In our last edition, we explored the evolving landscape of carbon markets — systems that enable companies to trade emissions and invest in offsets. This time, we zoom in on the foundation that makes credible climate participation possible: carbon accounting and management.

Why Carbon Accounting and Management matters

Before a company can offset emissions, it must measure them. Carbon accounting tracks emissions across operations and supply chains, while carbon management turns data into strategy — driving reductions, compliance, and net-zero alignment.

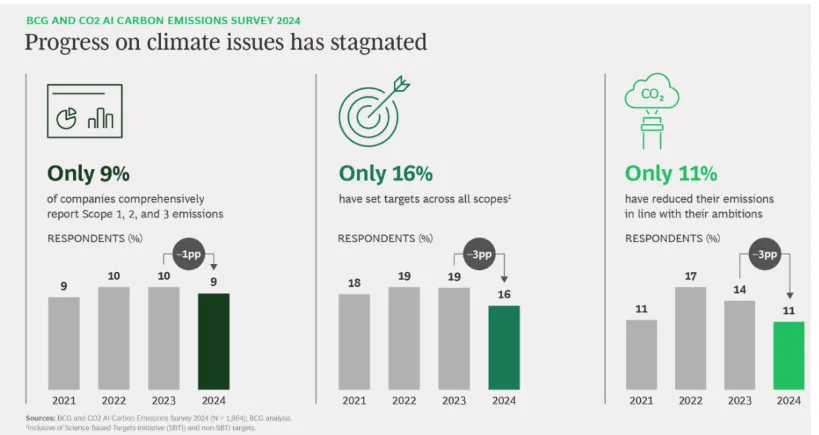

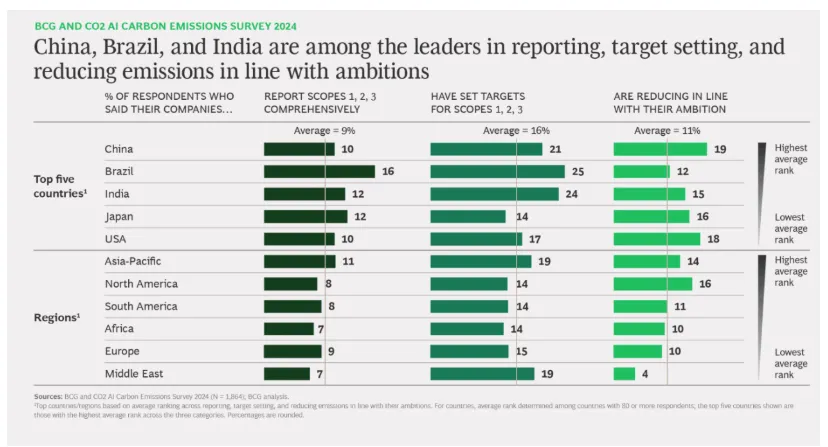

As climate change accelerates, organizations face mounting pressure from regulators, investors, consumers, and their own employees to take decisive action on emissions. Yet, according to BCG’s 2024 Carbon Emissions Survey, corporate progress on climate issues has stagnated, as seen below.

Source: BCG

These sobering figures highlight the urgent need for businesses to move from ambition to execution. Carbon accounting and management are no longer optional—they’re the bedrock of any credible climate strategy. Beyond environmental responsibility, they unlock financial, regulatory, and reputational benefits as detailed below:

- Customer Attraction: As per The Packer’s Sustainability Insights 2024 survey, over 75% of consumers now prioritize sustainability in their purchasing decisions. Companies that demonstrate environmental responsibility stand to strengthen brand loyalty and grow market share.

- Supply Chain Optimization: By extending carbon accounting to encompass the entire value chain, businesses can identify emission hotspots and implement targeted reductions, leading to operational efficiencies.

- Competitive Advantage: Early adopters of comprehensive carbon accounting position themselves as leaders in the transition to a low-carbon economy, potentially unlocking new market opportunities.

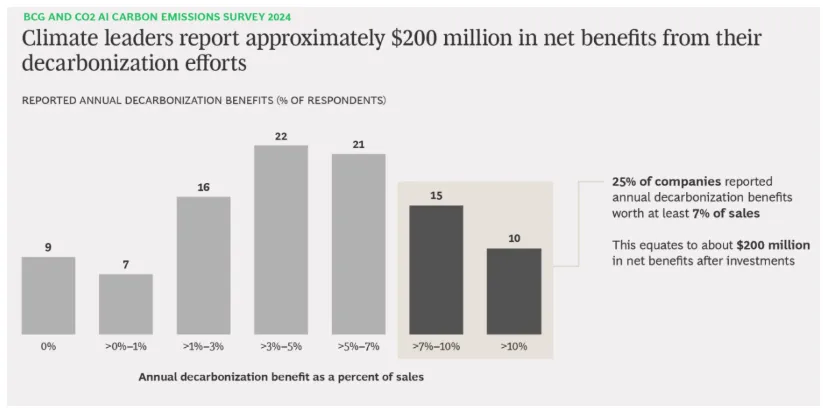

The below image quantifies the tangible benefits after carbon management and decarbonization.

Source: BCG

Understanding Carbon Accounting and Management

Below is a snapshot of the Carbon Accounting process used to measure, report, and manage emissions.

