OEMs have the highest share with 38.6%, followed by Battery Swapping and Mobility Services with 21.5% and 14.2% each respectively.

The most interesting trend is the relatively more even distribution of sub-sectors that received funding as compared to the previous year. The share of OEMs in the fund-raises announced went down from 75-80% in previous years to ~39% in the first 8 months of 2023, while the share of Battery Swapping, Charging, EV Fleets, etc. has increased.

OEMs that announced funding in the first 8 months of the year included Murugappa Group’s TI Clean Mobility, Mahindra & Mahindra, Ola Electric, Ather Energy, Simple Energy, River, and Kabira Mobility, among others.

The EV OEMs segment saw the highest number of deals (9 deals) totaling ~$448m followed by EV Components(8 deals) totaling ~$80m and Mobility Services (7 deals) totaling ~$165m.

Disclaimer: The information contained herein is a part of Ostara’s proprietary research, based on publicly available sources. These are the deals announced from Jan-Aug 2023 and include debt financing as well as future funding commitments in certain cases.

Do write to us with topics in Climate-tech, Mobility, and New Energy that you’d like us to cover in future editions.