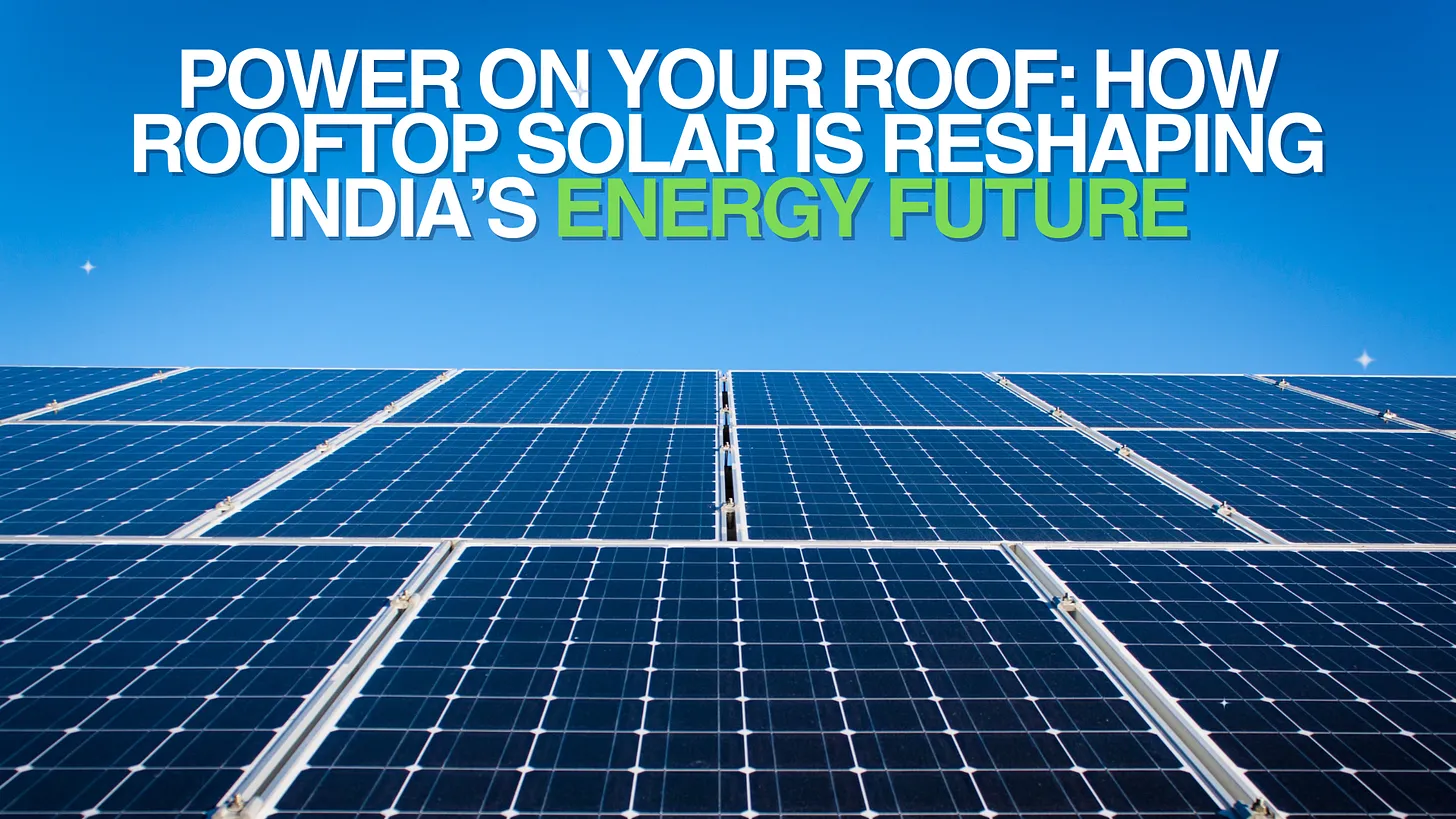

This month, we spotlight one of India’s most promising energy shifts: rooftop solar. As the country races toward energy independence and climate goals, rooftop solar is emerging not just as a green solution, but a financially sound one for homes, businesses, and institutions. With falling costs, generous government subsidies, and a growing network of service providers, rooftop solar is no longer a niche alternative—it’s quickly becoming the default.

In this edition, we unpack how India powers its buildings today, why rooftop solar makes strong economic sense, and what’s fueling its rapid adoption.

How India Powers Its Buildings Today

Before we explore the promise of rooftop solar, it’s important to understand how buildings in India consume power, and where that power comes from.

