From the CEO’s Desk

As I look back at my 8-year journey advising EV and Climate-tech startups and investors, 2024 seems like a milestone year. It is the year when, in many ways, the Indian EV and climate-tech ecosystem has started to become mainstream. Something we could barely dream of in 2017.

EV sales in India surged 30% year-on-year to 1.8 million units this year, led by electric two-wheelers at 59% market share. Over USD 1 billion in funding flowed into EV OEMs, components, mobility services, and battery technology, with notable investments like JBM Ecolife Mobility raising $100 million. Government initiatives, including the PM E-Drive scheme further accelerated adoption.

India’s decarbonization efforts also gained momentum, with solar energy leading the charge and green hydrogen, wind energy, and battery storage gaining prominence. IPOs in renewable sectors and policies fostering private participation in nuclear energy marked critical steps forward.

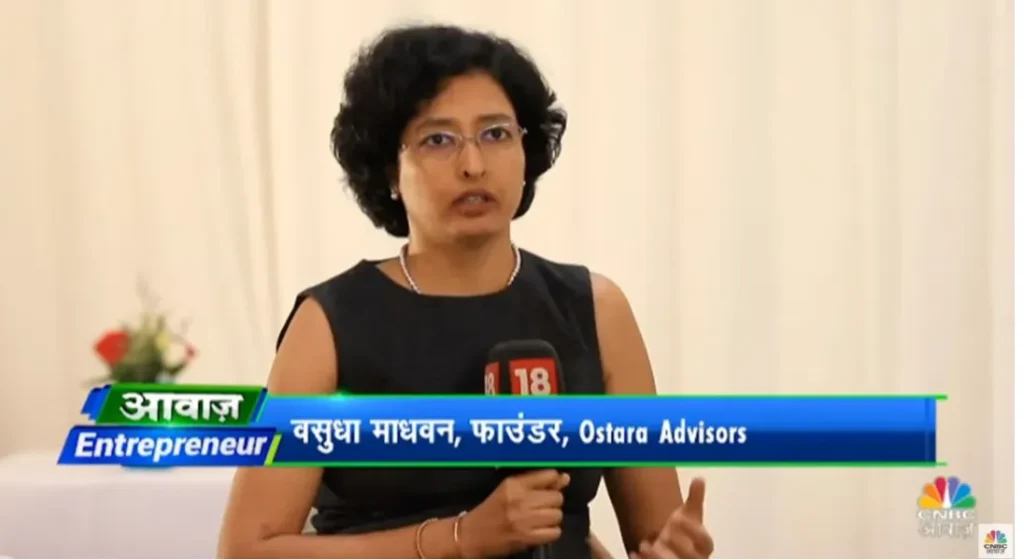

At Ostara Advisors, we’ve been proud to drive this transition. From advising EV startups to shaping funding strategies, our work was recognized by media outlets like CNBC-Awaaz, YourStory, The Economic Times, The Ken and others. Other highlights included moderating panels at ClimateNXT, and participating in discussions at the Chakra Growth Capital Open House 2024 and the EV panel at TiE Global Summit 2024.

I’m especially thrilled & humbled to have been recognized as part of The Better India’s MG Changemakers series this year.

I believe 2025 will be the year of Climate Investing and I look forward to partnering with you to make a meaningful contribution to this global movement!

Vasudha Madhavan, Founder and CEO

Ostara Advisors

(Source: EVreporter November 2023, EVreporter November 2024)

(Note: We have compared data from January to November 2024 with January to November 2023)

