Dear Reader,

In many cases, the easiest way for a factory to decarbonize is to purchase electricity from renewable sources for its energy needs. Renewable electricity generation having reached maturity as an industry in India provides an accessible pathway for economic and environmental benefits in the long run. Hence, increasing renewable electricity as an energy source for Indian industry becomes an essential lever for decarbonization of hard-to-abate sectors.

What is Electrification in Industry?

Industrial electrification refers to the process of switching from fossil fuel / other energy sources in factories to electricity, which is preferably generated from renewable sources.

Methods of Industrial Electrification

Ways to implement Electrification in Industry can be broadly classified into direct and indirect methods.

Direct electrification methods

Direct electrification refers to the process of replacing fossil fuels with electricity generated from renewable sources across various sectors like transport, buildings, and industry.

- Resistance heating: Heat is generated by passing current through the resistance of a conductor.

- Arc heating: Achieved by initiating an arc between current-carrying electrodes – the technology behind electric arc furnaces (EAFs).

- Induction heating: Utilises electromagnetic induction principles.

- Dielectric heating: Uses high-frequency electromagnetic fields.

- Electrolysis: Uses electricity to purify and extract metals.

Indirect Electrification methods

Indirect electrification, often referred to as power-to-fuel (P2X), involves the electrolysis of water to produce hydrogen and its derivatives. Certain industrial sectors, such as refining and ammonia, currently use grey hydrogen derived from the reformation of natural gas.

Decarbonizing these sectors by replacing fossil fuel-based hydrogen with electrolysis-based green hydrogen is a key target.

A major portion of the levelized cost of hydrogen, about 30-60%, is due to the cost of electricity, with the remaining cost primarily due to electrolyzers. Therefore, future cost declines in both renewable energy and electrolyzers will be crucial for reducing the overall cost of hydrogen.

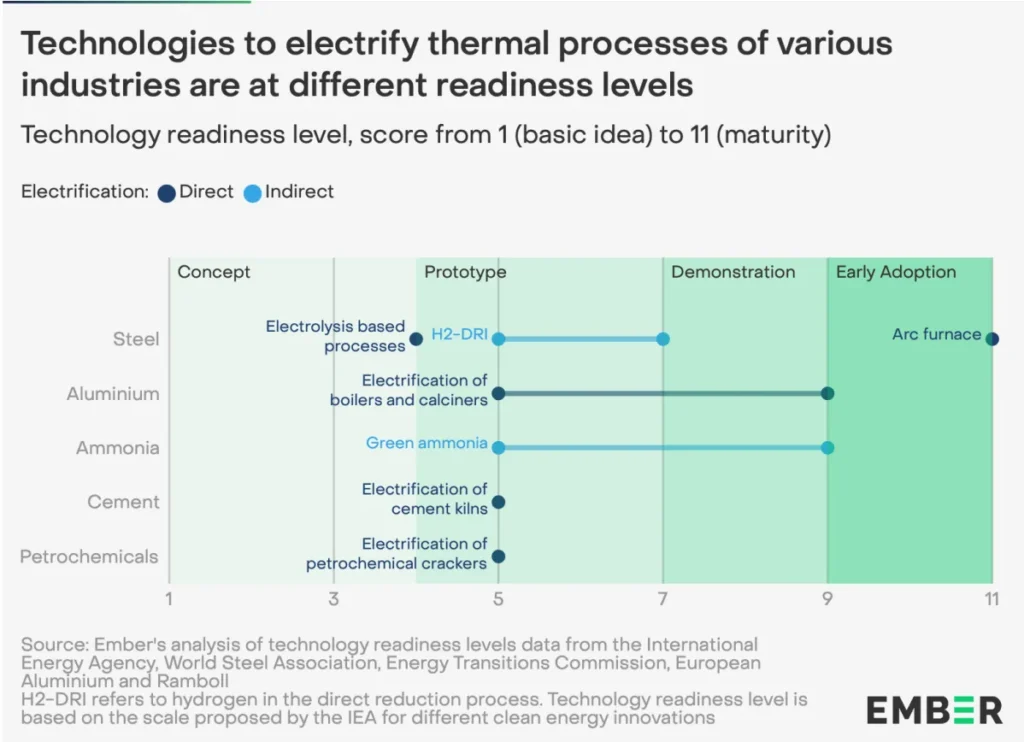

Electrification by Industry

Key practical approaches for industrial electrification are as under:

- Electric Arc Furnaces and Green H2 Direct Reduced Iron (DRI). A near-term decarbonization option is natural gas DRI.

- Cement: Electrified kilns.

- Petrochemicals: Electrified steam crackers.

- Ammonia: Green H2 for Ammonia production.