India’s Energy Sources: Still Coal-Heavy, but Changing Fast

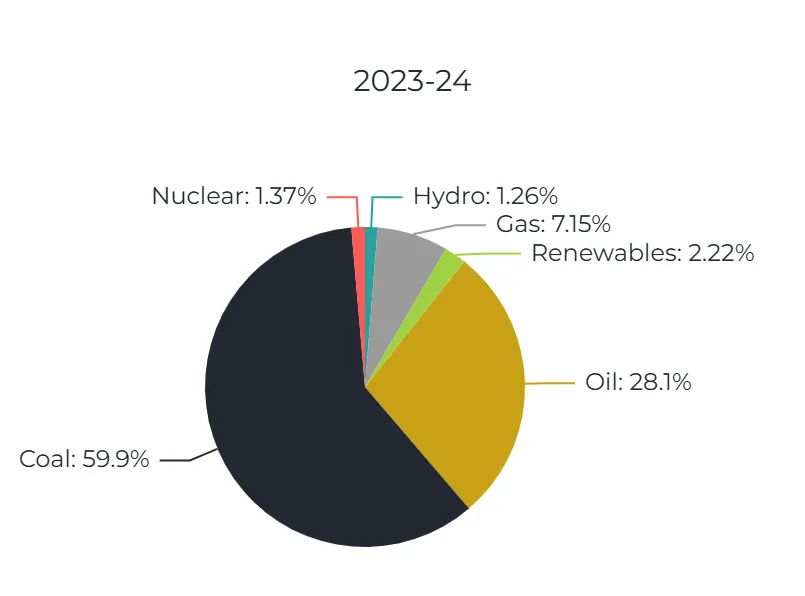

India’s Primary Energy supply sources are still predominantly fossil fuels—but that’s rapidly evolving.

(Source: NITI Aayog)

In FY 2023–24, India’s electricity generation remained heavily dependent on fossil fuels, with coal contributing nearly 60% and oil another 28.1%, together accounting for almost 90% of total power produced. Despite growing investments in clean energy, renewables made up only 2.22% of actual generation, highlighting the gap between installed capacity and real-world output. Gas contributed 7.15%, while nuclear (1.37%) and hydro (1.26%) remained marginal.

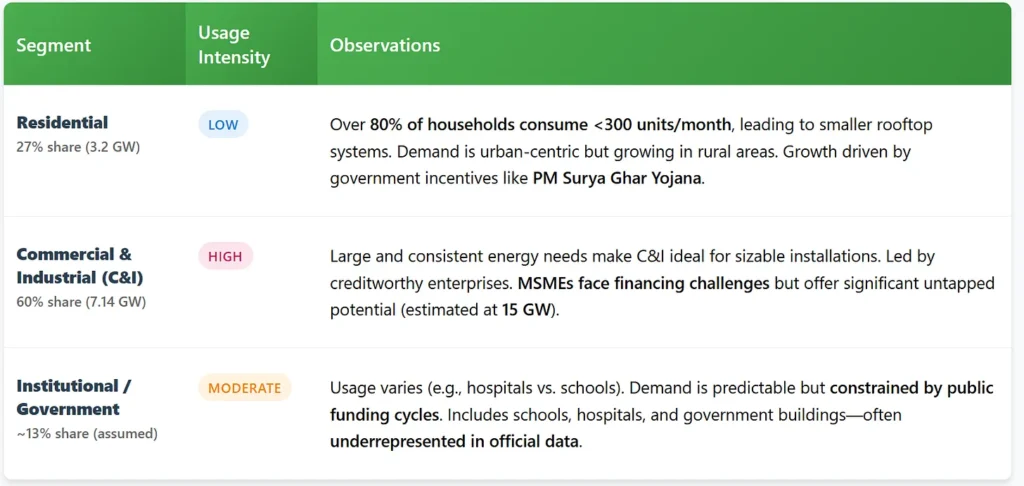

Rooftop Solar by Segment: Who’s Leading and Who’s Lagging?

India’s rooftop solar market varies widely across user segments. The table below summarizes usage intensity, adoption levels (as of March 2024), and key drivers or barriers across Residential, C&I, and Institutional/Government sectors, highlighting where growth is occurring and where untapped potential remains.

(Source: IEEFA)

Why Switching to Rooftop Solar Makes Financial Sense

Current Scenario (Without Solar):

A typical household consuming 400 to 600 units/month pays about ₹3000-5,000 / month in electricity bills. This adds up to approximately ₹36,000 – 60,000 / year in recurring expenses, which may increase annually due to tariff hikes.

With Rooftop Solar (5 kW System):

A 5-kW rooftop solar system can generate 400 to 600 units/month, effectively matching the energy needs of many urban households.

