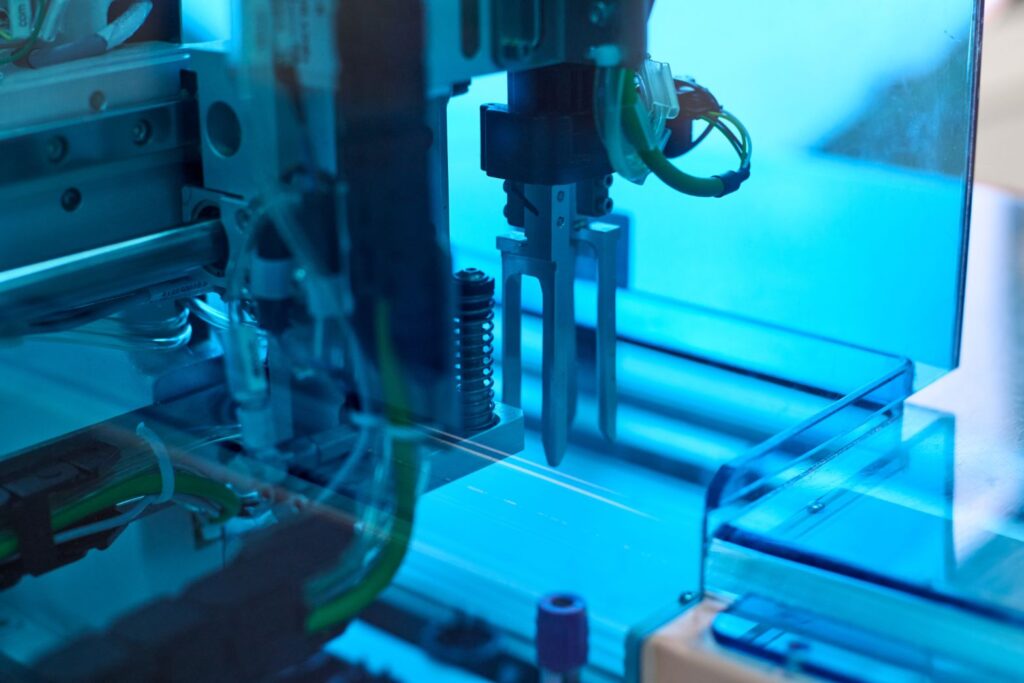

Enabling entrepreneurs who are making the world carbon-free

Ostara Advisors is India’s first specialist climate-tech investment banking firm.

We provide Fundraising and M&A solutions to companies and investors. We work with founders and investors who have a unique vision around building sustainable businesses.

We have built India’s best sector-focused global investor network for mobility and energy businesses, powered by our subject-matter expertise and thought-leadership in these sectors. We bring decades of experience in executing capital-raising strategies and crafting business combinations to drive win-win M&A outcomes for our clients.

The name is symbolic of the ‘dawn’ of sustainability in traditional industries and a growing focus on ‘lightening the carbon footprint’ across businesses

We deliver results for our clients. We work with a long-term perspective supporting clients through multiple growth stages. We were the first investment banking firm to bring global mobility & sustainability focused investors into India. We are also known for bringing first-time strategic investors to our clients.

Climate Entrepreneur

& Investor

Know more >

Industry Expert – Financial Technology

and Cloud Solutions

Know more >

Investment

Banker

Know more >

Bangalore, India

A pioneer in India’s electric mobility and climate-tech investment ecosystem, Vasudha is the Founder & CEO of Ostara Advisors and has led transformational deals, including India’s first M&A in the electric two-wheeler sector. With over 22 years of experience in Corporate & Investment Banking, she has catalyzed global capital flows into clean mobility, making Ostara Advisors a leader in growth-stage fundraising and M&A.

She has previously worked at Citibank, where she was responsible for setting up & expanding Citi’s India’s ‘Private Equity and Hedge Fund’ coverage vertical, ICICI Bank’s Treasury Division & the Product Technology Group and boutique investment banking firms and made her debut in the Top 20 on the All-India M&A League Tables in late-2018. In 2023, Vasudha was felicitated by India Energy Storage Alliance (IESA) as one of the Top 40 ‘Women leaders driving Energy sector in India’.

