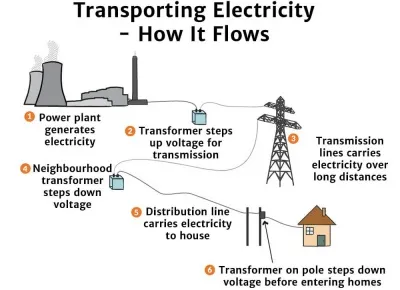

Welcome to Our Newsletter on Power Transmission and Distribution! In this edition, we explore how electricity journeys from generation to your home in India. We’ll examine the efficiency, environmental impact, and sustainability of our energy systems. Join us to uncover the technologies behind power transmission and discover the future of cleaner energy!

Source: SolarSchools

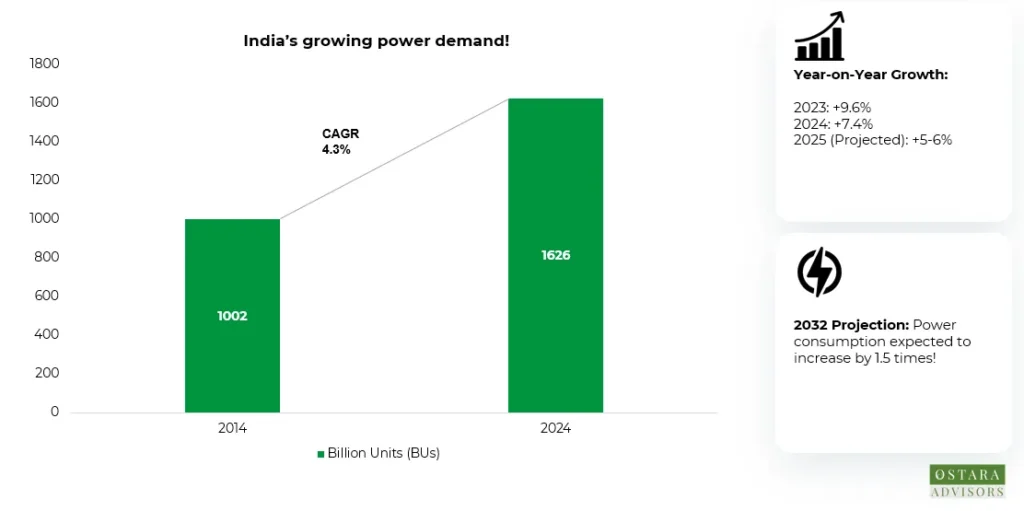

India’s growing Power Demand!

India’s power demand is on the rise! Here are the key numbers:

Source: Adani Energy Solutions

Urbanization, industrial growth, and rising household needs are driving this surge!

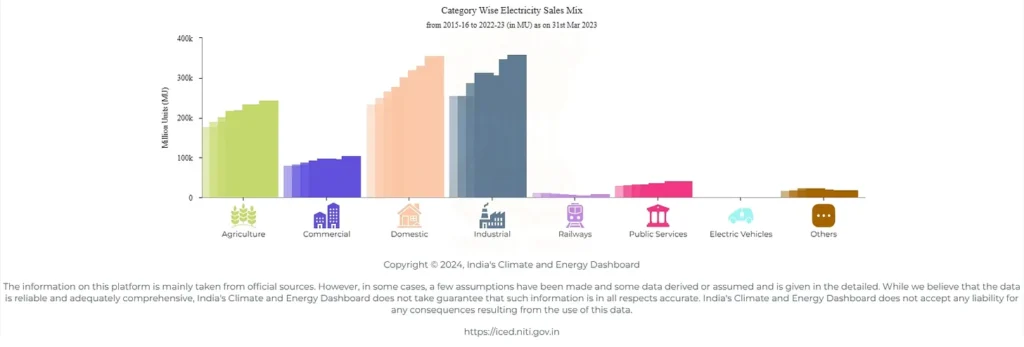

The commercial and industrial sectors are poised for strong growth in their power consumption, with an anticipated CAGR of 7-8% from Fiscal 2025 to 2029, driven by infrastructure development and initiatives like Atma Nirbhar Bharat. The chart below illustrates India’s growing power needs across various sectors from FY16 to FY23.