1. Data Ingestion:

Emissions data is captured from ERP systems, smart meters, IoT devices, logistics, travel, and supplier inputs using automated connectors and APIs that pull both structured and unstructured data in real-time, reducing manual effort and ensuring high data accuracy.

2. Emissions Calculation (GHG Protocol):

- Scope 1: Direct emissions from sources that a company owns or controls, such as company vehicles and on-site fuel combustion.

- Scope 2: Indirect emissions from the generation of purchased electricity, steam, heating, or cooling consumed by the company.

- Scope 3: All other indirect emissions across the value chain, including those from suppliers, product use, transportation, and waste.

3. Calculation Methods:

- Spend-Based: Estimates emissions by applying emission factors to financial expenditure data.

- Activity-Based: Calculates emissions using actual activity data like energy use (kWh) or distance traveled (km).

- Hybrid: Combines spend-based and activity-based data to improve accuracy and fill data gaps.

4. Analytics & Forecasting:

Leverage scenario modeling, internal carbon pricing, and emissions tracking to guide strategic decisions.

5. Reporting & Disclosure:

Ensure transparent emissions reporting and regulatory compliance by aligning with global standards such as the International Sustainability Standards Board (ISSB), Corporate Sustainability Reporting Directive (CSRD), U.S. Securities and Exchange Commission (SEC) climate disclosure rules, Carbon Disclosure Project (CDP), Task Force on Climate-related Financial Disclosures (TCFD), and Global Reporting Initiative (GRI).

6. Verification & Auditing:

Implement strong Measurement, Reporting, and Verification (MRV) protocols and use API-integrated tools to enable real-time data validation and third-party assurance.

Basic steps for the Org to transition to Carbon Accounting & Management

Below are the key steps an organization can take to begin its transition to Carbon Accounting & Management.

1.Climate Transition Plans:

Develop organization-wide roadmaps for emissions reduction and long-term value creation.

2.Product-Level Emissions:

Quantify carbon at the product level for precise measurement and informed eco-design decisions.

3. AI Integration:

Utilize AI to automate, optimize, and scale sustainability processes—enhancing accuracy, efficiency, and impact.

Global Leaders in Corporate Climate Action

Insights from the 2024 BCG x CO2 AI Carbon Emissions Survey show China, Brazil, and India emerging as frontrunners in climate accountability — outperforming global averages in:

- Comprehensive Scope 1–3 reporting

- Science-aligned emissions targets

- Actual emissions reduction

These markets demonstrate that bold, transparent action is possible — and increasingly, expected.

Source: BCG

Key Challenges in Carbon Accounting & Management

- Scope 3 Complexity:

Collecting emissions data across fragmented value chains (especially in sectors like manufacturing and agriculture) remains a hurdle. - System Integration:

Legacy systems hinder real-time data tracking. Organizations need interoperable tools to build compliance-ready audit trails. - Market Uncertainty:

As global carbon offset markets move toward regulated frameworks, businesses must adapt to new protocols for certificate generation, storage, and compliance—moving away from unregulated third-party systems.

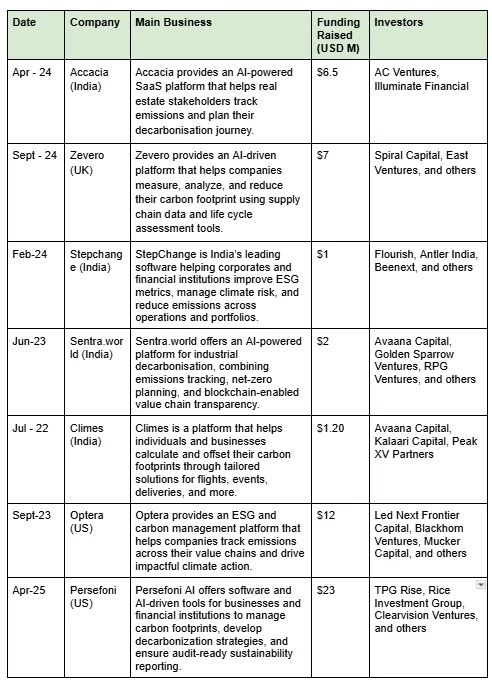

Notable Startups in the space:

Source: Optera, Persefoni, Clime, Sentra.world, Flourish Ventures, Zevero, Alt Carbon, Accacia

Carbon accounting and management are no longer technical checkboxes — they are strategic levers. From compliance to competitiveness, companies that act now will be better prepared for the inevitable shifts in regulation, investor scrutiny, and consumer expectations.

Ostara in the News

- On 7 May, Ostara Advisors was featured in The Economic Times as the exclusive financial advisor to Routematic in its $40 million Series C funding round. Led by Fullerton Carbon Action Fund and Shift4Good, the raise marks a significant step forward in advancing sustainable urban mobility.

- YourStory spotlighted Ostara Advisors on 7 May 2025 for serving as the exclusive financial advisor to Routematic in its $40 million Series C funding round.

- Business Standard featured Ostara Advisors on 7 May 2025 for advising Routematic in its Series C funding round. The publication recognized Ostara as India’s leading climate-tech investment banking firm, reinforcing our role in shaping the country’s sustainable growth agenda.