After an illustrious career in the Banking sector where she was known for her business acumen as well as her intrapreneur skills, she honed in on Climate-Tech as the vertical she wanted to make a mark in. Vasudha founded Ostara Advisors in 2015 to catalyze global capital flows into the clean mobility and climate-tech ecosystem in India. Taking a thought-leadership approach in these sectors, the firm is today an early mover in institutionalizing fund-raising in these sectors with a focus on growth stage fund-raising and M&A transactions.

Vasudha is also a mentor at Aspire for Her, a unique organisation that enables women to join and stay in the workforce, through campus engagement, mentorships and skilling workshops. Their vision is to impact 1 million+ women and add $5B to India’s GDP through increased participation of women in the workforce by 2025.

Vasudha earned her MBA in Finance from XLRI, Jamshedpur, India and her Bachelor’s degree in Commerce from Mount Carmel College, Bangalore, India. She is also a certified Advanced Scuba Diver and enjoys photography, having held several solo and group exhibitions of her work.

Vitaly Golomb is a seasoned technology entrepreneur, investor, and investment banker with over 20 years of experience in Silicon Valley. As a Partner at Drake Star, he led the Mobility and Climate Tech practice, advising companies like Rimac Automobili, Fisker, and Taiga Motors. Previously, Vitaly was a Founding Partner at HP Tech Ventures and CEO of several startups. He is the author of “Accelerated Startup” and a frequent keynote speaker at global tech conferences.

Vitaly’s expertise spans artificial intelligence, mobility, sustainability, and industrial tech. At Mavka Capital, he leverages his diverse background in venture capital, M&A, and entrepreneurship to guide innovative companies through complex market dynamics and growth opportunities.

Climate Entrepreneur and Investor

Industry Expert – Financial Technology and Cloud Solutions

Investment Banker

Subrat Panda is a veteran investment banker with over 20 years of experience in leading Capital Market transactions. His specialities include Public offerings (initial and follow-on), QIP issuances, equity rights issuances, open offers, private equity, debt capital markets, due diligence, corporate finance, financial modelling, valuations and investor interactions. He is currently Director at Motilal Oswal Investment Banking in Mumbai. Prior to this, he was VP, Capital Markets at Tata Capital. He started his career with SBI Capital Markets, the investment banking arm of India’s largest bank where he headed the Equity Capital Markets team in Mumbai. He has extensive experience in advising large and medium companies in the Financials, Infrastructure and Energy sectors on domestic and international fund-raising and M&A strategies. Early in his career, he was also on a special assignment to State Bank of India (SBI) to set up their online banking platform. Subrat earned his MBA in Finance from XLRI, Jamshedpur and completed his B.Tech (Electrical Engg.) from College of Engineering and Technology, Bhubaneswar. Subrat enjoys mountaineering in the Himalayas in his leisure time.

Mukund is a seasoned investment banker with 27 years of experience in advising companies on M&A and capital raising transactions. He has served most recently as Joint Managing Director at Motilal Oswal Investment Banking, where he worked from June 2014 to January 2021. During his career, he has facilitated over 70 strategic financial transactions including Motherson Sumi’s acquisition of PKC Group (Finland), sale of Aurangabad Electricals to Mahindra CIE, Siemens’ sale of Bangalore Airport, sale of Spicejet, Aegis’ acquisition of PeopleSupport (USA), sale of Air Deccan among others. Mukund has extensive experience in raising private equity funding as well as in the capital markets including IPOs, follow-on offerings, GDRs and ADRs for L&T Finance, Indostar, Dixon Technologies, Bharat Financial Inclusion, Tata Consultancy Services (TCS), Wipro, GAIL, etc.

Mukund has earlier worked for 9 years at Edelweiss Financial Services and started his career in 1996 with a 9-year stint at Morgan Stanley. Mr. Ranganathan holds a B.Tech degree in Electrical Engineering from Indian Institute of Technology Madras (1994) and a PGDM from Indian Institute of Management, Ahmedabad (1996).