Source: Niti Aayog

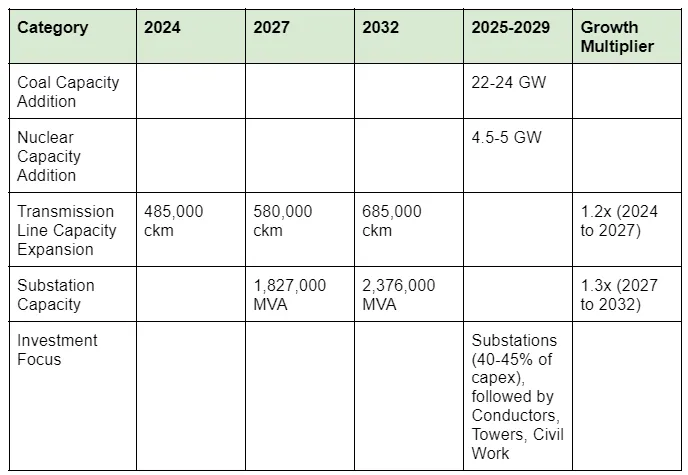

To meet rising power demand, India is ramping up its energy capacity! Here are the key highlights:

Source: Adani Energy Solutions, Value Quest

This modernization, driven by government policy, is key for reliable power delivery and a greener future!

The Power Sector in India is transforming!

India’s power distribution is transforming! Here are the key insights:

- Vertical Unbundling: State-owned utilities are now split into generation, transmission, and distribution.

- Tariff-Based Competitive Bidding (TBCB): Leads to significant tariff cuts for consumers and boosts private investment.

- Private Investment: Since 1998, the sector has attracted private and international players. As per IBEF, FDI inflows alone in the power sector reached US$ 18 billion between April 2000 to March 2024!

- Power Grid Corporation of India Limited (PGCIL), which once controlled the entire transmission network, now operates 38% of the transmission network with over 99% availability in FY2024.

- New Regulatory Body: The Central Transmission Utility (CTU) was established in 2021 to boost transparency and competition.

These changes are shaping a more efficient and competitive energy landscape!

India’s Energy Transition: Building the Grid for a Green Future

India is gearing up for a massive energy transformation! Here are the key highlights:

- Investment Surge (2025-2029):

- India is set to invest ₹3.0 to ₹3.2 trillion for expanding transmission infrastructure, supporting a target of 500 GW of renewable energy by 2030.

- Rising Demand from EVs:

- An expected increase of 11-13 billion units annually, necessitating smart charging solutions to prevent grid strain.

- Battery Storage Growth:

- Anticipating 55-60 GW of capacity by 2030 to support clean energy.

- Smart Grids Revolution:

- Enabling real-time communication, flexible grid management, and self-healing capabilities, ensuring efficiency and reliability.

- Global Standards:

- IEC standards (like IEC 61850 and IEC 62351) are paving the way for smart grid adoption.

These advancements are key to transforming India’s power sector into a sustainable, efficient, and future-ready system!

Ostara’s Take:

India’s clean energy transition is not just an environmental imperative; it’s a catalyst for innovation and economic growth. It will reshape industries by reducing operational costs and driving innovation, while consumers can expect lower energy bills and improved access to reliable power.

Ostara in the News

Team Ostara attended Chakra Open House 2024 organized by Chakra Growth Capital and RiSo Capital, in collaboration with NASSCOM. The conversations revolved around AI’s Impact on Climate and energy, climate sustainability, industry electrification, and India’s Green Hydrogen mission.

Our Founder and CEO, Vasudha Madhavan joined co-panelists and esteemed leaders of the industry: Chetan Maini, Co-Founder and Vice-Chairman, Sun Mobility, K R Jyothilal, Principal Secretary, Govt of Kerala, Dr. Rahul Walawalkar, the chairman of India Energy Storage Alliance (IESA) and Christine Vincent, Principal at Shell Ventures. Check out our LinkedIn post on the same: LinkedIn

Diwali greetings from Ostara Advisors!