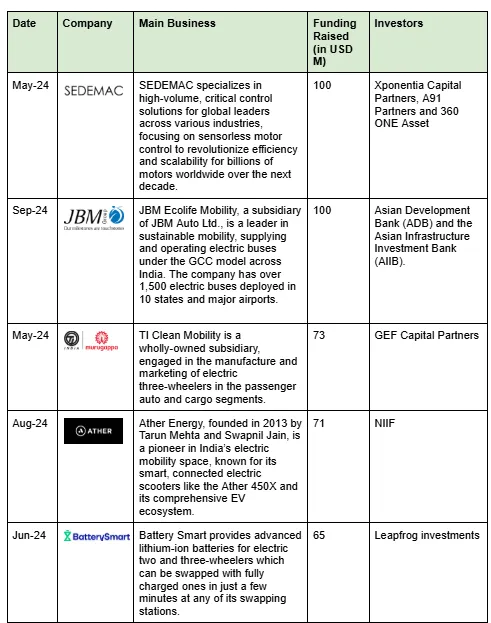

Notable fundraises in the Indian EV Ecosystem

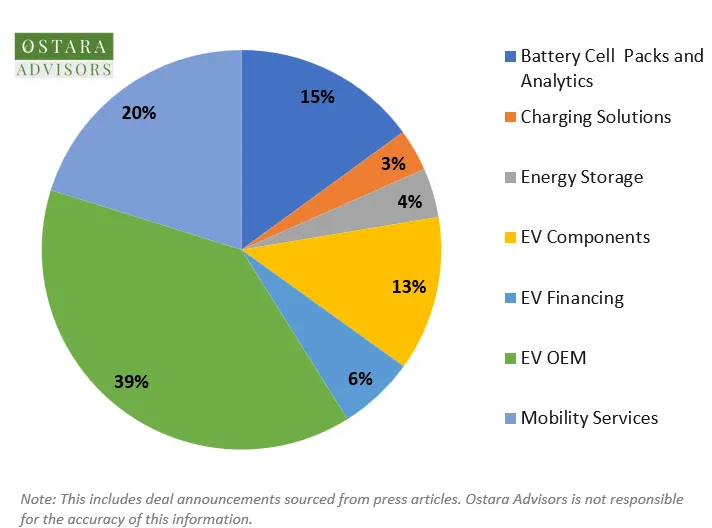

In 2024, the EV ecosystem in India saw over USD 1 billion in funding. Here is the funding breakdown across all EV subsectors:

(Source: Ostara Advisors)

(Note: The data pertains to January to November 2024)

The EV funding sector breakdown shows a strong emphasis on EV OEM (39%), highlighting the focus on electric vehicle manufacturers. Mobility Services (20%) follows, reflecting investment in supporting transport services. Significant attention is given to Battery Cell & Packs (15%) and EV Components (13%), crucial for vehicle performance. Energy Storage (4%) and Charging Solutions (3%) are growing sectors, indicating a need for infrastructure development. EV Financing (6%) shows moderate investment, signaling recognition of the financial solutions required to support EV adoption.

PFA some of the most notable deals of 2024:

(Source: Ostara Advisors)

Notable fundraises in the Indian Renewable and Climate-tech space:

Jupiter International: Photovoltaic (PV) solar cell manufacturer Jupiter International secured ₹300 crore from ValueQuest S.C.A.L.E. PE fund to expand its cell capacity from 800 MW to 1.8 GW and establish a 1.2 GW module manufacturing facility.

SolarSquare: Rooftop solar startup SolarSquare raised USD 40 million in Series B funding, led by Lightspeed Venture Partners and Lightrock, with participation from existing investors. The Company reported ₹170 crore revenue in FY24 and aims to double it in FY25.

SmartJoules: Energy efficiency firm Smart Joules secured USD 8 million from Denmark’s IFU to expand its Cooling-as-a-Service (CaaS) partnerships in healthcare and hospitality.

Key IPOs in EV and Climate-tech in 2024

Ola Electric, founded in 2017 and led by Bhavish Aggarwal, is a Bengaluru-based electric two-wheeler manufacturer. The company filed for a USD 654 million IPO in December 2023, which received SEBI approval in June 2024. The IPO included a fresh issue and an offer-for-sale (OFS) of 8.5Cr shares, with a 4.27X subscription.

Waaree Energies, a solar PV module manufacturer with 2 GW capacity and exports to 68 countries, listed at ₹2,550 on BSE, a 69.66% premium over its ₹1,503 IPO price. Proceeds of ₹4,321 crore (USD 508 million) will fund a 6 GW manufacturing facility in Odisha via its subsidiary Sangam Solar One and general corporate purposes.

Premier Energies, India’s second-largest solar cell and module manufacturer, listed at ₹991 on NSE, a 120% premium over its ₹450 IPO price. IPO proceeds of ₹969 crore (USD 114 million) will fund a 4 GW Solar PV TOPCon facility in Hyderabad, Telangana.

Ostara in the News in 2024

- Vasudha Madhavan was interviewed by CNBC_Awaaz on the emerging climate-tech startups and their ideal fundraising strategy on the sidelines of the LowCarbon.earth Accelerator Demo Day, in Bangkok, Thailand.

- Ostara Advisors views on the Indian EV leasing market have been published in The Economics Times dated April 28, 2024.

- Vasudha was featured in YourStory’s 100 Emerging Women Leaders on 24th August, 2024. The article covers Vasudha’s journey in establishing India’s first climate-tech-focused boutique investment bank.

- Vasudha joined co-panelists and esteemed leaders of the industry: Chetan Maini, Co-Founder and Vice-Chairman, Sun Mobility, K R Jyothilal, Principal Secretary, Govt of Kerala, Dr. Rahul Walawalkar, the chairman of India Energy Storage Alliance (IESA) and Christine Vincent, Principal at Shell Ventures, at the Chakra Growth Capital Open House 2024.

- Vasudha authored a guest article in ETPrime titled ‘The surprising connection between EVs, gig work and financial inclusion’ published on December 4, 2024. In the article, Vasudha highlights the pivotal role of gig workers in driving last-mile mobility—a cornerstone of today’s quick commerce and e-commerce ecosystems—and how access to EVs can transform their lives.

For a full list of Ostara’s press mentions and thought leadership, please visit https://ostara.co.in/news-and-updates/