After installation, electricity bills can drop to ₹1,500/month, or even ₹0—depending on usage, net metering policies, and state-specific regulations.

This results in savings of ₹3,500 to ₹5,000/month, or ₹42,000 to ₹60,000 annually.

Annual maintenance costs are minimal-typically ₹3,000 to ₹5,000, covering cleaning and system checkups.

Inverter replacement may be needed once in 8–10 years, costing around ₹25,000 to ₹40,000.

Optional insurance for fire, theft, or weather damage costs approximately ₹1,000 to ₹2,000/year.

Cost and Payback:

The upfront cost for a 5-kW rooftop solar system is approximately ₹3.5 to ₹4.5 lakh.

Under the PM Surya Ghar Yojana, only systems up to 3 kW are eligible for central subsidies (60% for the first 2 kW and 40% for the next 1 kW). Therefore, for a 5-kW system:

Subsidy applies only to the first 3 kW, effectively reducing the total cost by ₹78,000, depending on benchmark rates.

The effective post-subsidy cost is typically ₹2.72 to ₹3.72 lakh, depending on installer rates and location.

With annual savings of ₹42,000 to ₹60,000, the payback period ranges from 4.5 to 6.5 years.

Long-Term Gains:

After the payback period, the household enjoys free electricity for 20+ years, incurring only small maintenance expenses—making rooftop solar not just sustainable, but economically smart.

Rooftop solar offers strong economic benefits for both small and large businesses. For small enterprises, a 10-kW system, costing just ₹4–5 lakhs after 20–40% MNRE subsidies, can save up to ₹1.46 lakhs annually on power bills, with a quick payback in 3–4 years. Larger businesses benefit even more: with higher energy consumption, they can install bigger systems (like 100 kW or more), saving ₹8–12 lakhs per year or more. Net metering allows all excess energy to be sold back to the grid, improving returns. Over time, solar helps reduce operating costs, improve energy reliability, and increase property value.

What’s Driving Adoption Right Now?

India’s residential rooftop solar market is surging, powered by bold government policies, affordable technology, and increasing consumer confidence. Here are the five most critical forces accelerating this transition:

1. Pradhan Mantri Surya Ghar Yojana (PMSGY): Transformative Government Policy

Launched in February 2024, PMSGY is the single biggest catalyst for residential solar. It targets 30 GW across 10 million homes by 2027, with:

- 60% subsidy for systems up to 2 kWp and 40% for 2–3 kWp.

- Direct subsidy transfers to consumer bank accounts.

- Free electricity up to 300 units/month and income-generation through surplus power sales.

- Fully digital application system via the National Portal for Rooftop Solar (NPRS).

2. Falling Solar Costs and Standardised Solutions

The cost of solar panels, inverters, and mounting structures has dropped significantly. Combined with subsidies, many households now recover their investment in just 3–5 years. Large brands like Tata Power, Luminous, and Livguard offer plug-and-play rooftop kits, making installation quicker and more trustworthy.

3. Improved Access to Financing

Solar loans are now available from 25+ banks, NBFCs, and fintechs—many partnered directly with installers. Some states, like Kerala, offer interest subvention, further reducing monthly costs and making solar accessible to middle-income homes.

4. Net Metering and Simplified Approvals

Almost all states now support net metering, allowing consumers to earn credits for exporting excess solar energy. Regulations are also more streamlined; many states have waived feasibility checks for systems under 10 kW and mandated fast-track meter installations.

5. Leadership by Progressive States

Gujarat leads with ~75% of India’s residential rooftop solar capacity, enabled by strong discom support, awareness campaigns, and simplified approvals. Kerala, Maharashtra, Rajasthan, and UP are also driving adoption through local subsidies, consumer education, and ecosystem development.

Rooftop solar is no longer optional, it’s fast becoming the norm in India’s energy transition. In our next edition, we’ll dive deeper into how the ecosystem works, the key players driving it, and the innovations happening in the space.

Ostara in the News

Catch up on our latest milestones, media coverage, and what we’ve been working on!

Our Founder, Vasudha Madhavan was featured on India GameChanger Podcast on July 17, 2025, where she spoke about India’s rise as a global climate-tech hub, driven by visionary capital, early-stage innovation, and a fast-maturing ecosystem.

Check out the full podcast on the YouTube link!

Ostara Advisors was featured in YourStory on July 29, 2025, where we shared our plan to launch a dedicated climate-tech fund and discussed emerging trends and funding challenges in the sustainability space.

Read the full story here.

Vasudha was featured in the Economic Times on July 24, 2025, where she spoke about the India–UK FTA as a breakthrough for climate-tech, unlocking long-term investments in electric mobility, green hydrogen, and resilient infrastructure.

Read the full article here.