Source: Ember

Key benefits of Electrification

Apart from being cost-effective due to declining prices of renewable energy, Industrial Electrification helps reduce greenhouse gas emissions significantly.

According to the International Energy Agency (IEA), Electrification could reduce India’s industrial greenhouse gas emissions by up to 40% by 2050, playing a pivotal role in achieving global climate targets and limiting temperature rise.

Replacing coal-based power sources with renewables leads to substantial air quality improvements, particularly in industrial regions. This transition reduces pollutants and mitigates health hazards for communities.

The Outlook for Industrial Electrification in India

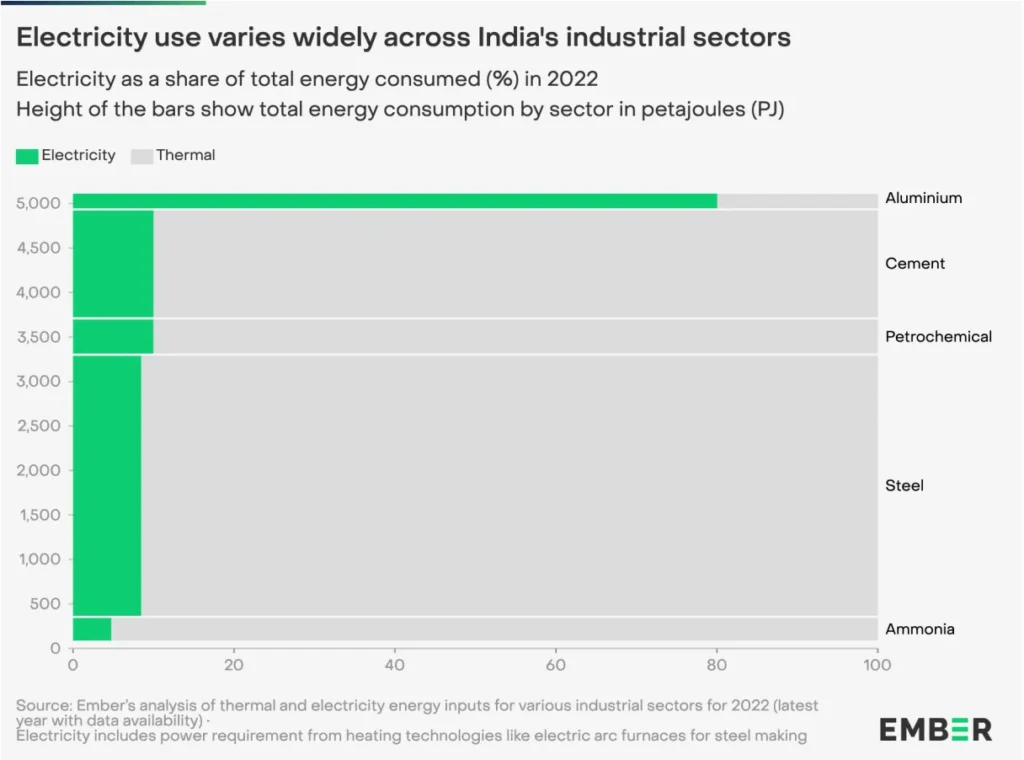

Industry makes up about 31% of India’s total emissions. The majority of India’s heavy industries emissions come from iron/steel, cement, aluminum, petrochemicals, and fertilizer/ammonia production. Heavy industries vary in their rate of electrification.

Source: Ember

- Per Ember, only about 11% of India’s industry is currently electrified on an average, and most industries (other than aluminium production) are even lower than that. For example, steel (8.5%), cement (10%), petrochemicals (10%), and ammonia (4.8%).

- Challenges to decarbonize include the need for high-temperature heat processes, use of fossil-fuel-based chemical feedstocks, and the presence of process emissions (for example calcination during cement production).

- Direct electrification technologies for most sectors (except for electric arc furnaces, that are already dominant) have low TRLs and are expected to enter industrial facilities after 2040.

- Per EMBER, India needs about 85 GW of Renewable Electric Sources to decarbonize its current heavy industry electric demand, and is estimated to need about 120 GW by 2030.

The success of industrial electrification and decarbonisation heavily depends on the commercialisation of hydrogen production. The good news is that there are some decarbonization pilot projects underway, like TATA Steel’s new 311 million dollar plant in Ludhiana, which features a scrap-based electric arc furnace. Dalmia Cement has signed an MOU with SaltX to produce low-carbon cement, and UltraTech Cement is working with Coolbrook to decarbonize their products.

We hope to see much faster progress in industrial decarbonization via the adoption of renewable energy in key industrial processes, accelerating our path to Net Zero.